- Wall Street indexes are experiencing volatility due to geopolitical tensions and anticipation of Nvidia’s Q3 earnings report.

- The release of Nvidia’s Blackwell chip is a major highlight, with potential implications for the AI and computing sectors.

- The performance of Nvidia’s stock could significantly impact the broader market, including the S&P 500 and Nasdaq indexes.

Most Read: GBP/USD, GBP/JPY Price Action Ideas Post UK Inflation Release

The major Wall Street indexes have struggled today thanks to a rise in geopolitical tensions between Russia and Ukraine and the Nvidia earnings release. The S&P 500 and Nasdaq 100 are trading down 0.64% and 0.93% respectively. Wall Street’s “fear gauge” .VIX jumped to 18.79 before easing slightly, but it was still trading at its highest since the Nov. 5 U.S. presidential election.

NVIDIA Earnings Preview: What to Expect

Nvidia earnings will be released in a short while and remains a key event with some analysts referring to the release as the most important economic event of the quarter. Markets remain concerned about lofty AI valuations despite positive earnings releases from the rest of the ‘magnificent 7’.

Investors are cautious about NVIDIA’s Q3 2024 earnings despite the company’s strong recent performance. Analysts think NVIDIA will earn between $33 billion and $34.3 billion, which is about 81% to 82% more than last year. They also expect earnings per share to be between $0.75 and $0.79, up 85% from the previous year.

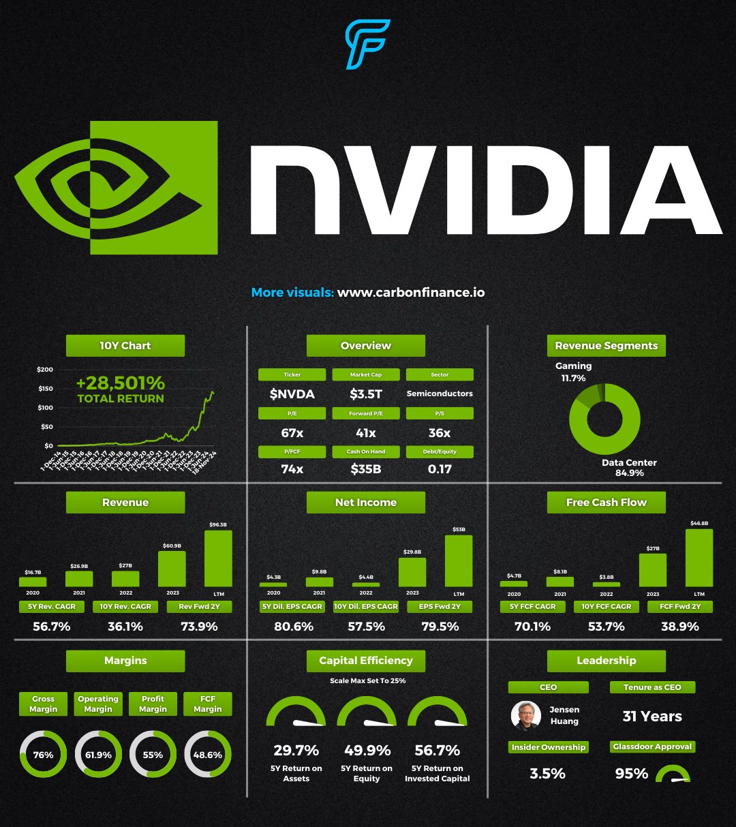

Source: CarbonFinance (click to enlarge)

A major highlight this quarter is NVIDIA’s new Blackwell chip. Wall Street is paying a lot of attention to it, seeing it as a big deal for artificial intelligence and computing. This chip might help NVIDIA grow even more and keep its lead in the market.

Along with this market participants will be keeping a close eye on inventory levels as the tug of war between supply and demand remains key moving forward. As seen with other magnificent 7 stocks, forward guidance will prove just as important, with any sign of a potential slowdown being expected or concerns around the impact of a trade war and markets could be spooked which could negatively affect NVIDIA and by extension both the S&P 500 and Nasdaq 100.

The broader impact of NVIDIA earnings should not be understated given the performance after the last 3 earnings reports. In February, the stock gained +43%, June 46% with a -21% being recorded in August. This has also led to wild swings for the SPX and Nasdaq as well.

Investors are watching closely to see if NVIDIA can do better than what analysts expect and keep growing and innovating. Positive or negative the results are likely to have a massive impact on Wall Street Indexes.

Technical Analysis

Nasdaq 100

The Nasdaq 100 has struggled following the initial Trump election rally which propelled the index beyond the 21000 handle.

Despite the 700+ point selloff since the post election high, the overall bullish trend remains intact.

On the daily chart below, only a daily candle close below the swing low just below the 20000 handle would lead to a change in structure. Until then the bullish trend remains in play with the long term descending tredline also resting lower down close to the 19800 handle.

We also have the 100-day MA which rests around the 19786 handle and could come into play as well should we get an extended selloff.

Looking at the upside and immediate resistance rests at 20790 before the 21000 comes into focus. Beyond that we have the recent highs at 21250 which provide the next hurdle.

Immediate resistance rests at 20484 before the all-time highs around 20790 come into focus.

Nasdaq 100 Daily Chart, November 20, 2024

Source: TradingView (click to enlarge)

Support

- 20000

- 19786

- 19123

Resistance

- 20790

- 21250 (all-time highs)

- 21500

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.