- The USD/CAD pair is declining due to the anticipation of aggressive rate cuts by the US Federal Reserve, which could narrow the interest rate differential between the US and Canada

- Canada’s better-than-expected trade surplus in June, driven by increased crude oil and gold exports, further strengthened the Canadian dollar.

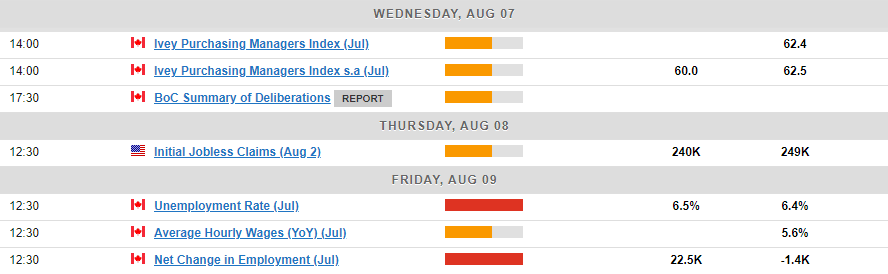

- BoC summary of deliberations and job data releases expected to provide insights into the central bank’s views and the employment situation.

Most Read: Gold (XAU/USD) Steadies After Volatile Monday; DXY Bounces Back

USD/CAD continues to decline in the US session after failing to secure acceptance above the 1.3900 level.

The Canadian Dollar stands to benefit significantly from the aggressive rate cuts now anticipated from the US Federal Reserve. Just two weeks ago, the Bank of Canada was addressing concerns about a rate differential with the US. However, with current market expectations, this issue seems less pressing as recession fears take precedence.

The Bank of Canada has been contending with slow economic growth and rising unemployment, leading it to initiate rate cuts. Markets are now anticipating 75 basis points (bps) in cuts from the BoC and 100 bps from the US Federal Reserve. The BoC has already implemented 50 bps in cuts, so if market predictions hold true, the rate differential could narrow to just 25 bps by the end of the year.

The Canadian Dollar aso gained a modicum of strength this afternoon thanks to a better than expected trade balance print. Statistics Canada revealed that the Canadian economy recorded a surprising trade surplus of C$638 million ($461 million) in June, driven largely by a surge in crude oil shipments from the recently expanded Trans Mountain Pipeline.

A significant increase in gold exports further bolstered overall export figures. Combined with energy product shipments, this growth helped exports surpass imports for the first time in four months, Statistics Canada reported.

Analysts surveyed by Reuters had predicted a C$1.84 billion trade deficit. Additionally, May’s trade deficit was revised down to C$1.61 billion from an initial estimate of C$1.93 billion.

Canadian Data is Key

This week features a scarcity of high-impact data from the US, placing the spotlight on geopolitical developments and Canadian economic updates.

Tomorrow, the Bank of Canada (BoC) will release its summary of deliberations, offering insights into the Central Bank’s perspectives. On Friday, key job data will be released, crucial in light of the recent rise in the unemployment rate over the past few months.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

From a technical standpoint, USD/CAD briefly climbed above the 1.3900 resistance before retreating. This movement, combined with a shooting star candlestick close on the daily chart yesterday, suggests further downside potential.

Immediate support is at 1.3740, with the 100-day and 200-day moving averages providing additional support at 1.3680 and 1.3650, respectively.

If the pair moves higher, it will face resistance at 1.3854, followed by the significant 1.3900 level.

USD/CAD Chart, August 6, 2024

Source: TradingView (click to enlarge)

Support

- 1.3740

- 1.3680

- 1.3650

Resistance

- 1.3850

- 1.3900

- 1.4000

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.