- Alphabet and Reddit exceed Q3 earnings expectations, driven by strong ad sales and cloud revenue.

- Microsoft’s Q1 FY2025 earnings will be a key indicator of broader AI demand, with Azure and AI services in the spotlight.

- Could Meta and Microsoft facilitate fresh highs on the Nasdaq 100?

- Nasdaq 100 remains range-bound ahead of Meta and Microsoft earnings releases.

Most Read: Gold (XAU/USD) Price Reclaims $2750/oz Amid Record $3 Billion Inflows into Gold Funds

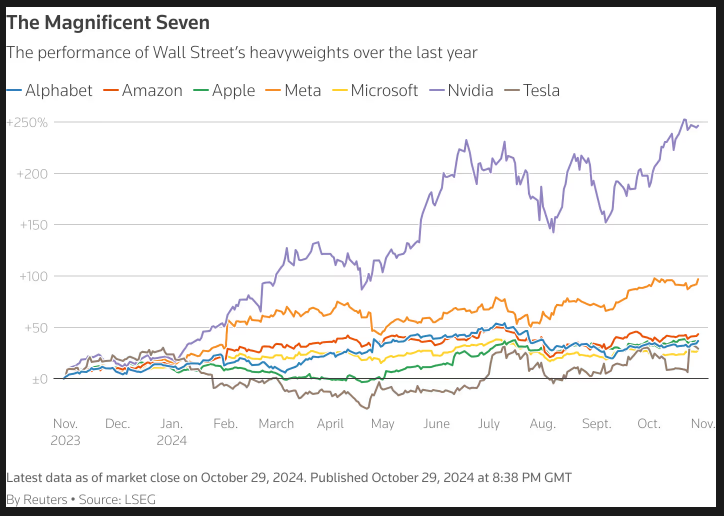

US Earnings are now in full swing with Alphabet GOOGL.O, the first of the five “Magnificent Seven” megacap stocks due to report results this week, having leapt 6.3% in premarket trading.

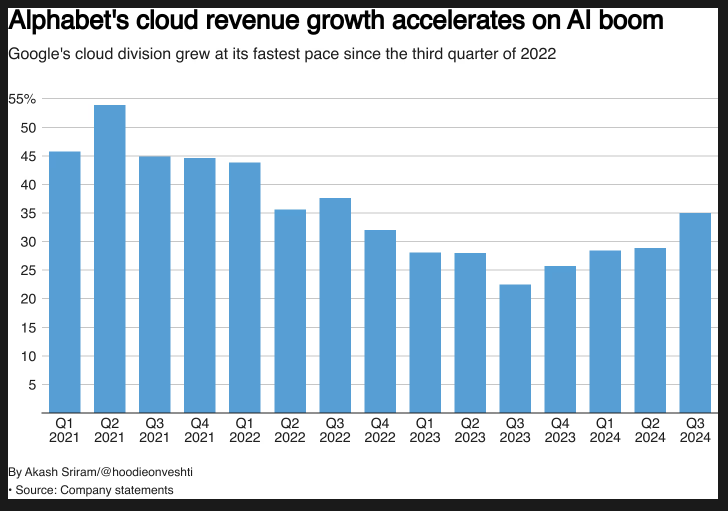

Alphabet beat expectations with both revenue and Q3 profit thanks in large part to its cloud business and Youtube Ad sales. Ad sales have proven to be the surprise of earnings season so far with Reddit RDDT.N also reporting positives regarding Ad sales. Reddit jumped 21% after reporting a quarterly profit for the first time since going public.

Alphabet also surprised by increasing its operating margin which rose from 28% to 32% despite continued capital spending on AI development. This is a big deal for markets as one of the concerns heading ito earnings season was whether the ‘magnificent 7’ would be able to justify their lofty valuations. Many analysts had feared that earnings would disappoint as there have been signs of an economic slowdown outside the US.

Source: LSEG

Meta and Microsoft Earnings Preview

Microsoft MSFT and Meta report after market close today and both shares are trading slightly highly early in the US session. Markets will no doubt be paying attention to Ad Sales and Cloud revenue from Meta and Microsoft respectively as well as the general revenue and profit numbers.

