- The S&P 500 and Nasdaq 100 continue their slide following underwhelming earnings reports and poor risk sentiment.

- Microsoft’s Q4 earnings are anticipated to be $2.94 EPS on revenue of $64.5 billion, with cloud revenue expected to reach $36.8 billion. Investor focus is on AI earnings and future spending plans.

- JOLTZ job openings exceeded expectations, and coupled with easing inflation, rate cut discussions are prevalent.

Most Read: GBP/USD Stalls as Bulls and Bears Clash Ahead of Central Bank Meetings

Earning season has surprised many as companies worldwide lower their full-year sales and profit guidance. This comes against a backdrop of rate uncertainty, the China growth picture and rising geopolitical uncertainty.

It would appear that the higher for longer rate environment is finally starting to take its toll on companies.Debate continues to rage on the health of the Chinese economy. Some analysts are of the opinion that the weak demand out of China is down to concerns about the future. The Government has introduced some measures of late, with the hope being that this will bear fruit.

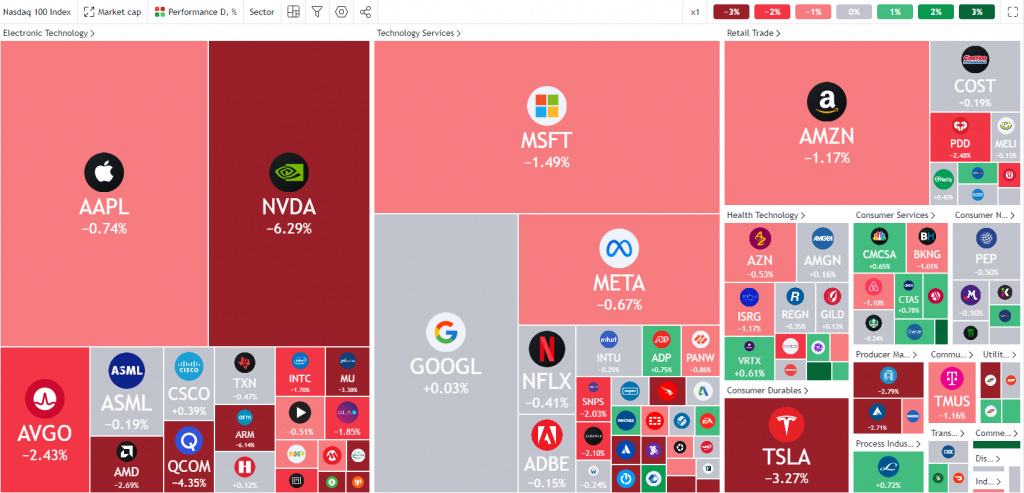

NASDAQ 100 Heatmap

Source:TradingView.com

The S&P 500 and Nasdaq 100, have slid following the US open today, with the tech heavy Nasdaq down as much as 1.45% at the time of writing. Given the underwhelming numbers from high-profile companies this season, so far have been disappointing to say the least. Will Microsoft (MSFT.O) follow in the same vein?

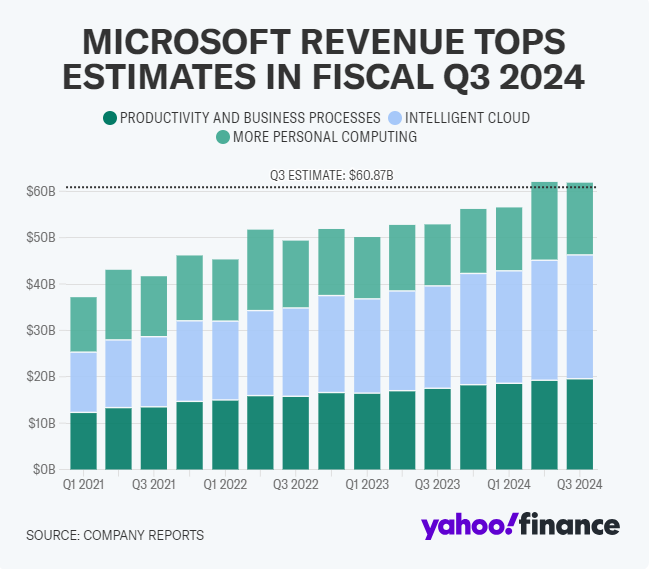

Microsoft Earnings Preview

Microsoft (MSFT.)) are delivering their fiscal Q4 results after market close today. For the quarter, Microsoft is projected to report earnings per share of $2.94 on revenue of $64.5 billion, according to Bloomberg data. In the same period last year, Microsoft posted EPS of $2.69 on revenue of $56.2 billion. Cloud revenue is anticipated to reach $36.8 billion, with Intelligent Cloud revenue, including Azure, expected to total $28.7 billion.

