- Wall Street experiences choppy trading as investors await Fed Chair Powell’s speech.

- Nasdaq 100 and S&P 500 react to mixed earnings reports, with Disney surging and Cisco declining.

- US PPI data shows a slight uptick, raising concerns about potential inflationary pressures.

Most Read: Bitcoin’s (BTC/USD) Bull Run: On-Chain Data Signals New Demand, $100k in Sight?

Wall Street Indexes continue their choppy price action which has been a feature this week. It is not a huge surprise given the moves we witnessed after the US election which sent the S&P 500 and Nasdaq 100 to fresh all-time highs.

US CPI data yesterday came out largely in line with expectations with some whipsaw price action in the aftermath. Markets did however increase their bets on a rate cut for December but the 2025 outlook on rate cuts remains up in the air. Markets are now only pricing in around 77bps of cuts between now and the end of December 2025.

US PPI data was released a short while ago and saw a slight uptick last month with the headline PPI number coming in above the 1.9% forecast at 2.4% YoY. The MoM Core print also ticked up slightly to 0.3% vs expectations of 0.2%. Is this a warning that price pressures may slowly be returning?

Continuing jobless claims numbers came out in line with forecasts around the 1.873m with the initial jobless claims number coming in just under forecasts. Rate cut expectations saw a marginal change in the aftermath with markets still expecting a December cut.

Fed Chair Powell will also be speaking later in the day as he provides an updated economic outlook to business leaders in Dallas. I’m sure many leaders will be keen to hear more from the Fed Chair on his views around inflationary risks which have returned to the conversation post election.

Further comments are also expected from Fed policymakers Barkin and Williams later in the day.

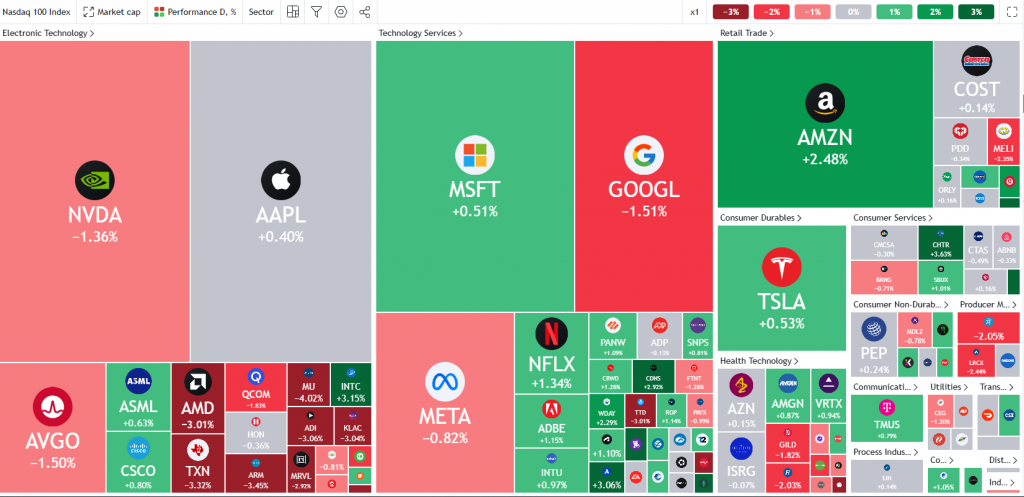

NASDAQ 100 Heatmap

Source: TradingView

Looking at the earnings picture and Walt Disney DIS.N shares rose around 6.5% after earnings beat estimates. The company reported an adjusted earnings per share (EPS) of $1.14, surpassing the estimated $1.10. Total revenue reached $22.57 billion, slightly exceeding expectations of $22.47 billion. The company also saw impressive growth in its subscriber base, boasting 122.7 million subscribers compared to the anticipated 119.85 million. Revenue from the entertainment segment came in at $10.83 billion, outpacing the projected $10.66 billion, while the experiences segment generated $8.24 billion, marginally above the forecasted $8.2 billion. Looking ahead, the company anticipates high single-digit growth in adjusted EPS for the fiscal year 2025, exceeding the estimated 4% growth.

Cisco’s CSCO.O stock fell by 3.3% after the company announced that its expected annual revenue would be about the same as predicted, following their report on Wednesday.

Technical Analysis

S&P 500

From a technical standpoint, the S&P 500 has been confined to a tight trading range this week having rallied some 4.72% last week to breach the 6000 handle.

Since however, the S&P 500 has failed to kick on as the last batch of earnings filter through. The triangle pattern breakout is still in play with target 1 around the 5910 handle already being breached. The pattern’s optimal target lies around the 6170 mark which could still materialize.

On the downside 5910 and 5860 are key support areas should the pullback deepen.

Conversely, a move higher faces little resistance with the recent highs being key at around 6028 before 6100 and lastly, 6170.

S&P 500 Daily Chart, November 14, 2024

Source: TradingView (click to enlarge)

Support

- 5910

- 5860

- 5757

Resistance

- 6028

- 6100

- 6170

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.