To break it down more, When it comes to Meta which reported second-quarter ad impressions and the average price per ad, each up 10% year-over-year. Markets will be keen to gauge if this could continue. Following the surprise by Alphabet in regard to its operating margin, markets will be keeping a close watch on Metas AI spending and operating margin as well.

Microsoft is set to announce its earnings for the first quarter of fiscal year 2025, which ended on September 30, 2024. Investors are eager to see the demand for Microsoft’s AI services as the company invests heavily in AI infrastructure. Wall Street expects Microsoft to report $64.51 billion in revenue, a 14% increase from last year, with earnings of $3.08 per share. Key areas to watch include the impact of AI on Azure’s revenue growth, which saw a 9% contribution from AI technologies last year.

Additionally, the performance of Microsoft 365 Copilot, which uses AI to improve productivity, remains undisclosed and highly anticipated. Capital expenditures, which hit a record $19 billion last quarter mainly for AI and cloud infrastructure, are expected to rise further. Microsoft’s results are seen as a key indicator of broader AI demand in the industry

Source: LSEG

Technical Analysis

Nasdaq 100

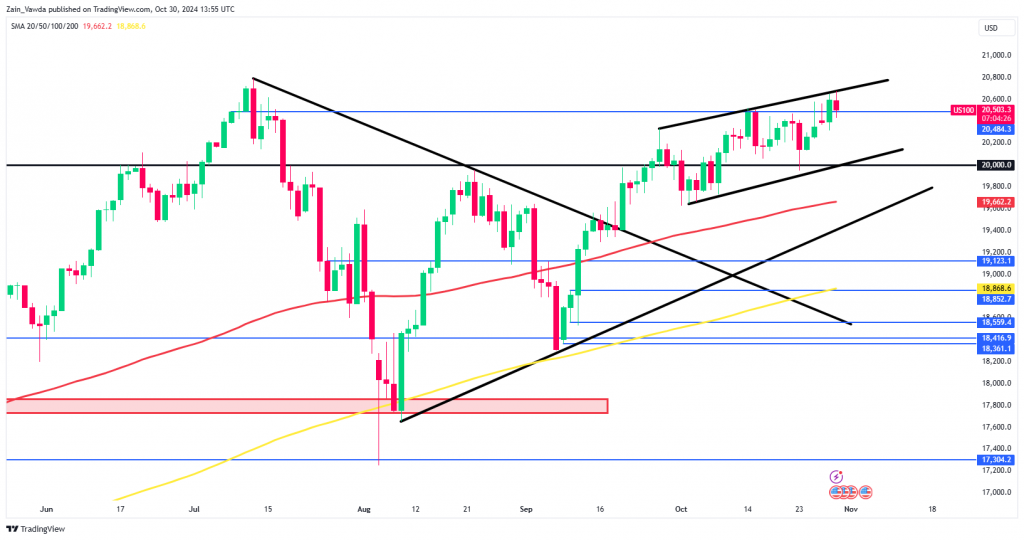

The Nasdaq 100 has for the first time closed above the key 20484 resistance level. This is key as the tech index has failed to breach this level since the initial test on the 14 October. The all-time highs around 20789 are not that far off, however we are seeing an initial pullback following the US open.

The Nasdaq is likely to remain below the all-time highs ahead of Meta and Microsoft earnings later in the day. The question is, could positive data from the two push Nasdaq to fresh all-time highs.

The Nasdaq 100 is also trading in an ascending channel which usually precedes a breakout to the downside. This doesn’t bode well for the bulls but time will tell if this materializes.

Immediate resistance rests at the previous highs around 20789 before the 21000 handle comes into focus.

Conversely, a move lower from here may find support at 20136 before the 20000 handle becomes the source of focus.

Nasdaq 100 Daily Chart, October 29, 2024

Source: TradingView (click to enlarge)

Support

- 20136

- 20000

- 19757

Resistance

- 20790 (all-time highs)

- 21000

- 21250

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.