- Japanese stock market has continued to outperform against the rest of the world.

- Positive earnings momentum from Japanese corporations is providing support.

- BoJ Governor Ueda has sounded optimistic about the current upward inflationary trend in Japan.

The Japanese stock market has continued to show resilience despite the current heightened risk of global stagflation and rising geopolitical tensions. The benchmark Nikkei 225 and MSCI Japan have recorded a month-to-date return of +1.30% and +0.95% for May respectively at this time of the writing outperformed the US S&P 500 (-0.75%), MSCI Asia Ex Japan (+0.57%), MSCI Emerging Markets (+0.72%) and STOXX Europe 600 (+0.06%).

Strategic and tactical reasons that explained the potential outperformance of the Japanese stock market against the rest of the world have been highlighted in our previous article (click here for details & recap).

Earnings momentum is supporting several TOPIX-17 Sectors

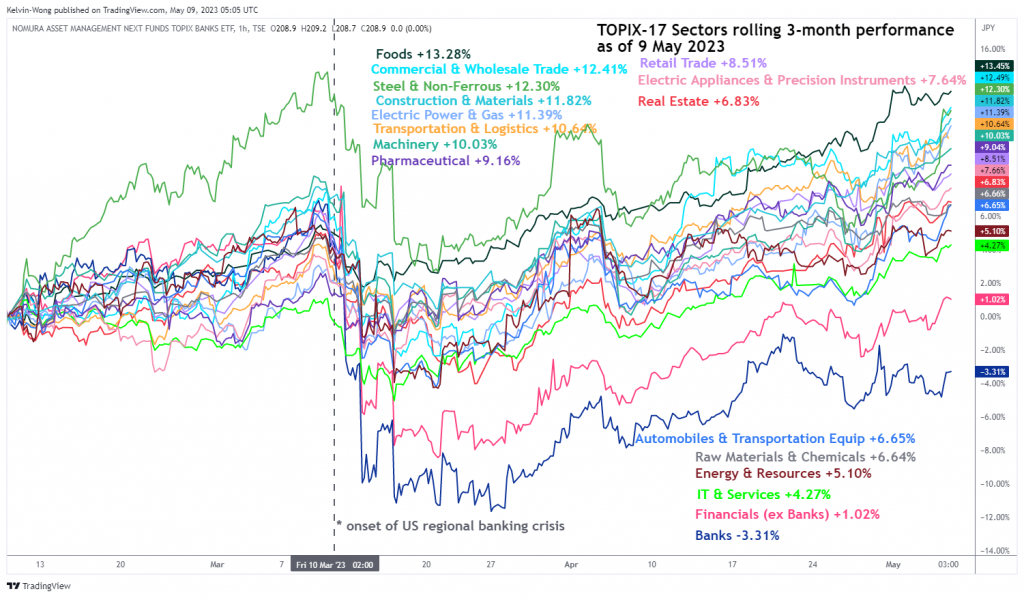

In today’s Asian session, the Nikkei 255 has added a further intraday rally of +1.00% on the backdrop of upbeat and better-than-expected corporate earnings of steelmakers and shipping companies which has reinforced the 3-month rolling outperformance of the TOPIX Steel & Non-Ferrous Sector (+12.30%) and Transportations & Logistic Sector (+10.64%) that enable these sectors to rank 3rd and 6th positions among the 17 TOPIX sectors.

Fig 1: TOPIX-17 Sectors 3-month rolling performances as of 9 May 2023 (Source: TradingView, click to enlarge chart)

