- US Non-Farm Payroll (NFP) data release is highly anticipated amidst shifting expectations of a Fed rate cut.

- Market predictions for the NFP report vary, with analysts split on expected figures.

- S&P 500 technical analysis reveals a bullish triangle pattern, will the bulls finish the week strong?

Most Read: US Dollar Index (DXY) Extends Gains, BoE Governor Bailey Remarks Weighs on GBP/USD

NFP Preview: What to Expect

Market participants are waiting on today’s jobs report from the US in a week that has seen geopolitical risk take hold of market sentiment. The Iranian attack on Israel which came without much warning really seemed to spook markets and continues to play a role in Oil and Gold prices in particular. This begs the question… will the jobs report be overshadowed by the geopolitical risk?

Heading into the jobs report and market expectations have seen a significant shift this week following pushback from Fed Chair Powell and others around another 50 bps cut in November. This has seen markets aggressively price in a 25 bps cut which has led to a revival of sorts for the US Dollar.

The expected payroll figure is 150k, but more attention should be given to the unemployment rate, which is anticipated to remain steady at 4.2%. A slight miss of these expected figures is unlikely to change the Fed outlook but could lead to some short term spikes across a host of markets.

The data is likely to face scrutiny given that we have seen 16 of the last 19 job reports face a downward revision. This is unprecedented as the 2008 financial crisis did not result in as many downgrades as we have seen this year. Analysts already seem to be split on the print they expect, with UBS and Goldman Sachs predicting 180k and 165k respectively. Kalshi and Factset however are on the more moderate end of the prediction scale, eyeing a print of 148k and 140k respectively.

Source: BLS, Haver Analytics, BofA Research, Kobeissi Letter

My takeaway from all of this is that we would need to see a significant miss or downward revision to the jobs numbers for any significant movements to take place today. Anything else is likely to result in short-term spikes with little to no follow through.

There are a host of assets that are hovering near key areas of support and resistance which is why the NFP report is still being closely watched. The US Dollar Index (DXY), EUR/USD, GBP/USD and Gold are among those assets trading near or at key levels.

As for US Equities, the Nasdaq 100 and S&P 500 are also near recent highs and have also retreated following Powell’s comments this week. The threat of regional war in the Middle East and potential threats to supply chains and oil prices are also keeping markets on edge.

Potential Impact on the S&P 500

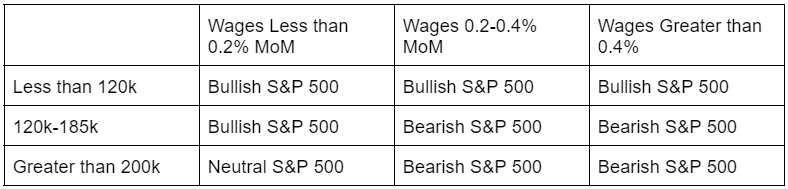

Looking at the data release, I have compiled a list of what the potential impact on the S&P 500 could be depending on the wage growth and NFP number. This is just my expectations and no guarantee that this is the reaction we may get from markets but could be a useful guide.

Table Created by Zain Vawda

Technical Analysis S&P 500

Looking at the S&P 500 chart below and the pullback this week has actually been a positive for potential bulls looking to get involved.

The technical triangle pattern which saw a breakout last week is still in play and following the pullback may be ready to continue its move higher. The NFP may just be the catalyst needed to give the S&P the impetus for further upside.

S&P 500 Daily Chart, October 4, 2024

Source: TradingView (click to enlarge)

Support

- 5669

- 5635

- 5538

Resistance

- 5760

- 5910

- 6000

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.