- Swiss National Bank (SNB) decision anticipated, markets split on 25 or 50 basis point rate cut.

- Strong Swiss Franc pressures exporters, raising expectations of FX intervention.

- SNB’s comments on Franc and intervention will be key to future price movements.

Most Read: Gold (XAU/USD) Prices Underpinned by Geopolitics, China Stimulus and ETF Flows, $2650 Up Next

SNB Preview: FX Intervention Ahead?

Market participants are awaiting the next major Central Bank decision which comes from the SNB tomorrow. The Swiss Franc has been enjoying an excellent run since the May 1st high around the 0.92246 handle.

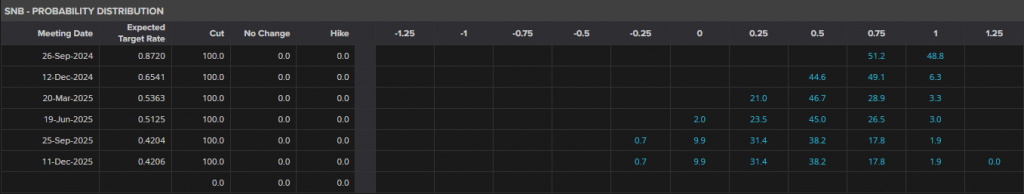

Looking at the Swiss economy, inflation has been consistently lower than expected, but the strong Swiss franc is putting pressure on exporting companies. Looking at refinitiv data and markets are split between a 25 and 50 basis point rate cut on Thursday. Market participants will keep a close eye on any guidance from the Swiss National Bank about intervening in the currency markets.

Source: LSEG

The SNB is also expected to downgrade its outlook on inflation moving forward following the most recent inflation data. Inflation is currently averaging 1.2% in Q3 versus the 1.5% expected with concern now resting more on the effect of a strong Swiss Franc on companies amid weakening demand in Europe.

The stronger Franc has become a major issue for Swiss exporters with watch manufacturers last week urging the SNB to ensure the Swiss Franc weakens. This has raised the question of FX intervention once more, with growing expectation that the Central Bank will intervene and step up its intervention in the coming weeks. Growing uncertainty around the globe has also made the Swiss Franc more appealing thanks to its safe haven status and this is another reason why FX intervention may be necessary.

Potential Impact and USD/CHF Technical Analysis

Despite the split consensus heading into tomorrow’s meeting, I am leaning more to the 25bps camp. This is the least risky option at present for the SNB as they do have FX intervention available to ensure weakness in the Franc.

A 25 bps cut may see some short term appreciation in the Franc but with intervention chatter prevalent, any gains could prove short-lived. Market participants should pay attention to comments from the SNB Chairman regarding the Franc and the potential for intervention as this may play a key role in how price develops once the SNB decision is over.

USD/CHF

From a technical perspective, USD/CHF has been in a period of consolidation since August 22. The range between 0.85288 and 0.84099 has held firm with the pair appearing to form a base here for potential longs.

The Fed decision of a 50 bps cut was not enough to inspire a breakout to the downside and thus my take is such a breakout remains unlikely. A short-term retest of the range low may occur but I expect the daily candle to remain inside the range barring any unexpected surprises.

Looking at the RSI, it has crossed above the neutral 50 level which is a sign that bullish momentum is present. This could prove beneficial for USD/CHF bulls eyeing a move higher.

A move higher and daily candle above the range high at 0.8528 will then face the inner trendline which rests around the 0.8580 to 0.8600 handle. A break higher brings resistance at 0.8700 ad 0.8750 into focus.

USD/CHF Daily Chart, September 25, 2024

Support

- 0.8400

- 0.8334

Resistance

- 0.8528

- 0.8600

Source: TradingView (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.