- USD/CHF is poised for a potential bullish move following a recent breakout, supported by a confluence of technical and fundamental factors.

- The Swiss National Bank’s preference for a weaker CHF and the repricing of Fed rate cut expectations contribute to the bullish outlook.

- Upcoming US CPI and PPI data releases could further fuel the USD rally and drive USD/CHF to new highs.

Most Read: Brent Crude – Oil Eyes $80 a Barrel as Geopolitical Concerns Linger, Libya Production Returns

USD/CHF is eyeing an extended move to the upside following a breakout last week. A brief pullback yesterday has set the stage for a move, will geopolitical risk reignite interest in the CHF and hamper the move?

Fundamental Overview

Considering the current economic and fundamental landscape, things have clearly shifted from a week ago. In its latest meeting, the Swiss National Bank indicated a preference for a weaker CHF, following feedback from several Swiss companies that the industry would benefit from such a move.

The Central Bank which is known for FX intervention in the past has been touted to do so again if CHF gains continue. The recent geopolitical tension has certainly piqued the interest of those touting for FX intervention.

The recent rally in the USD and repricing of rate cut expectations has changed the picture slightly. Markets are pricing in a little less than 50 bps of cuts for the rest of the year from the Federal Reserve and this bodes well for further upside in USD/CHF.

The geopolitical risk is an interesting one as the US Dollar also benefits from safe haven appeal. Thus there is a chance that a rise in geopolitical risk could see USD gains balance out any gains by the CHF making any rise in geopolitical tensions irrelevant when it comes to USD/CHF.

US Data Ahead

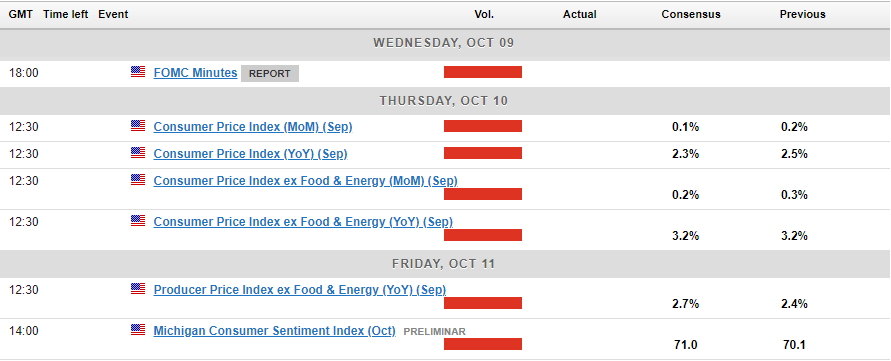

This week, US data ahead brings the US CPI and PPI releases which could add some fuel to USD/CHF.There has been growing chatter after the US Jobs report that a rise in inflation may rear its ugly head in the near future. The recent rise in Oil prices on the back of geopolitical risk could play its part if Oil prices remain elevated.

This week however, any uptick in inflationary pressure could further aid the US Dollar rally and thus propel the USD/CHF pair to fresh highs. Fed policymakers should also be eyed as any comments around rates may spur on some volatility as well.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

From a technical standpoint, USD/CHF was stuck in a period of consolidation for two weeks before breaking out on October 4. Since then the pair has broken above the inner descending trendline.

A pullback yesterday which retested the trendline sets the stage for a move higher. The confluences are too hard to ignore at this stage with overarching fundamentals lending support to this setup.

Immediate resistance to the upside rests at 0.8633 and before the 100-day MA comes into focus at 0.8744. The 100-day MA rests just below a key area of resistance and the outer descending trendline around 0.8750.

Dropping down to a four-hour (H4) chart and a H4 candle close below the swing low at 0.8500 would invalidate the bullish setup.

USD/CHF Daily Chart, October 8, 2024

Source: TradingView (click to enlarge)

Support

- 0.8535

- 0.8500

- 0.8400

Resistance

- 0.8633

- 0.8757

- 0.8890

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.