- Japanese overnight index swaps show rates turning positive by the December 19th BOJ meeting

- Prior to the BOJ decision, Japan CPI is expected to see base effects help trim inflation down to 3.0%

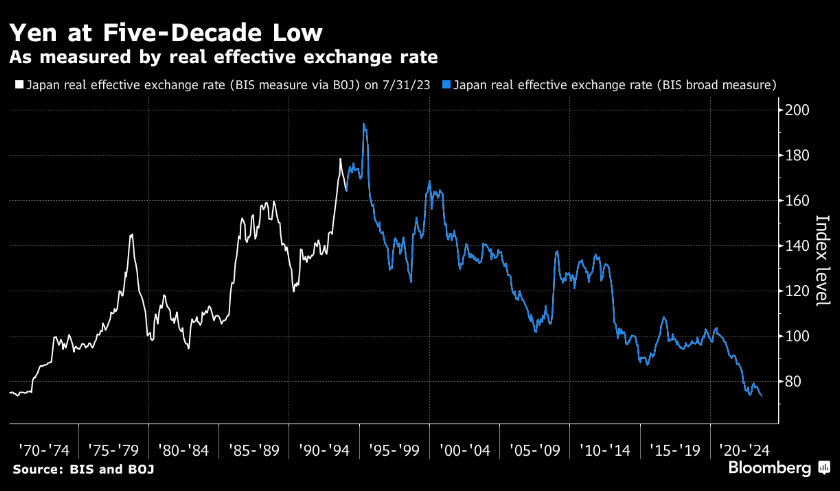

- BIS: Yen real effective rate (against basket of currencies) falls to record low (dating back to the early 70s)

The Fed rate decision drove home the message that interest rates will be staying higher for longer. Now it is the BOJ’s turn to show what they will do about the yen. Verbal intervention has been steady, but what everyone wants to know is will Governor Ueda signal a new intensity of hawkishness. The BOJ policy decision will likely see the central bank maintain its existing policies with the balance rate and 10-year yield target. In July they adjust YCC framework and they might keep that intact for now.

The BOJ needs to deliver a hawkish hold here as any letdown could easily send the yen towards the 150 level, which some think is the line in the sand for actual intervention. Earlier in the week, Japan’s top currency official Kanda said, “We maintain extremely close communication with foreign authorities, especially the United States, on a regular basis.”

Given the weakening global outlook, Japan officials have an opportunity to take advantage of how the market is positioned. The BOJ should consider signaling they are a lot closer to abandoning their negative policy rate. If successful, they could see yen rally towards the 146.00 region. Over the coming months, the yen may also get a boost from safe-haven flows as a global energy crisis could dampen everyone’s outlook.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.