- Emerging markets and China’s risk premiums over Japan have been narrowed.

- Japan is considered a potential defensive play as its stock market valuation is much lowered than the rest of the world.

- Nikkei 225 is consolidating within a long-term uptrend phase in place since March 2009.

The Japanese stock market has underperformed and languished against the US since the infamous burst of Japan’s property bubble in early 1990 that led to two decades of sticky deflation. Even though, the implementation of “Abenomics” in December 2012; a potent mix of expansionary fiscal and monetary policies had led to an accumulated gain of 150% seen in the Nikkei 225 till the end of 2022, it is still 36% below its all-time high level of 38,957 printed in December 1989 before the bursting of the property bubble from its current level of 28,590 at this time of the writing.

Why this time may be different?

Let’s take a trip down memory lane. The underperformance of Japanese equities against the rest of the world since 1990 has been attributed to two main factors; localized demographics where Japan’s birth rate declined faster than the increase in her aging population which led to lower productivity.

Secondly, the entry of China into the World Trade Organization in December 2001 kickstarted two decades of globalization that saw the emergence and attractiveness of a new investing asset class, emerging markets over the prior 1980s decade of Japan’s electronics exports dominance.

Fast forward to today, the world is in a much different place; globalization has broken down since the US-China trade war implemented by the Trump administration in 2018, and under the current Biden administration, the rivalry between the two major superpowers remains intact, this time round is the “battle” of securing high-end semiconductor chips.

The impact of such “hostilities” between the US and China has led to a breakdown of globalization and the “emerging markets risk premium” once sought after by international investors has either narrowed or diminished. Also, China is now facing an aging population problem where its population shrank to a level below total deaths in 2022, the first time such an occurrence happen since the 1960s.

Hence, the edge once enjoyed by China and emerging markets over Japan is likely to take a backseat.

Japan’s central bank, BoJ may be forced to normalize its ultra-easy monetary policy

On 20 December, BoJ made a significant adjustment to the controlled bandwidth of its yield curve control (YCC) policy; another form of “creative” quantitative easing program that was introduced in September 2016. The latest YCC policy adjustment has now allowed the 10-year JGB bond yield to move 50 basis points on either side of the 0% target, wider than the previous 25 basis point band.

This “step-up” tweak is likely to be a precursor to an interest rate hike in 2023 by the BoJ as it normalized its decade-long ultra-loose monetary policy in Japan due to a growth in inflationary pressures where the core inflation has increased steadily above 2% year-on-year (the central bank’s target) for several consecutive months since April 2022.

Given that prices of market-based transacted financial instruments are determined by a significant portion of greed and fear, thus a small policy adjustment or tweak is likely to trigger a butterfly effect in the global financial markets.

Also, bearing in mind that Japanese corporations (financial institutions & non-financial institutions) are one of the highest net exporters of capital on a global scale as they seek to invest overseas to get a better return, and such flows of funds may start to flow back to Japan due to the normalization of domestic monetary policy.

For example, overseas fixed income yield premium over similar Japanese investment instruments is likely to be narrowed, hence making outbound investments unattractive for Japanese corporations on a hedged currency basis. Hence, it may trigger a positive feedback loop in the Japanese stock market.

Japan’s stock market may be considered a defensive play

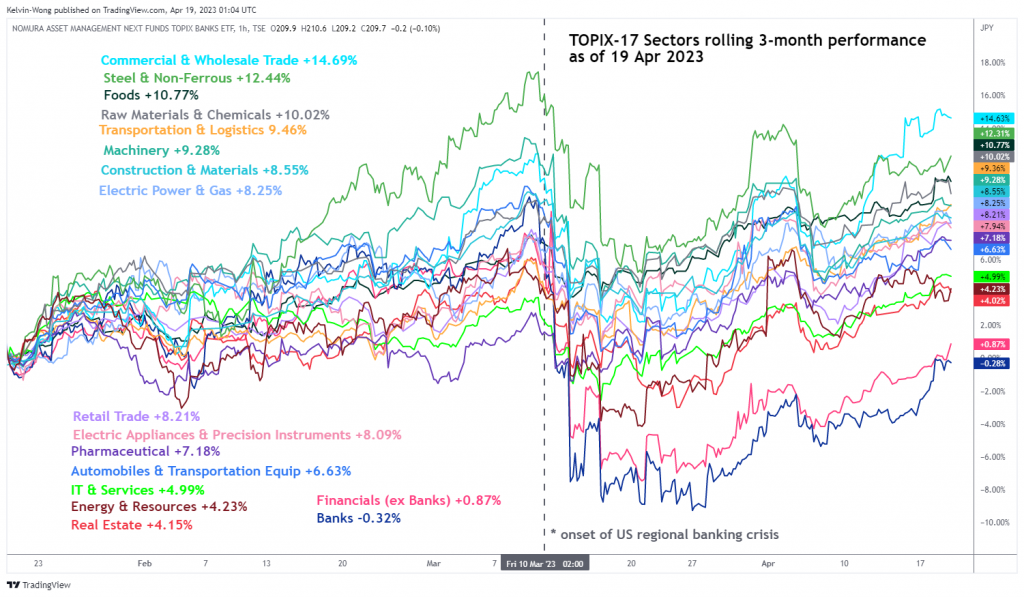

Source: TradingView as of 19 Apr 2023 (click to enlarge chart)

Japan 225 Technical Analysis – Consolidating within a long-term secular uptrend phase with positive elements

Source: TradingView as of 19 Apr 2023 (click to enlarge chart)

Since its 31-year high of 30,835 printed on 14 September 2021, the Japan 225 Index (a proxy for the Nikkei 225 futures) has evolved into a consolidation “Symmetrical Triangle” range configuration for 18 months within a long-term secular uptrend in place since 10 March 2009 low of 6,945.

The upper (resistance) and lower (support) boundaries of the “Symmetrical Triangle” is at 28,665 and 25,630 respectively.

The monthly RSI oscillator has staged an impending bullish breakout from its corresponding descending resistance which indicates a revival of long-term upside momentum that may translate to a potential bullish breakout of the “Symmetrical Triangle” range configuration of the Index.

However, a break with a weekly close below 24,190 long-term pivotal support invalidates the bullish tone for a decline towards the next support at 20,700.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.