- Fed Chair Powell signals policy adjustments are needed, emphasizing concerns about labor market weakness.

- The impact of Powell’s remarks on the FX space saw GBP/USD and EUR/USD reach new highs.

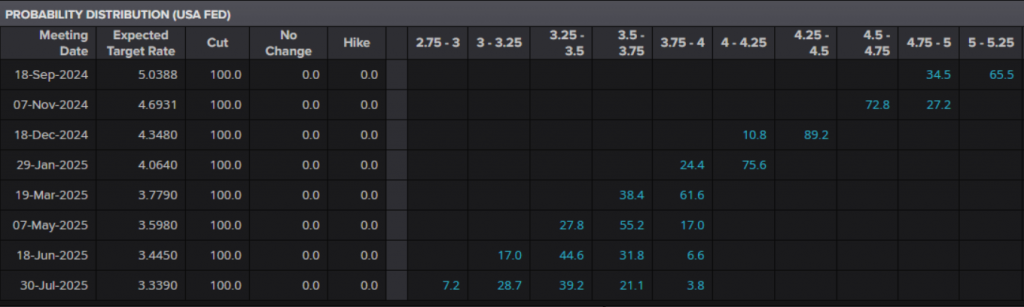

- Markets are pricing in a 34.5% chance of a 50 bps cut and 65.5% of a 25 bps cut at the Federal Reserve’s September meeting.

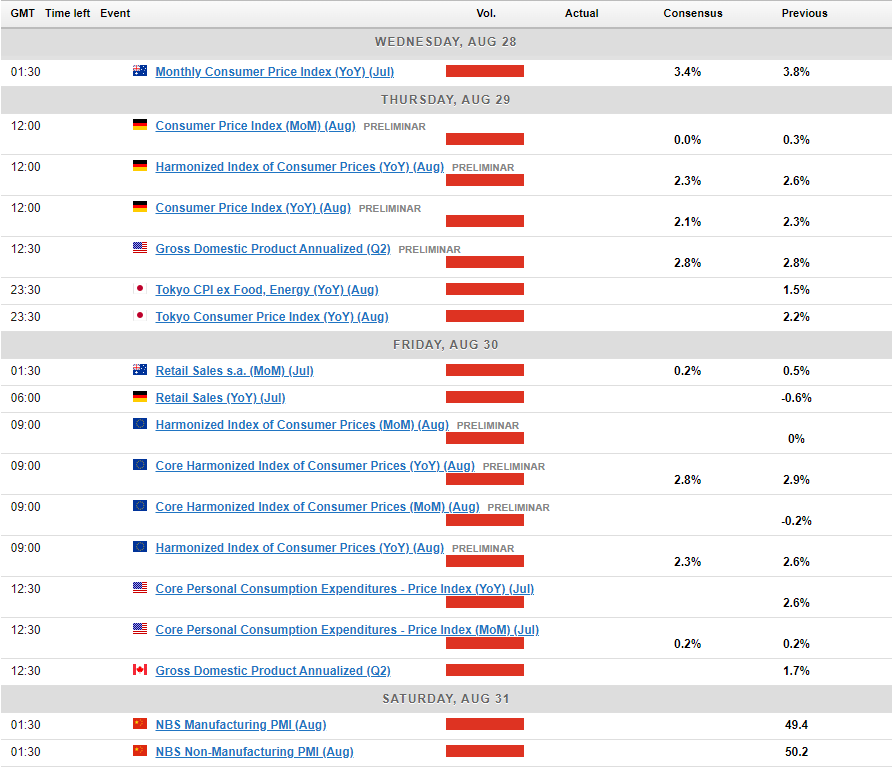

- US PCE and EU Inflation data are highlights.

Read More: Bitcoins (BTC/USD) Steady Range: Mt Gox Impact and Future Outlook

Week in Review: Time for Policy to Adjust

As the week draws to a close, Fed Chair Jerome Powell certainly delivered with his remarks at the Jackson Hole Symposium.

Heading into the Powell speech my biggest fear was that markets had priced in a lot for September already and the response to Powell’s remarks may be muted. The Fed Chair however delivered, noting that it is ‘time for policy to adjust’ while reiterating his concern around further labor market weakness.

Markets are pricing in a 34.5% chance of a 50 bps cut and 65.5% of a 25 bps cut at the Federal Reserve’s September meeting. Between now and then the biggest focus will be placed on the jobs data out on September 6th. This comes after the largest downward revision on jobs data by the Bureau of Labor Statistics since the global financial crisis.

Any significant downside miss by the September jobs print and expectation for a 50 bps cut will ramp up. In Fed Chair Powell’s own words “Fed does not welcome further weakening of the labor market”.

Source: LSEG

After a brief pullback on Thursday, the DXY slid to fresh lows on Friday following Powell’s remarks. The impact of this on the FX space saw GBP/USD print fresh highs above 1.3200 and EUR/USD finally revisit the 1.1200 handle.

Oil is on course for back to back gains but is likely to finish the week in the red. Ongoing demand concerns and stalling airline fares continue to weigh on oil prices. The anticipation of rate cuts may add a bit of optimism but we will have to wait and see if that bleeds over into next week.

US Indices enjoyed a strong week overall with the three major indexes on course for a weekly gain despite some up and down moves on Friday. Much like Gold, US Indices did not manage to hold onto its gains following the Powell remarks. Is this a sign that much of the potential 25 bps rate cut for September has already been priced in?

The Week Ahead: Lots of Data but Fed Rate Cut Set in Stone

Asia Pacific Markets

In Asia, the upcoming week is a busy one on the economic data front. Inflation, GDP and Production data take center stage with upbeat data prints expected.

