A quiet day in Asia for G10 with only USD/CNH providing some excitement. Stocks continue their march higher ahead of central banks and expected China easing.

Asia G10 FX

A generally range bound day for currencies in Asia with AUD, EURO and USDJPY trading around their mid-range points of 0.7500, 1.1000 and 106.00 respectively.

NZD has managed a somewhat asthmatic rally to 7060 on the session boosted by a slightly better than expected milk price auction. Nevertheless ahead of the expected dovish economic update from the RBNZ tomorrow, it would be a brave man to turn rampantly bullish on Kiwi.

CHINA

USD/CNH has provided some interest today with the PBOC setting the fix below 6.7000 again causing a washout of short-term long positions. USDCNH dropped 200 points in a straight line to 6.6900 before buyers emerged. The bounce was no doubt helped by Chinese planning agency, the NDRC downgrading their CPI forecast to 2% for 2016 vs an official target of 3%. This has kept the China easing trade well in play and limited USDCNH downside.

HANG SENG

This gave a fillip to China stocks with the Hang Seng up 1.3% midday on the China easing play. The Hang Seng is now well and truly ensconced within the weekly Ichi moko cloud. We do have some important weekly resistance just above here at 22072, the 38.2% fibo retrace. A weekly close above will target the 23000 area. Note though the 100 and 200-week moving averages and the 50 % fibo retracement all lie in this region.

AUSTRALIA

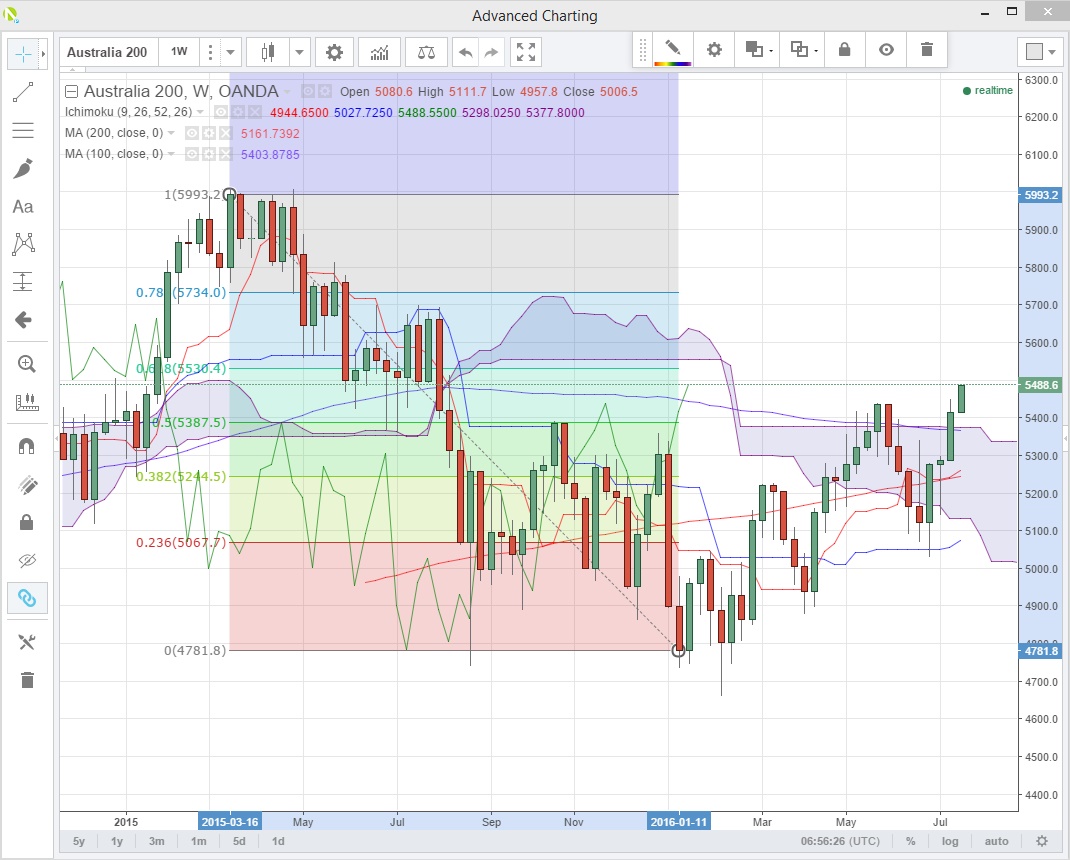

The ASX continues its march higher. Shrugging of disappointing results from BHP Billiton and Rio Tinto in the last two days. Clearly again, the China easing story continues to drive prices in commodity (read metals) related stocks despite the less than stellar supply set up in the markets.

The ASX is well above the weekly cloud now targeting the 61.8% fibo retrace at 5530, with support at 5370, the top of the weekly cloud and the 200-week moving average.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.