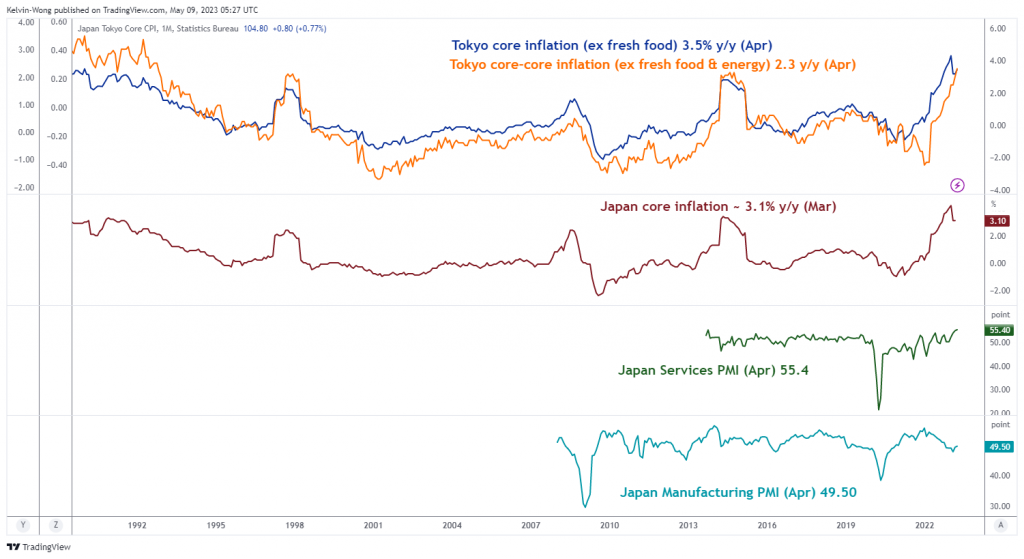

Also, the finalized April reading of the Jibun Bank Japan Services PMI has been revised up to a record high of 55.4 from its preliminary print of 55.0; it also marked the 8th consecutive month of expansion in the services sector with new orders growing the most in over 15 years amid greater spending on travel, leisure, and tourism. These latest data observations suggest that Japan’s domestic internal economic growth is showing potential signs of sustainable recovery.

Expansion in Japan’s Services PMI is moving in tandem with inflation

Fig 2: Japan inflation, manufacturing & services PMIs as of Mar & Apr 2023 (Source: TradingView, click to enlarge chart)

Also, the rise in the services sectors’ activities has coincided closely with the leading Tokyo inflationary data (core & core-core) that has continued to grow and surpassed the Bank of Japan (BoJ)’s 2% inflation target for the 11th consecutive month. Thus, the urgency of the BoJ to normalize its current ultra-easy monetary policy stance has quickened its “pressure” which in turn may lead to further anticipation of Japanese corporate investors’ overseas capital flow back to the domestic Japanese financial markets in the search for better yields on a hedged currency basis.

BoJ’s Ueda sounded “optimistic” about the current trend of Japan’s inflation

BoJ Governor Ueda made an upbeat parliamentary speech on the prospects of Japan’s inflation situation earlier today.

He has mentioned that Japan’s economic growth has picked up and inflationary expectations remain at high levels, seeing some positive signs of an inflation trend that implied the current pace of inflationary growth is sustainable.

Added that BoJ will end its 10-year Japanese Government Bond (JGB) yield curve control programme and start to shrink its balance once the 2% inflation target has been met in a sustainable and stable manner.

However, Ueda highlighted several uncertainties in growth such as whether the recent surge in wage growth can be sustained and spread to smaller and medium-sized corporations.

Overall, BoJ Ueda’s latest speech which came on the latest backdrop of positive macro data and earnings releases for Japanese corporates seems to be skewed toward an increase in optimism that Japan may soon emerge from its decade-plus long deflationary spiral and increase the prospects of bringing forward the normalization of BoJ’s current ultra-easy monetary policy.

Hence, it may create a positive feedback loop back into the Japanese stock market at least in the short to medium term. Next up, we will have the earnings results from the two heavyweights; Toyota Motor Corp on Wednesday and SoftBank Corp on Thursday to provide further clues on whether Japan’s current positive earnings momentum can be maintained.

Japan 225 Technical Analysis – Short-term uptrend intact

Fig 3: Japan 225 trend as of 9 May 2023 (Source: TradingView, click to enlarge chart)

The Japan 225 Index (a proxy for the Nikkei 225 futures) has staged the expected bullish breakout from its major “Symmetrical Triangle” range resistance in place since 14 September 2021 as highlighted in our previous article.

Interestingly, the price actions of the Index have managed to retest the former “Symmetrical Triangle” range resistance now turns pull-back support at 28,480 on 3 May 2023 and staged a rebound thereafter.

Current price actions have evolved into a short-term ascending channel in place since its 15 March 2023 low of 26,380. In addition, the 4-hour RSI oscillator has continued to exhibit upside momentum and has not yet reached a prior extreme overbought level of 81.55%.

The next resistance to watch in the short-term will be at 29,700/29.970 (the upper boundary of the short-term ascending channel, swing high areas of 4 Nov/16 Nov 2021 & a cluster of Fibonacci extension levels)

However, a break below the 28,480 key short-term pivotal support may jeopardize the bullish tone to expose the next support coming in at 28,065 which also confluences closely with the upward-sloping 50-day moving average.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.