We’re seeing a decent rebound in the markets on Friday as strong gains in oil provides a timely boost to what has been a rather gloomy week.

While the gains are welcome, I’m not convinced at this stage that this is anything more than a dead cat bounce. The gains in oil are being driven by comments from UAE energy minister who claimed that OPEC are willing to discuss production cuts with other oil exporters, which could in theory drive a more sustainable rise in prices. The problem is this is not the first time we’ve had these kinds of reports and nothing has since materialised. We get a short-term boost followed by a return to lower prices. I don’t expect this time to be any different.

What’s more, while markets are getting a welcome boost from the rebound in oil, the other fundamental factors that have weighed heavily this year remain. I see no reason to believe that any short-term rallies won’t continue to be sold into, as they have repeatedly this year.

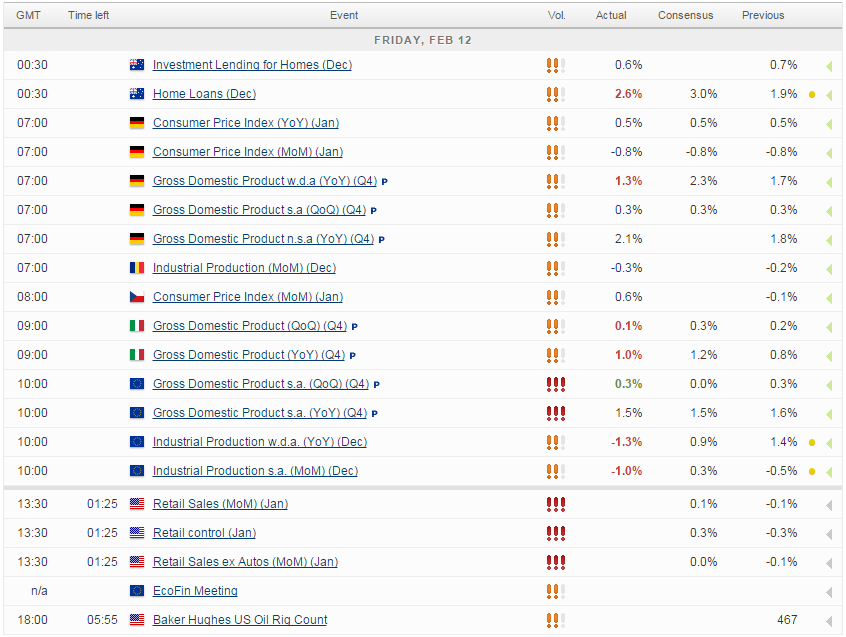

Focus will shift to the U.S. consumer today with retail sales and consumer sentiment figures being released. The lack of consumer spending has been one of the biggest frustrations with the U.S. recovery until now, with the additional disposable income from lower oil prices not creating enough of an incentive to drive people into the shops. Instead, people appear to be using the additional revenue to deleverage. While this may benefit the U.S. in the long-term, for now the consumer dependent economy is being held back as a result.

The lack of wage growth in the U.S. may be behind the lack of spending. Wage growth is generally more sustainable than extremely low oil prices so it’s possible that consumers just view this as a short-term bonus which shouldn’t be fluttered away at a time when wages aren’t rising much. The last financial crisis which was built on unsustainable debt is probably also still fresh in the memory and the deleveraging process is still taking place.

In the absence of strong sustainable wage growth, we can probably continue to expect consumers to be a little cautious, at least for now. January’s sales are expected to be flat following December’s surprise decline which will continue to cast doubt on the strength of the U.S. recovery. Consumer sentiment on the other hand is expect to rise once again and remain near pre-financial crisis levels, with the UoM release seen at 93. There is clearly a disconnect between consumer sentiment and actual sales but this does suggest that we may not be far away from the return of the consumer.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.