- US trade restrictions on China could significantly impact the semiconductor industry, causing a selloff of chip stocks, including Nvidia and ASML.

- ASML’s Q2 earnings exceeded expectations despite a decline in net income, but concerns remain about potential revenue loss if restrictions tighten.

- Geopolitical tensions between the US and China are expected to intensify, with implications for various sectors, including technology.

MOST READ: EUR/USD Rallies Toward Key Confluence Zone Amid Accelerating DXY Selloff

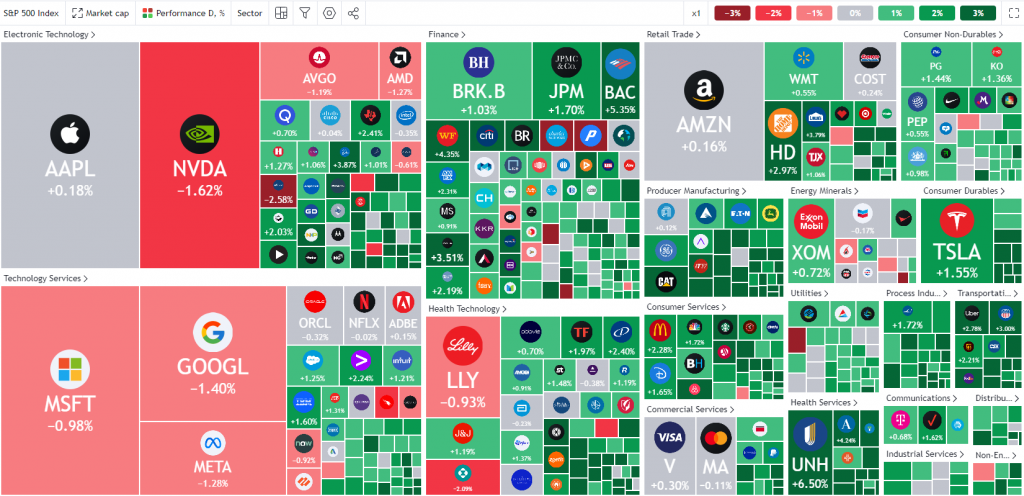

US Equities struggled in pre-market trade as the threat of trade restriction on China resulted in a selloff of chip stocks.

S&P 500 Heatmap

Source: TradingView.com (click to enlarge)

Chip manufacturers lead the selloff with Nvidia and ASML dropping 3.5% and 7.5% respectively closely followed by big names Apple, Microsoft and Meta with losses of between 1% and 2%. The potential for stricter restrictions on chip-makers comes at an interesting time as Donald Trump announced his VP pick, JD Vance. Vance is a known critic of China and this has no doubt added a further layer of intrigue to the rumors.

There does appear to be push back though, as according to reports allies see the proposed steps by the US as somewhat draconian in nature. According to sources familiar with the matter, the US appears to be using this tactic as a way to get commitment from allies to adhere to stricter restrictions.

The US delegate to the World Trade Organization (WTO) said that challenges China presents to the global trading system are increasing. The WTO representative went further stating that the Chinese government has no inclination to change its policies to embrace market-oriented principles and policies.

US Earnings and Russell 2000

US earnings data has been overshadowed today by news from China. ASML shares dropped despite a strong Q2 earnings report. Although ASML is already restricted from selling its most advanced product lines in China, the company declined to comment further.

CEO Christopher Fouquet mentioned that 2024 is a transition year as they prepare for a robust 2025. Despite a 19% year-over-year decline in net income for Q2, the results surpassed analyst estimates of $1.41 billion, reaching $1.74 billion.

In Q2, China accounted for approximately 49% of ASML’s total sales, which could explain the selloff. Losing such a significant portion of revenue should the US impose tighter restrictions on chip manufacturers. Geopolitical and trade tensions are expected to intensify leading up to the US election and into 2025. The question remains: how significant will the impact be?

Earnings Calendar

The biggest beneficiary since the US inflation print last week has been your smaller cap stocks. This is evidenced by the Russel 2000 enjoying its best period in over 4 years. The Russell 2000 has outperformed the Nasdaq 100 by nearly 12 percentage points over the last four sessions, a feat last seen in 2011. This pivot was facilitated by increasing hopes of a rate cut and a resilient US economy and labor market.

READ MORE: Russell 2000: Another laggard catch-up play as UST yield curve bull steepening firms up

Technical Analysis

From a technical standpoint, the S&P 500 is poised to end a three-day rally as support at 5575 comes into focus. Breaking this support level could pave the way for a retest of the psychological 5500 mark. However, for this to occur, the S&P 500 must first surpass the 100-day moving average, which provides support at 5545.

On the other hand, a move higher could lead to a retest of recent highs or new peaks for the index. This scenario would likely depend on the resolution of concerns surrounding US restrictions on Chinese trade. If these threats persist or if the European Union takes similar actions, it could negatively impact global stock markets and pose a significant risk to sustainable profitability for leading firms in Q3 and beyond.

S&P 500 Daily Chart, July 17, 2024

Source: TradingView (click to enlarge)

Support

- 5575

- 5545

- 5500

Resistance

- 5634

- 5664

- 5700

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.