Microsoft is widely seen as the frontrunner in the AI race and thus AI earning will be monitored closely. Beyond Microsoft’s AI earnings, investors will be keen to learn about the company’s future spending plans on the technology. In Q3, Microsoft reported $14 billion in capital expenditures, including finance leases, as it continues to expand its AI infrastructure.

Source: Yahoo Finance

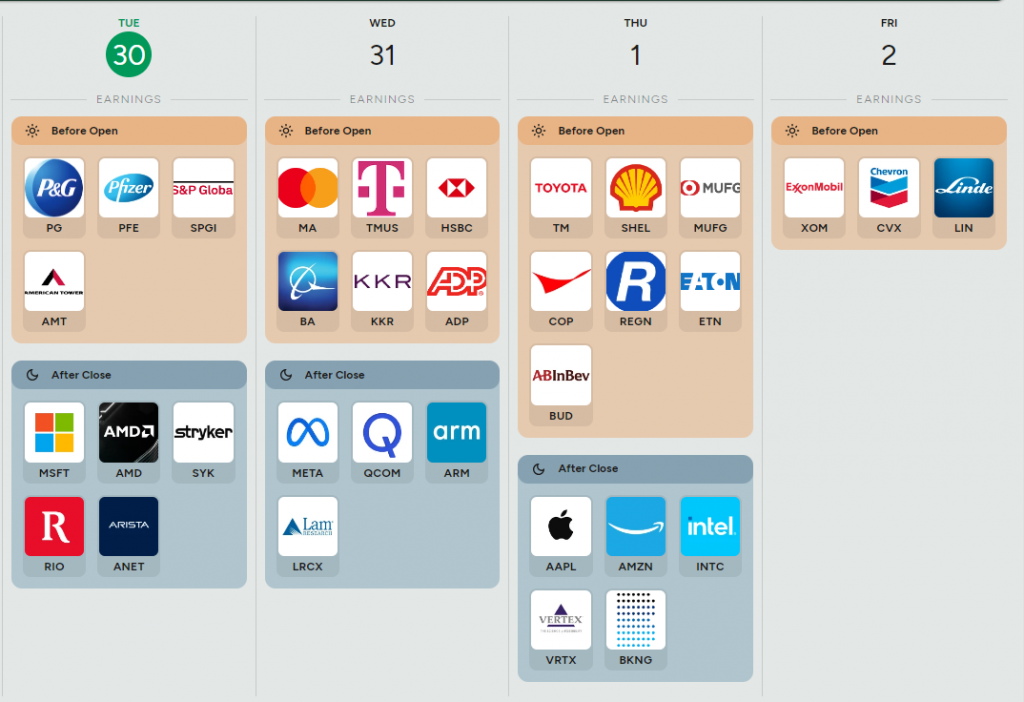

US Earnings and Data Releases

Jobs data and the NFP report is due on Friday and today provided the first glimpse at some jobs data. JOLTZ job openings came in higher than expected, this coupled with inflation easing has kept rate cut chatter in overdrive.

There are a host of earnings releases still ahead this week as well as the FOMC meeting. The notable companies ahead include Apple, Amazon and Meta.

Source: SavvyTrader

Technical Analysis on S&P 500

From a technical perspective, the S&P 500 is currently down about 1.2%. The index has been pulled lower primarily by the tech sector, which is down 2.08%, while energy is up 1.22%.

Looking at the chart, the S&P 500 is now very close to last Thursday’s lows around the 5392 mark and appears to be testing the support-turned-resistance at 5421. A break below the 5392 support level could lead to further declines, with support expected around 5330 and 5267.

Conversely, an upward move from here will first need to overcome intraday resistance at 5444 before the 5500 level becomes significant again. Above the 5500 mark, both the 100-day and 200-day moving averages provide resistance ahead of the recently set all-time highs.

S&P 500 Chart, July 25, 2024

Source: TradingView (click to enlarge)

Support

- 5392

- 5330

- 5267

Resistance

- 5444

- 5500

- 5515

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.