- The rising power and influence of the EU’s far-right political parties have spooked European financial markets.

- A poll has indicated prominent French far-right National Rally party is leading by a significant margin over the incumbent President Macron’s party for the upcoming 1st round of the French legislative election on 30 June.

- The rapidly rising yield spread of the French and German 10-year government yields has triggered a reflexive negative feedback loop into the German DAX.

The rising popularity of the far-right political parties in the European Union has translated into a reckoning force to behold after they gained a significant foothold of votes in the European Parliament elections last Sunday, 9 June.

French President Macron’s centrist party has lost heavily to the far-right National Rally party led by Le Pen, a prominent leader of the far-right camp in the EU election which prompted Macron to call for a localized French legislative snap-election that is expected to be held in two rounds; the first round of voting starts on 30 June 2024 followed by the second round on 7 July 2024.

According to a poll conducted by Elabe on Thursday, 13 June, Le Pen’s far-right National Rally would win the first round of the French legislative election with 31%, a significant margin over Macron’s party that would come in third with 18%.

These poll results have further spooked European financial markets as policies advocated by French far-right political parties tend to favour looser fiscal policies that drive up the budget deficit and could negatively impact French economic growth in the medium term to long term.

Bond vigilantes are back in full force

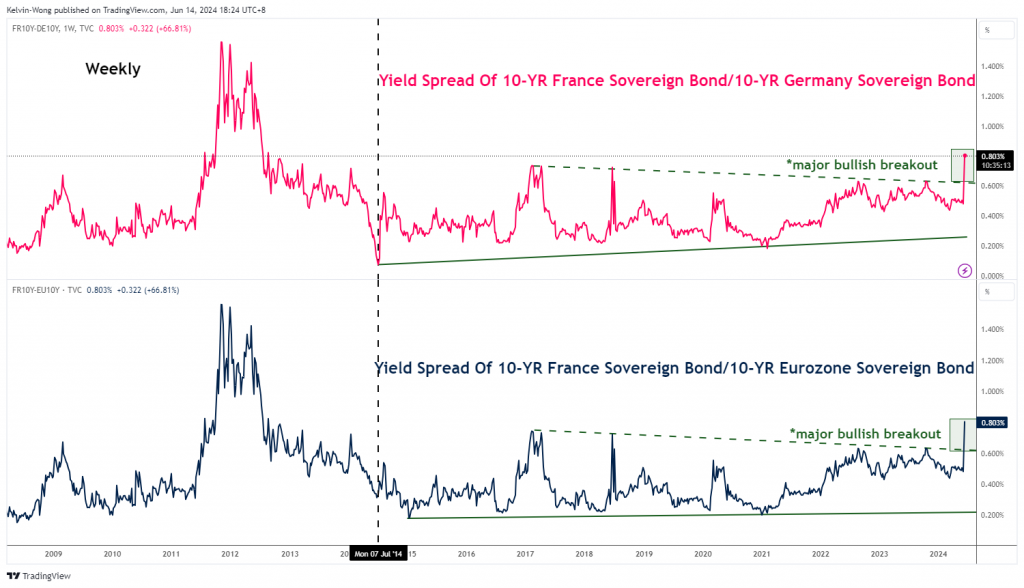

Fig 1: Yield spread of 10-year French & German government bonds as of 14 Jun 2024 (Source: TradingView, click to enlarge chart)

The bond vigilantes have already punished this potential upcoming lack of fiscal spending discipline in France. French sovereign bonds sold off, driving their yields over Germany and Eurozone government bonds to the highest level in almost 12 years.

The spread between the French and German 10-year government bond yields has widened to 81 basis points (bps) intraday at this time of the writing after a major bullish breakout from a basing formation, the most since August 2012 (see Fig 1).

The rout has also spread to the German stock market

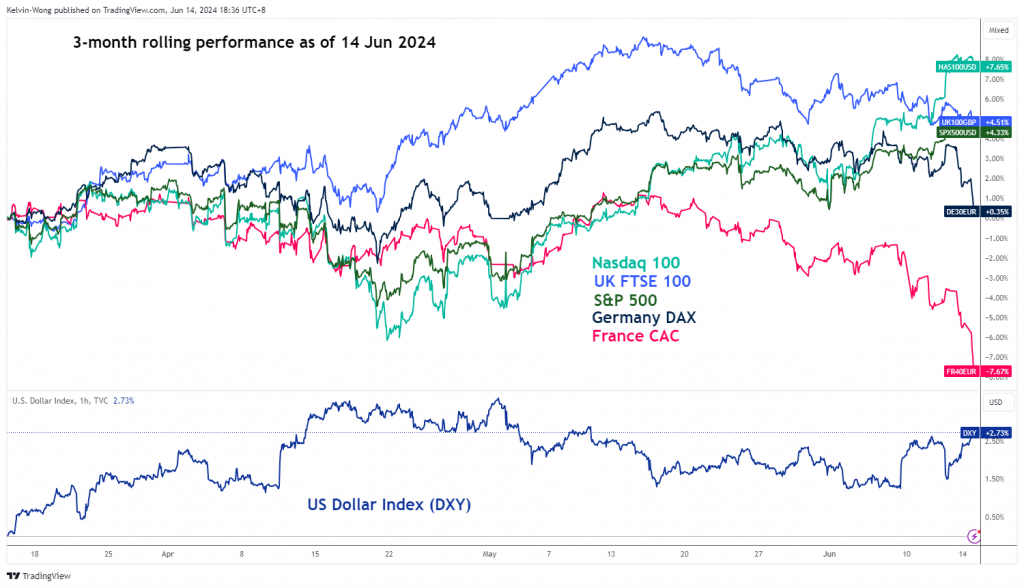

Fig 2: 3-month rolling performances of CAC 40 & DAX with US Dollar Index of 14 Jun 2024 (Source: TradingView, click to enlarge chart)

The French benchmark stock index, the CAC 40, has tumbled by 7.9% on a three-month rolling performance basis as of Friday, 14 June, a stark underperformance against the UK FTSE 100, the US S&P 500, and Nasdaq 100.

Given that France is one of the anchor economies in the European Union and Eurozone, any significant negative adverse movement in the French stock market is likely to trigger a similar cascading reflexive effect on other European stock markets, even the “mighty German DAX” has not been spared as its earlier positive performance in the past three months has dwindled to almost zero now (see Fig 2).

German DAX medium-term uptrend has been damaged

Fig 3: Germany DAX medium-term & major trends as of 14 Jun 2024 (Source: TradingView, click to enlarge chart)

The price actions of the Germany DAX CFD Index have staged a daily close below its 50-day moving average and the lower boundary of its medium-term ascending channel from the 18 January 2024 low.

In addition, a bearish momentum condition has been flagged by the daily RSI momentum indicator. Overall, these bearish elements have suggested that the bears are now in control where the Index is likely to shape a potential multi-week corrective decline sequence within its major uptrend phase that is still intact since its 3 October 2022 low of 11,795 (see Fig 3).

If the 18,935 key medium-term pivotal support is not surpassed to the upside, further weakness may prevail to expose the next medium-term supports at 17,480 and 16,900 (also the 200-day moving average).

On the other hand, a clearance with a daily close above 18,935 invalidates the bearish tone to see the continuation of the impulsive up move sequence for the next medium-term resistances to come in at 19,320 and 19,935.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.