Kiwi dollar sunk like a stone after Central Bank RBNZ kept the main policy Overnight Cash Rate at 2.5%. RBNZ Governor Wheeler did hint at raising interest rates soon, saying that” There is a need to return interest rates to more-normal levels” as current rate remains at record low. Finance Minister Bill English also chipped in later in a separate interview, saying that he expect NZ rates to rise this year, but that have done little to placate the market as NZD/USD is staying just around 0.82 round figure – a more than 70 pip fall before from before the announcement.

So is the market disappointed that RBNZ did not raise rates? If we look at the bearish reaction on the rates announcement it seems like a cut and dry conclusion, but it should be noted that analysts actually expected RBNZ to hold rates this time round. Furthermore, even the most hawkish of all analysts believe that the 1st rate hike should happen in Q1 2014, or as late as April, hence it seems strange that market will place so much speculation/hope in the first policy meeting of 2014.

Hourly Chart

Perhaps we should see the post RBNZ reaction in light of a muted reaction following the FOMC surprise QE taper yesterday. NZD/USD went down sharply to a low of under 0.824 after the Fed voting members made a unanimous vote to cut monthly QE purchases by another $10 billion which was unexpected given that this would be Bernanke’s swan song. However, NZD/USD climbed back up above 0.827 almost immediately, close to where prices were before the Fed announcement likely due to the fact that speculators/traders do not wish to short NZD/USD too aggressively on the off chance that RBNZ may actually raise rates later. Hence the decline post RBNZ is actually a delayed bearish reaction to the Fed, and not that market is genuinely disappointed on RBNZ not hiking rates.

Furthermore, it should be noted that NZD/USD has been trading lower for the past week, losing to all major currency. Hence it will not be surprising to see bears being over eager to continue their selling after the biggest potential bullish risk has been eliminated. Between now till 13th March when the next policy meeting will occur, it is unlikely that there will be any other major bullish risk event, allowing bears to run wild for now.

With this in mind, short-term momentum is definitely on the downside, and we could see prices testing 0.82 support and even extend the losses being yesterday’s swing low as bears will be more willing to commit.

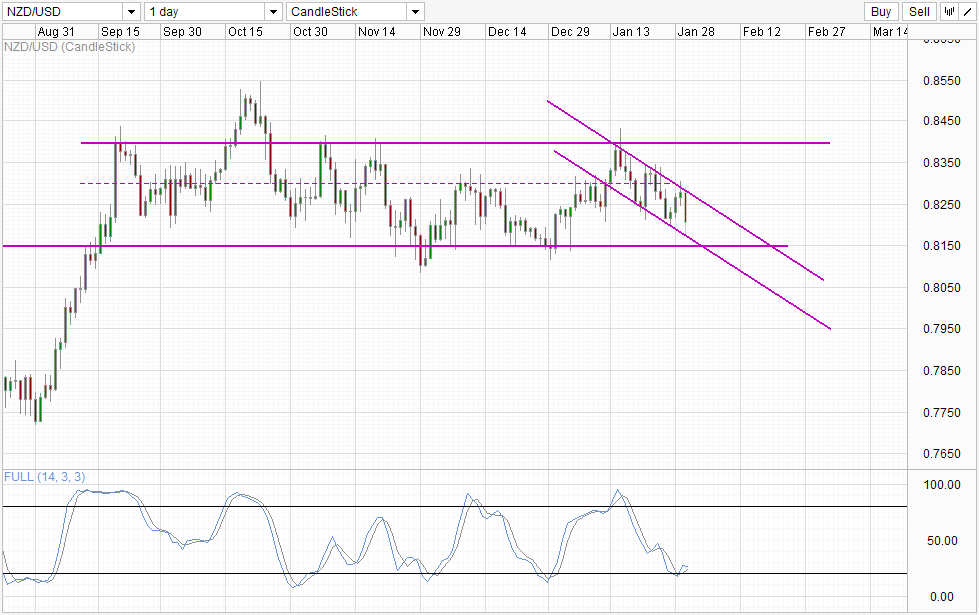

Daily Chart

Broad direction for Daily Chart is bearish for a push towards 0.815, but verdict is still out whether this morning’s swing low constitute a rebound off Channel Bottom which opens up a short-term push towards Channel Top and possibly confluence with 0.825 round figure and previous floor. Stochastic curve is now pointing lower right now but there is still a gap between Stoch/Signal line, and the bullish cycle signal that was provided isn’t yet invalidated, and hence a push higher cannot be ruled out.

Long-term wise, recent decline actually bodes well for traders who want to long NZD/USD when RBNZ start to hike rates. As mentioned above, this decline is not a result of disappointment that RBNZ did not raise rate, as such there is no evidence that market has fully priced in the eventual rate hike. Even if market has priced in the rate hikes, the decline yesterday mean that there will be at least some room for bullish growth when RBNZ does indeed raise rate either in March and/or April.

More Links:

AUD/USD – Falls Away Sharply from Resistance Level at 0.88

EUR/USD – Volatility Increases but Remains Indecisive Below Resistance at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.