- The recent three-week slide in the Nasdaq 100 has almost wiped out its post-US presidential gains.

- The persistent uptrend of the 10-year US Treasury yield has made US equities unattractive and overvalued as measured by the S&P 500 Shiller excess CAPE yield.

- 20,790 remains the key downside trigger level for the Nasdaq 100.

This is a follow-up analysis of our prior report “Nasdaq 100 Technical: At risk of staging a multi-week corrective decline” published on 20 December 2024. Click here for a recap.

Since our last publication, the Nasdaq 100’s price movements have failed to surpass its current fresh all-time high printed on 16 December 2024 and inched downward to challenge the key medium-term bearish trigger level of 20,790 on last Friday, and Monday, 13 January.

It printed an intraday low of 20,538 before it rebounded and closed at 20,784 at the end of the US session on Monday. The Nasdaq 100 has declined by 6% from its current all-time high level on 16 December last year which almost wiped out close to three-quarters of its ex-post US presidential election gains.

Finally, the bond vigilantes have evoked their “mightiness” on the US stock market where the higher long-term cost of borrowings via the relentless uptrend seen in the 10-year US Treasury yield increased the fear of lesser net profit margins that override the positive aspects of the incoming Trump administration’s deregulation and steep corporate tax cut policies.

Tighter liquidity translates into higher opportunity costs for holding US equities

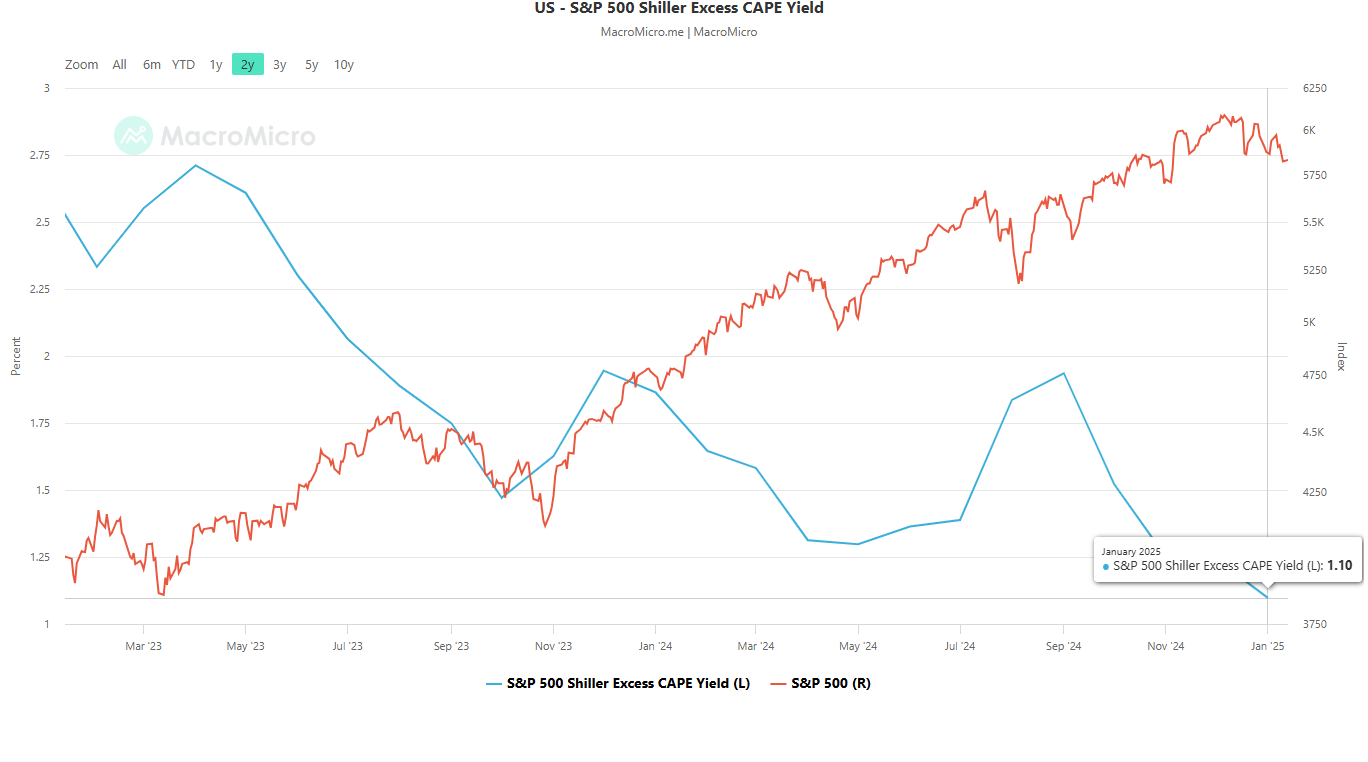

Fig 1: S&P 500 Shiller excess CAPE yield with S&P 500 as of 13 Jan 2025 (Source: MacroMicro, click to enlarge chart)

The S&P 500 Shiller excess CAPE yield is calculated by the S&P real earnings yield (inverse of CAPE) subtracted by the 10-year US Treasury real yield which represents a gauge of the real excess earnings return of the S&P 500 relative to the yield of a long-term US Treasury bond.

