Hourly Chart

USD/JPY was already strongly bullish this morning following the release of FOMC minutes which drove USD higher. However, bulls were capped below 100.50 for a large part of Asian morning due to traders taking profit ahead of BOJ rate decision. As a side note, this is a strange decision as downside risk for BOJ event is low – BOJ wasn’t expected to announce any new stimulus this time round, the short bet is on December rate decision, and it is almost impossible that BOJ will issue hawkish statements. Hence, upside risks are higher as any dovish surprise would have sent USD/JPY sharply higher, which makes early profit taking pre announcement a bit peculiar.

Nonetheless, in so doing, USD/JPY traders are being cautious, and that is actually good news as this would mean that the subsequent rally post BOJ announcement would have lesser chance of a snappy pullback. This is true even though Stochastic readings are extremely Overbought, as the 100.50 breakout has inspired strong bullish technical pressure on top of the hope that BOJ will reveal something big in December coupled with US Fed potentially tapering in early 2014 if not December.

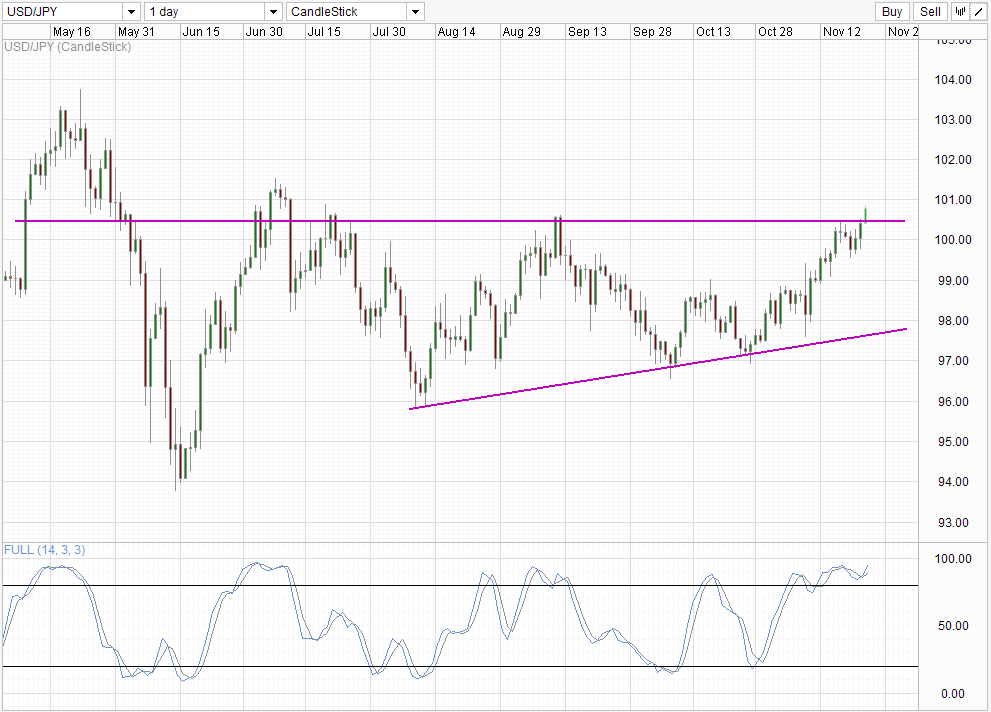

Daily Chart

Weekly chart is less optimistic though. Price may still face significant resistance all the way to 101.5, especially since Stochastic readings are heavily Overbought. Prices will need to clear that in order to increase bullish conviction towards 2013 high of 103.7.

However, from another perspective, bulls should be glad that the bullish road here isn’t easy, as only real strong (read: non speculative) bullish conviction/momentum will be able to break this resistance band, which means the fundamental reason for rally must be clear and obvious – e.g. BOJ announcing a stupendous stimulus package in December. With this break, the odds for strong bullish follow-through will be high, and bulls will be rewarded for their patience.

Things are not so straight forward for bears though. If BOJ disappoints, prices will definitely dip, but the bearish follow through will need to depend on whether market is still hopeful for further stimulus package in the future. Hence traders would need to wait and discern sentiment from price action, and automatically assuming that price will hit towards the rising trendline below may not be accurate.

More Links:

Gold Technicals – Stable Below 1,250 Post FOMC Minutes

US S&P 500 – Stocks Feeling Taper Heat But L/T Bullish Momentum Intact

US10Y – Staying above 126.5 for now post FOMC Mintues

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.