Japan leads the way with a host of data releases as market participants continue to watch closely. In Tokyo, consumer inflation is anticipated to decline from 2.2% year-on-year in July to 1.9% in August, primarily due to the government’s temporary energy subsidy program. Despite this, the service sector is expected to see an acceleration in price increases, fueled by robust wage growth.

Industrial production is likely to bounce back with a 3.0% month-on-month rise, reversing the 4.2% drop in June, as auto manufacturing gradually recovers and semiconductor-related output improves, as indicated by recent export data. Meanwhile, labor market conditions are projected to remain tight due to persistent labor shortages, reflecting ongoing challenges in workforce availability. The data should support the hawkish stance taken by BoJ Governor Ueda in his Friday testimony before the Japanese parliament where he promised more rate hikes ahead.

China delivers no major data releases except for the Lending facility rate and industrial profits data.

Australia has a busy week ahead with the RBA hoping the data will make their jobs and decision making process easier. There is a host of data out of Australia but the biggest ones will likely be the inflation report and retail sales data. The recent RBA decision to keep rates on hold was met with some skepticism but there is hope that inflation remained steady over the period. The combination of seasonal influences, a slowdown in food price inflation, and decreasing gasoline prices is expected to result in a nearly flat month-on-month change.

Europe + UK + US

In Europe and the US, it’s another data-heavy week. The UK has a bank holiday on Monday to start the week but the US and other parts of Europe remain open.

Most of the high impact data releases from Europe and the US are due later in the week. The key highlights will be EU inflation data and of course from the US we have the Fed’s preferred inflation gauge, the PCE price index.

Usually the PCE would have a major impact on rate cut expectations however heading into next week’s release and jobs data is likely to hold a bigger sway. Unless we have a massive miss from the US and a significant rise in the PCE number any response to the data is likely to be muted.

The EU inflation figures are crucial, especially after sources from the ECB suggested rising backing for a 25 basis point cut at the next Central Bank meeting. If inflation decreases slightly or aligns with expectations, this could put some pressure on the Euro, as traders are likely to increase their bets on a rate cut.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

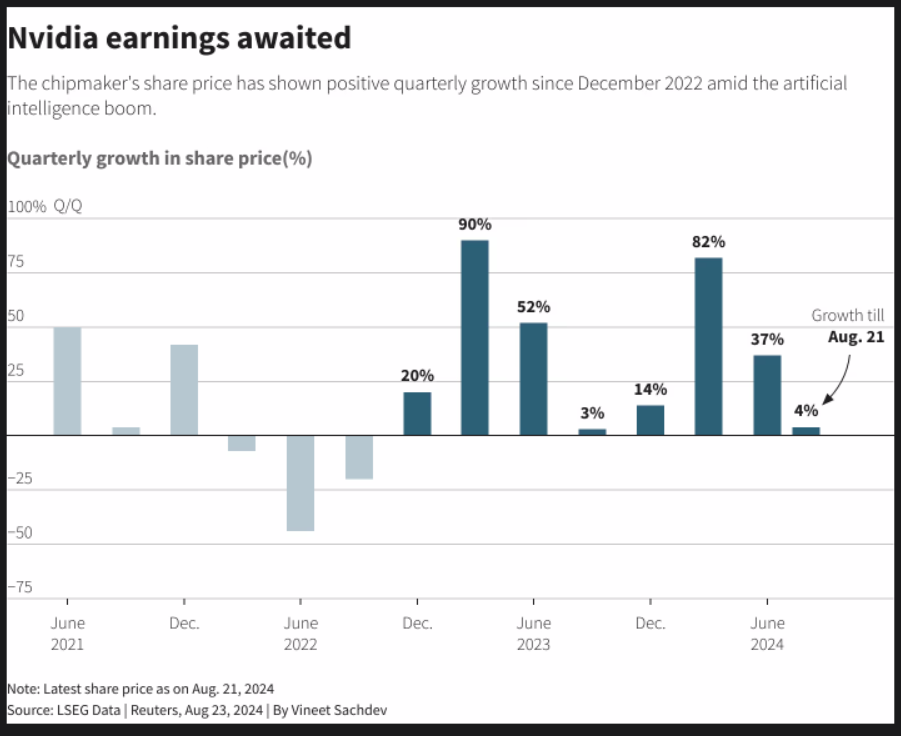

Lastly on the earnings front we have the much anticipated Nvidia earnings release next week. Nvidia shares remain up around 150% this year as markets will be looking to gauge the investor enthusiasm around AI. There has been growing chatter comparing the rise of Nvidia to the early 2000s dotcom bubble and the selloff following lackluster data by Alphabet and Tesla led to a steep selloff. Will AI mania get another vote of confidence and propel US indices to fresh highs?

Source: LSEG

Chart of the Week

This week’s highlighted chart is Brent Crude Oil following a mixed week. Brent is now trading at a delicate level heading into the new week with a host of headwinds to consider as well.

The late surge off a key support level on Thursday and Friday has made the outlook heading into next week intriguing. We had two massive bullish days which brings a retest of the descending trendline to the fore as the new week begins.

Demand concerns continue to plague oil prices and may hamper a deeper recovery next week. Immediate resistance rests at 80.00 psychological level with the descending trendline just resting above.

On the downside 77.25 support is key before the 75.00 mark is reached.

Brent Crude Oil Daily Chart – August 23, 2024

Source:TradingView.Com (click to enlarge)

Key Levels to Consider:

Support:

- 77.25

- 75.00

- 73.00

Resistance:

- 80.00

- 81.58

- 82.54 (200-day MA)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.