The excess CAPE yield has been declining steadily since September last year from 1.94 to a current value of 1.10 in January which implies that the S&P 500 is overpriced versus US Treasury bonds (see Fig 1).

A further decline in the excess CAPE yield is likely to make it harder to justify investing in risk assets such as equities as opportunity costs increase relatively unless growth continues to be a high conviction theme play. Also, a higher 10-year US Treasury yield tends to have a tightening effect on the economy which in turn reflects generally tighter monetary policy and liquidity conditions.

Longer-term market breadth has deteriorated

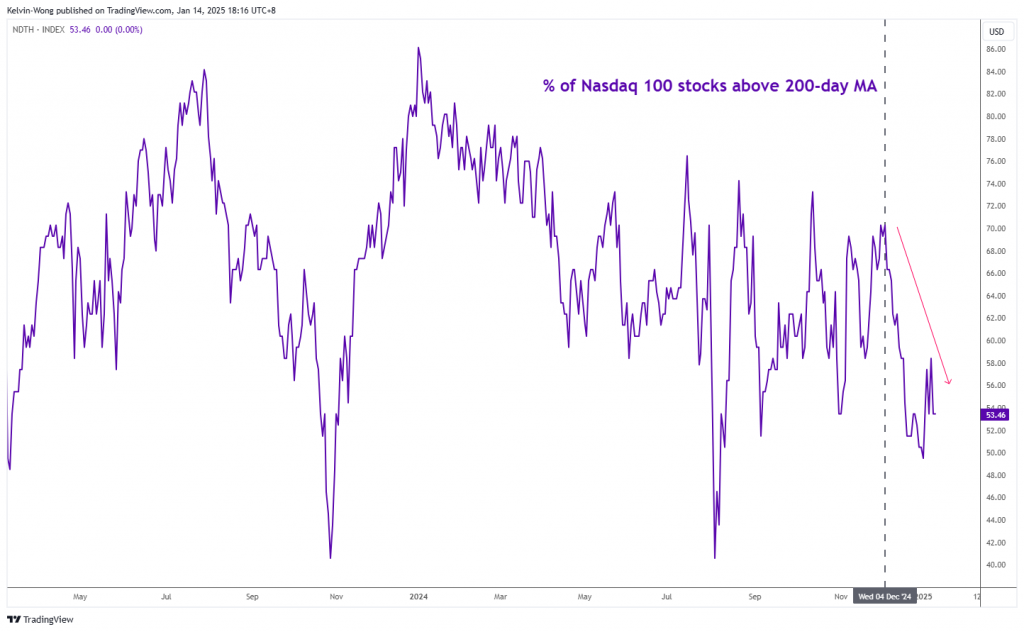

Fig 2: Percentage of Nasdaq 100 component stocks above 200-day moving averages as of 13 Jan 2025 (Source: TradingView, click to enlarge chart)

Right now, the percentage of Nasdaq 100 component stocks trading above their respective key long-term 200-day moving averages has plummeted from its ex-post US presidential election peak of 70% on 4 December 2024 to 53% as of Monday, 13 January (see Fig 2).

This set of weak market breadth indicator of the Nasdaq 100 does not bode well for its major uptrend phase in place since October 2022 as the Nasdaq 100 is still holding above its 200-day moving average since late January 2023 while its internals (component stocks) have weakened in strength.

Bearish medium-term momentum

Fig 3: Nasdaq 100 CFD major & medium-term trends as of 14 Jan 2025 (Source: TradingView, click to enlarge chart)

Since 24 December 2024, the daily RSI momentum indicator of the Nasdaq 100 CFD Index (a proxy of Nasdaq 100 E-mini futures) has continued to shape a series of “lower highs and lower lows” and has not reached its oversold region.

This observation suggests medium-term bearish momentum remains intact. Watch the key 20,790 intermediate support, and a daily close below it may trigger a multi-week corrective decline sequence to expose the medium-term supports of 19,840 and 18,310 in the first step (see Fig 3).

However, clearance above the 22,470/980 medium-term pivotal resistance zone invalidates the bearish scenario for the continuation of its impulsive upmove sequence for the next medium-term resistances to come in at 23,980/24,440 and 25,080/570.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.