- GBP/USD is stuck in a tight range, reflecting market indecision.

- Upcoming US data releases, including GDP and PCE data, could trigger a breakout from the range.

- The US Dollar Index’s performance will heavily influence GBP/USD’s movements.

Most Read: S&P 500 Eyes Fresh All-Time Highs Despite Trump Tariff Threats. 6500 by Year End?

Cable has continued to consolidate in a 100 pip range this week with yesterday a prime example of the indecision at play. GBP/USD tested both the high and low of the range before finishing the day relatively flat.

US Data Ahead and Central Bank Meetings

There has been some respite for the GBP as the US Dollars impressive rally has also stalled this week. Despite this GBP/USD has failed to push on which could be a sign that bears may be holding the edge.

Given the lack of UK data this week, the US will be key with a slew of medium and high impact data releases scheduled. The FOMC minutes were released yesterday, with more cuts expected but ‘gradually’. No surprise really given the potential implications that may arise from a Trump Presidency.

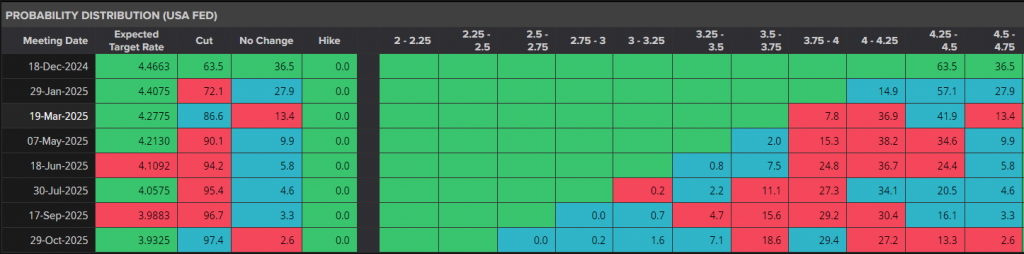

The December Fed meeting is around 60-40 in favor of a rate cut of 25 bps but the January meeting seems to be favoring a pause. The meeting will come 9 days after Donald Trump takes office and I would think a pause would be a prudent approach given Trump’s tariff rhetoric.

Source: LSEG

Looking across the pond and the Bank of England (BoE) are expected to pause in December. This could work in favor of the GBP in the short-term but moving forward into 2025 and the BoE are likely to cut more than the Fed at present. This of course could change as more data is released and the impact of Trump’s economic policy is felt.

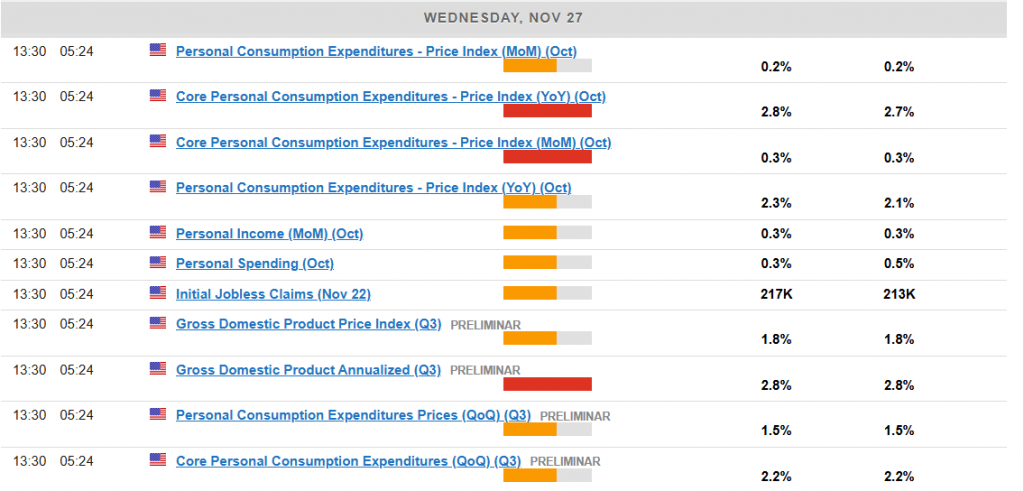

A batch of US data awaits later in the day with initial jobless claims and the 2nd GDP estimate. We will also get the first glimpse of PCE data as well which may shed more light on the recent rise in US PPI and CPI data. The data could once again drive GBP/USD price action but as has been the case of late, any moves are unlikely to prove sustainable.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

US Dollar Index (DXY)

The Dollar Index has been interesting to monitor of late and has been a driving force for dollar denominated pairs.

The DXY is trading below the multi-month key level at 107.00 which it has done on Monday and Tuesday this week. However, the index has failed to close below this level which has been key to keeping bulls interested.

The daily candle close today will be key with a close below this level likely to lead to further downside. It is key to monitor the US data as this could be key to where the DXY ends the day.

US Dollar Index (DXY) Daily Chart, November 27, 2024

Source:TradingView.com

GBP/USD

From a technical standpoint, GBP/USD has been stuck in a 100 pip range for the last four days. Price is making a move to the upside at the moment but acceptance above the range high at 1.2618 is needed for further upside to materialize.

A move above this key level opens up a test of resistance at 1.2681 and 1.2750. Looking further and we have the 200-day MA at 1.2819.

A rejection and a move lower from these levels faces support at the 1.2500 psychological level with a break of this level leading to a run toward the 1.2440 and 1.2312 handles respectively.

GBP/USD Daily Chart, November 27, 2024

Source:TradingView.com

Support

- 1.2500

- 1.2440

- 1.2312

Resistance

- 1.2618

- 1.2681

- 1.2750

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.