- President-elect Trump announced plans for tariffs on goods from Canada, Mexico, and China.

- Despite tariff concerns, the S&P 500 continues to climb, with economists predicting it could reach 6500 by year-end.

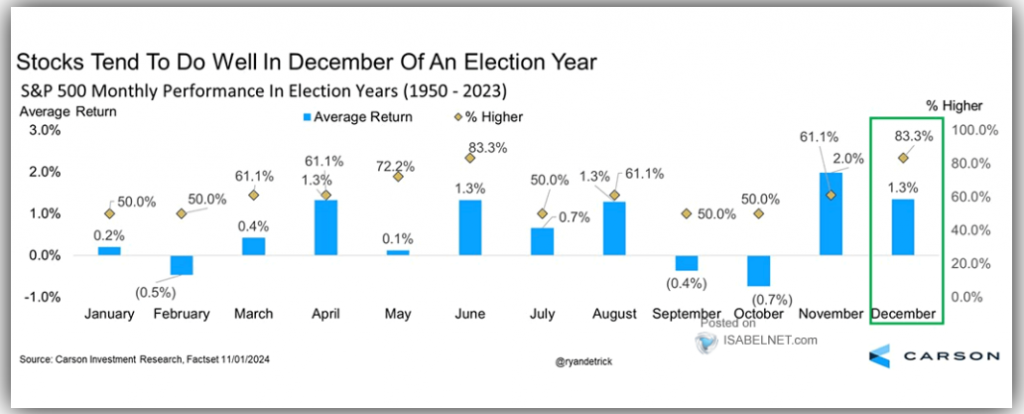

- The S&P 500 has historically performed well in December during election years, adding weight to the possibility of a “Santa Rally.”

Most Read: Brent Crude – Oil Eyes Recovery as OPEC + Deliberate Oil Cut Rollover

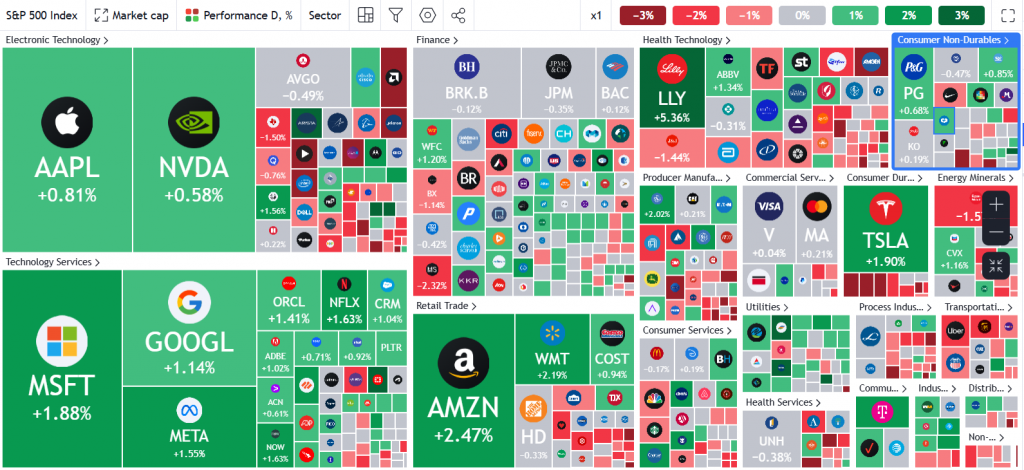

Wall Street Indexes continued their advance today with the S&P within touching distance of fresh all-time highs. Market participants were given a lot to ponder following remarks by President Elect Donald Trump promising tariffs on top US trade partners.

Markets are also awaiting the Federal Reserve minutes due out later in the US session.

Source: TradingView

Tariff Pledges by President Elect Trump

President Elect Donald Trump came out swinging as he tends to do at times stating that he plans to apply a 25% tariff on goods from Canada and Mexico, which could go against the trade deal he made during his previous term. He also proposed an extra 10% tariff on Chinese imports, increasing the chances of trade conflicts.

The impact of the comments was felt across various markets and instruments with currencies like the Australian Dollar suffering as a result. Looking at US Stocks and the biggest losers were automakers like Ford and General Motors, which rely on tightly connected supply chains between Mexico, the U.S., and Canada, saw their stock prices fall by 2.2% and 4.7% in premarket trading.

Despite this the S&P has continued to rise with a poll of economists stating that the S&P 500 will finish 2024 at 6500, up from the previous poll in August which predicted 5900. That would mean a near 10% gain during the month of December. A lot of faith in the ‘Santa Rally’ it would seem.

S&P 500 Performance During Election Years

The poll by economists predicting a year end target of 6500 may not be far off if one looks back at S&P 500 performance during the month of December in election years. Looking back at data from 1950 to the present, the S&P 500 has posted gains 83% of the time in the month of December with an average gain of 1.3%.

Source: Isabelnet, Carson Research.

Technical Analysis

S&P 500

From a technical standpoint, the S&P 500 continues to rise steadily and has continued its impressive performance in 2024.

The triangle pattern still remains in play with a long-term target around 6170. The S&P is currently testing a key area of resistance which is also the ATH around the 6010 handle as a break looks inevitable with all eyes shifting toward the long term target at 6170.

If we do get a pullback, immediate support rests at 5910 before the support areas at 5848 and 5757 come into focus.

The 14 period RSI is approaching overbought territory but this is no guarantee that a pullback will materialize.

Nasdaq 100 Daily Chart, November 26, 2024

Source: TradingView (click to enlarge)

Support

- 5910

- 5848

- 5757

Resistance

- 6010

- 6170

- 6200

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.