- USD/CHF is showing potential for bullish continuation.

- The Swiss National Bank may welcome a weaker CHF due to pressure from the swiss export sector.

- Upcoming US data and geopolitical events, including the IMF meeting and US election, could impact USD/CHF.

Most Read: Markets Weekly Outlook – PMI Data and IMF Meeting Dominate the Agenda

s eyeing an extended move to the upside as it hovers around a support area on Monday. Safe Haven appeal appears to be keeping the Swiss Franc supported at present as USD bulls eye further gains.

As expectations around Fed policy continue to shift, the CHF and the Swiss National Bank have faced different challenges. After exporters urged the government to do something and the strong CHF, the Central Bank will actually welcome some organic weakness in the CHF.

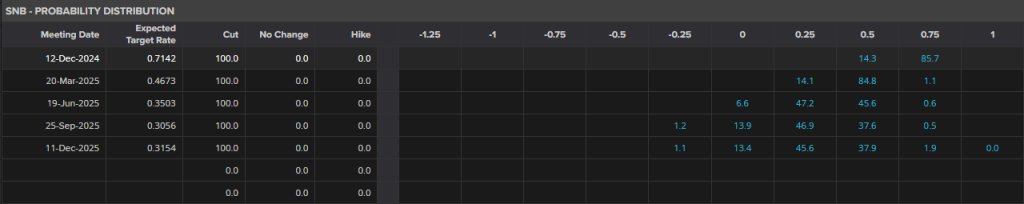

Switzerland has enjoyed easing price pressures for a while now which have raised expectations for further rate cuts from the Swiss National Bank (SNB). In September, Switzerland’s annual Consumer Price Index (CPI) slowed to 0.8%, the lowest in over three years, even though the Swiss National Bank cut its key interest rates at all three meetings this year.

This could lead to policy divergence if the trend continues and this could weigh on the CHF and thus push USD/CHF higher.

Swiss National Bank Interest Rate Probabilities

Source: LSEG Workspace

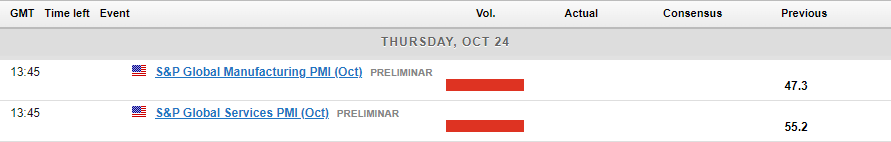

US Data Ahead

There is not a lot in terms of data from the US this week with larger volatility and price swings expected from the IMF meeting in Washington. The meeting will provide a platform for major Central Bank Governors to provide comments and discuss what they see as the path forward.

Geopolitical tensions remain key given the CHF often attracted haven demand. The US election has been adding another layer of uncertainty as it draws nearer.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

From a technical standpoint, USD/CHF on a weekly chart below finished last week extremely bullish and just a few pips off the weekly high. USD/CHF is experiencing a slight pullback today as it languishes between the inner and outer trendline.

USD/CHF Weekly Chart, October 21, 2024

Source: TradingView (click to enlarge)

Looking down to the daily chart below and you can see price is currently resting on the support handle.Immediate resistance rests at 0.8700 which is the 100-day MA before.

A break above this level will finally give the pair a chance to retest the descending trendline. Will we get a break or a bounce?

Now there are other scenarios that may develop depending on external circumstances. There may be a short-term pullback toward 0.8550 support or the 0.8500 handle.

**Please note that this is a follow- up piece. Further technical analysis here: USD/CHF Technical Outlook: Confluence Area Hints at Bullish Breakout

USD/CHF Daily Chart, October 21, 2024

Source: TradingView (click to enlarge)

Support

- 0.8633

- 0.8550

- 0.8400

Resistance

- 0.8700

- 0.8756

- 0.8890

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.