- Macro factor (10-year US Treasury yield) has likely taken over the driver’s seat in dictating the short to medium-term directional movements of the major US stock indices.

- Last Friday, 31 May key intraday bullish reversals recorded in the S&P 500, Nasdaq 100, and Dow Jones Industrial Average were led by an earlier rally in the 10-year Treasury Note futures that kickstarted in the European session.

- Watch the key short-term support of 18,340 on the Nasdaq 100.

This is a follow-up analysis of our prior report, “Nasdaq 100: Pay close attention to Nvidia price actions ex-post earnings release” published on 21 May 2024. Click here for a recap.

Since our last publication, the Nasdaq 100 has traded higher and printed a fresh intraday all-time high of 18,907 on 23 May reinforced by Nvidia’s rosy Q1 earnings results and upbeat revenue guidance for Q2.

Momentum and micro (firm-based earnings beats or misses) factors matter then. Interestingly, the macro factor has now taken on the driver’s seat since 24 May.

How can we decipher it?

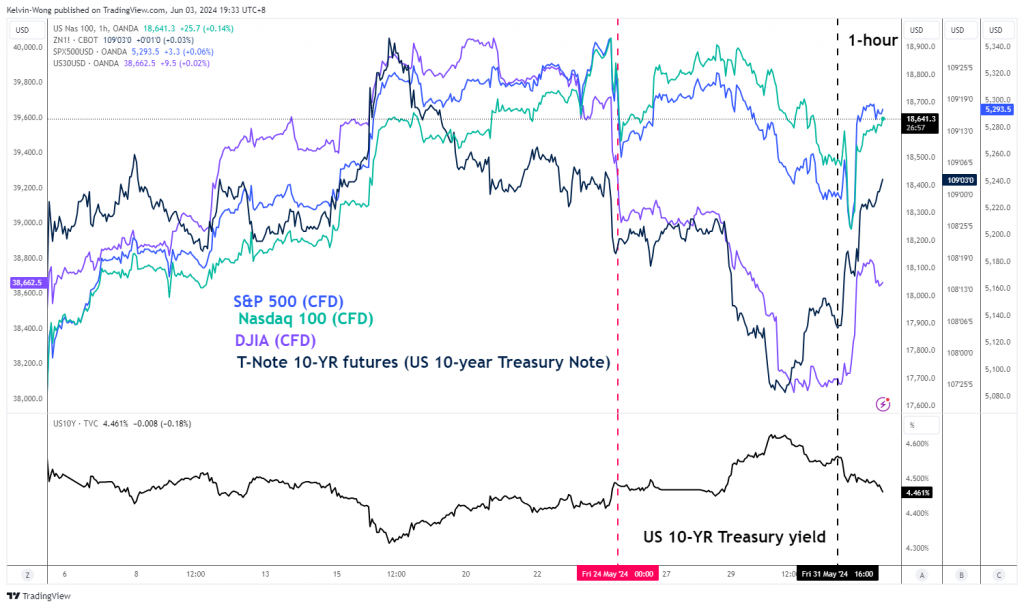

By examining the movement of the 10-year US Treasury yield with the movements of the major US stock indices. From 24 May to 29 May, the US 10-year Treasury yield rallied by 15 basis points (bps) to print a 4-week high of 4.62%, and over the same period, the major US stock indices declined (in reverse tandem) and further extended their losses to last Thursday, 30 May; S&P 500 (-1.31%), Nasdaq 100 (-1.43%), and Dow Jones Industrial Average (-2.45%).

Why did higher US Treasury yields hurt US stock indices?

A further push-up in longer-term US Treasury yields, such as the 10-year yield where the “danger level” is anchored at its major resistance of 5% and clearance above it may unleash a bout of risk-off behaviour among market participants; a negative feedback loop via increasing long-term borrower costs for consumers and corporations which in turn could see a reduction in profit margins of US corporations as well as reduce the quantum of earnings upgrades from sell-side analysts.

Also, the S&P 500 is now trading at a high 12-month forward P/E ratio of 20.3, above its 10-year historical average of 17.8 (according to data from FactSet as of 31 May 2024). This rather lofty valuation number may become harder to sustain if the 10-year US Treasury yield keeps climbing northwards. In addition, the equity risk premium which is measured by the earnings yield of the S&P 500 against the 10-year US Treasury yield may shrink further, making the S&P 500 (US equities) less attractive to US Treasury bonds.

Last Friday’s key bullish reversal in US stock indices was led by 10-year US Treasury Note futures

Fig 1: 10-year US Treasury Note futures direct correlation with S&P 500, Nasdaq 100 & DJIA as of 3 Jun 2024 (Source: Trading View, click to enlarge chart)

All the major US stock indices erased their intraday losses after the second half of last Friday, 31 May US session and rallied strongly into the close with daily gains recorded in the S&P 500 (+0.80%), Dow Jones Industrial Average (+1.51%), and almost unchanged for Nasdaq 100 that reversed up from an earlier intraday loss of -1.9%.

Interestingly, these bullish intraday moves seen in the major US stock indices have been led by a similar bullish reversal seen in the 10-year US Treasury Note futures during last Friday, European session ahead of the start of the US session; bonds pricing 101 where a reduction in the US Treasury yield (in this instance the 10-year) tends to see an increase in the price of the corresponding 10-year US Treasury Note (see Fig 1).

10-year US Treasury Note futures is still exhibiting positive momentum

Fig 2: 10-year US Treasury notes futures (continuous contract) medium-term trends as of 3 Jun 2024 (Source: Trading View, click to enlarge chart)

Since the movement of the 10-year US Treasury Note futures (inverse relationship with US stock indices if one compares them with the 10-year US Treasury yield) has a leading direct correlation with the major US stock indices, it is paramount to analyze the short to medium-term momentum reading of the 10-year US Treasury Note futures since the macro factor is now a significant catalyst in dictating the likely movement of the major US stock indices at least in the short to medium-term.

The daily RSI momentum indicator of 10-year US Treasury Note futures is displaying a series of “high lows” and has not reached its overbought region which suggests a potential incremental bullish momentum reading (see Fig 2).

If the key-medium-term support at 107-23 holds, the 10-year US Treasury Note futures may see the next intermediate resistance coming at 110.12(also the 200-day moving average), and above it exposes the key medium-term resistance at 111-08 (the descending trendline in place since 27 December 2023 swing high.

Nasdaq 100 managed to recapture the 20-day moving average

Fig 3: US Nas 100 major and medium-term trends as of 3 Jun 2024 (Source: Trading View, click to enlarge chart)

Fig 4: US Nas 100 short-term trend as of 3 Jun 2024 (Source: Trading View, click to enlarge chart)

Last Friday, 31 May, the price actions of the US Nas 100 CFD Index (a proxy of the Nasdaq 100 futures) managed to trade back above the 20-day moving average and formed a daily bullish reversal “Dragonfly Doji” candlestick pattern that indicates a potential revival of its bullish impulsive upmove sequence within its medium-term uptrend phase in place since 18 April 2024 (see Fig 3).

Watch the 18,340 short-term pivotal support and a clearance above 18,830 near-term resistance may see the next intermediate resistances coming in at 18,990/19,055 and 19,160/19,180 in the first step (see Fig 4).

On the flip side, failure to hold at 18,340 sees the risk of the extension of the corrective decline to expose the next intermediate support at 18,100 (also the 50-day moving average), and a break below it sees the 17,810 key medium-term pivotal support.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.