- The Japanese Yen is gaining against its G7 counterparts due to rumors that the Bank of Japan (BoJ) will reduce bond buying and potentially raise interest rates.

- Governor Ueda has emphasized wage growth as a key factor, and both average wages and average cash earnings YoY have shown a steady upward trend.

- Japan is set to establish a national minimum wage standard of 1,054 yen per hour on average, the largest increase ever.

Most Read: Oil Price Update: Brent Holds Critical Support Amid US Inventory Decline

Bank of Japan (BoJ) to Detail Bond Buying Plan…. Rate Hikes Incoming?

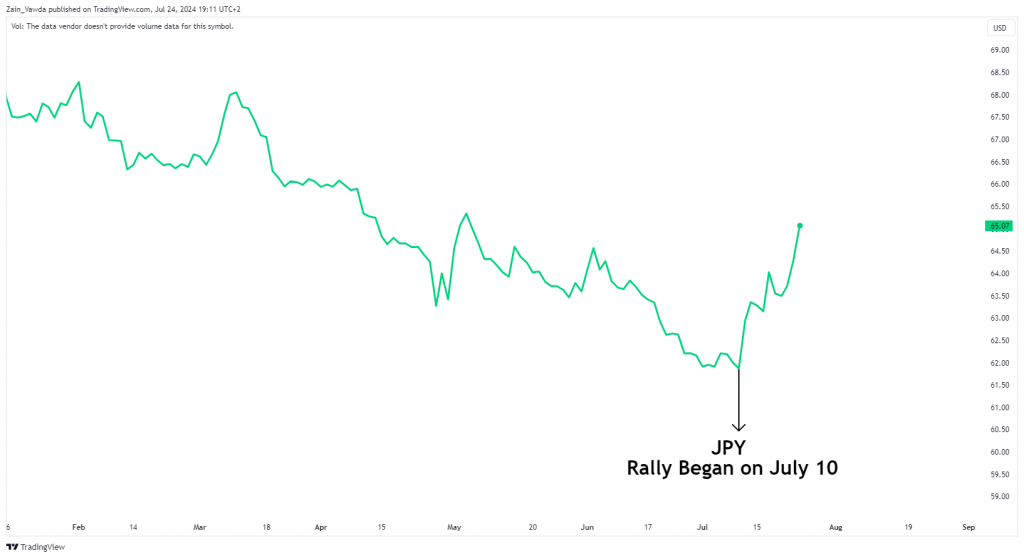

The Japanese Yen is having an exceptional week, continuing to make substantial gains against its G7 counterparts. After two weeks of intervention speculation, the focus has now shifted, driving further gains for the Yen.

Japanese Yen Index

Source: TradingView.com (click to enlarge)

This morning, rumors emerged that the Bank of Japan (BoJ) will announce a plan at next week’s meeting to halve bond buying over the coming years. Sources also suggest that the BoJ will debate raising interest rates, with Governor Ueda aiming to align Japan more closely with global peers.

This aligns with Governor Ueda’s message when he took office. He has emphasized wage growth as a key factor, and both average wages and average cash earnings YoY have shown a steady upward trend.

Additionally, news broke today that Japan is set to establish a national minimum wage standard of 1,054 yen per hour on average, marking the largest increase ever. This step aims to ensure wage growth aligns more closely with core inflation, which was 2.5% in May.

It appears that everyone is focused on inflation and overall economic growth, overlooking a key message that has been a consistent theme during Governor Ueda’s tenure: the need for sustainable wage growth. The data suggests that the Governor has made progress in this area, though there is still room for improvement. The new minimum wage may help bridge this gap.

The rumors have driven Yen bulls into overdrive, breaking through key support areas. The USD, EUR, and GBP have all lost significant ground against the Yen. Given today’s reaction to the rumors, it will be interesting to see how much has already been priced in and whether there will be any movement when the BoJ meets next week.

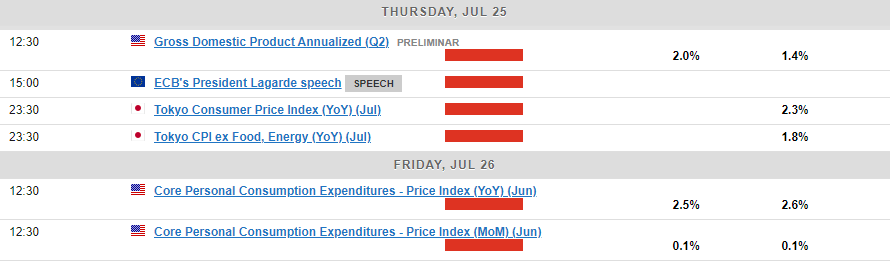

Economic Data Ahead

Later in the evening we will get the updated CPI numbers from Tokyo which is unlikely to overshadow the optimism ahead of next week’s meeting. US GDP and PCE data could however have an impact on the Yen, particularly if we get a significant uptick in the PCE number. A PCE and GDP print in line or slightly softer than expectations could further aid Yen bulls and push USD/JPY closer toward the 150.00 psychological handle.

Source: For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis

USD/JPY

The USD/JPY pair has broken through the long-term descending trendline that has been in play since December 2023. Following a retest of this trendline, USD/JPY is on track for its third consecutive day of losses but is currently resting on a key support area.

Presently, USD/JPY is holding at 153.60, a level that has shifted from resistance to support and is maintaining the price at the moment. A daily candle close above this level could pave the way for a retest of resistance at the 155.00 handle and the 100-day moving average.

Conversely, a break below this point would bring the 200-day moving average and the psychological 150.00 level into focus, particularly as we approach next week’s BoJ meeting.

It’s important to note that upcoming key US data releases could introduce some volatility. The critical question is whether any reactions or movements in response to this data will be sustainable.

Support

- 153.59

- 151.91

- 150.00

Resistance

- 155.00

- 156.50

- 157.73

USD/JPY Daily Chart, July 23, 2024

Source: TradingView.com (click to enlarge)

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.