- EUR/USD faces pressure due to a strong US Dollar and concerns about the ECB’s policy direction.

- The US election and potential trade war concerns are weighing on the Euro.

- The interest rate differential between the Fed and ECB is a key factor to watch.

Most Read: Markets Weekly Outlook – PMI Data, UK Inflation and the Soft Landing Conundrum

The US Dollar bulls continue to hold firm at the start of the week following signs that some weakness may materialize. So far this has proven to be false, as Asian session declines were immediately wiped out following the European.

ECB Policymakers Send Mixed Signals

The US election has raised concerns for the EU regarding a potential trade war, and its impact on the Euro Area. Mixed messaging from ECB policymakers this morning has kept EUR/USD under pressure following an attempted rally at the start of the European session. Markets will no doubt be eyeing a speech by ECB President Christine Lagarede this evening in Paris for clues as to how the ECB views the potential impact of a Trump Presidency.

Earlier in the day, ECB Vice President Luis de Guindos said that the main worry has moved from high inflation to concerns about economic growth. A trade conflict between the Eurozone and the US could start after Trump said in his campaign that the Eurozone would face serious consequences for not purchasing enough American goods.

Rate Differential Concerns Grow

Following another bout of strong US data last week and an uptick in US PPI numbers, markets continue to price in less cuts from the Federal Reserve. This has kept the USD underpinned at a time when the ECB is dealing with disappointing growth and the possibility of more aggressive rate cuts.

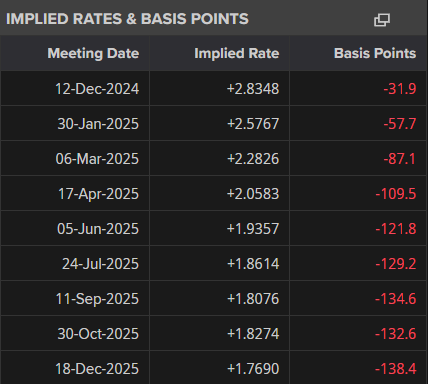

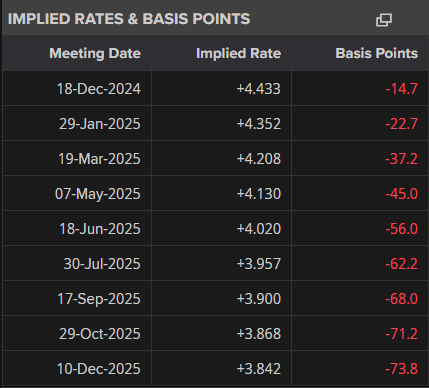

As things stand, the ECB is scheduled to cut rates as much as 140+ bps through December 2025, the Fed are only expected to cut around 70+ bps. This is a massive discrepancy and if this gap continues to grow, the chances of further losses for EUR/USD will rise.

ECB and Federal Reserve Implied Rates – December 2025

ECB

FED

Source: LSEG

Looking ahead to the rest of the week, US and EU PMI data will be key. For the Euro Area more so than the US as concerns linger around growth moving forward. A disappointing PMI print for the EU will keep the Euro on the back foot.

The US PMI data will have markets focused on performance as well, largely to see if the US economy is as strong as recent data suggests. Job creation in the sector might also be of interest given the up and down payroll figures and downgrades in the US.

For a full breakdown of the week ahead and key economic data releases, read the Weekly Market Outlook now.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis of EUR/USD

From a technical standpoint, EUR/USD is holding above the key psychological handle at 1.0500. An inverse hammer candle close on Friday hinted at further upside today, but there remains significant downward pressure on the pair.

This is evidenced by the failure of the pair to hold onto gains with early European session largely wiped out already in a similar vain to Friday.

The positive is that EUR/USD continues to hover around oversold territory on the RSI period 14. This of course not a guarantee of a move higher but a sign that attention should be paid for a potential reversal.

Immediate resistance rests at the 1.0600 and 1.0700 handles respectively before a potential retest of the descending trendline around the 1.0755 handle comes into focus.

A move lower here and a break of the 1.0500 handle faces support at 1.0450 before support at 1.0366 becomes a possibility.

EUR/USD Daily Chart, November 18, 2024

Source: TradingView.com

Support

- 1.0500

- 1.0450

- 1.0366

Resistance

- 1.0600

- 1.0700

- 1.0755

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.