While the start of the week is looking relatively quiet, with the U.S. markets closed on Monday in celebration of Independence Day, the rest of the week is likely to be anything other than dull.

Of course, Brexit will remain the dominant story in the markets again this week with investors remaining somewhat in limbo over the future of the UKs relationship with the E.U.. The initial reaction to the result was one of shock and panic selling but since then the markets seem confused as to which way to turn. The political situation isn’t helping matters and until we know who is going to lead the U.K. through this particular storm, we’re unlikely to get much more clarity on what the next steps will be.

The FTSE has rebounded much stronger than its peers, benefiting it would seem from the weakness in the pound that followed the referendum result. While the pound has since stabilised a little, further weakness could lie ahead which may provide some short term support for the index, with futures pointing to another slightly higher open this morning.

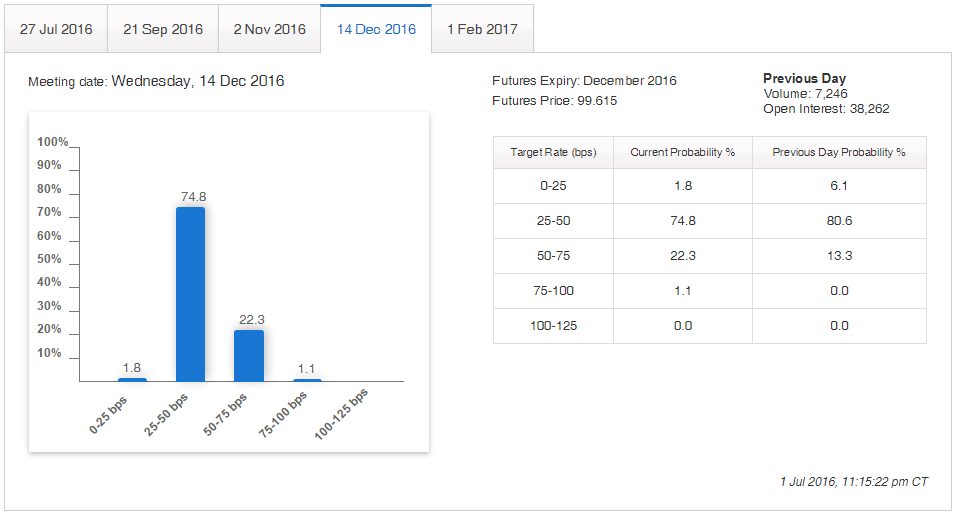

The U.K. won’t be the only focus for investors this week though with a number of key pieces of economic data being released, none more important than Friday’s U.S. jobs report. It seems likely that the next Fed rate hike will have to be put on the backburner in light of the UKs vote to leave the E.U. due to the heightened global risk and financial market instability that this brings, but these data releases remain extremely important.

While the markets now seem convinced that there will be no rate hike this year, which isn’t an unreasonable assumption, it’s also not a guarantee.

Source – CME Group FedWatch Tool

Should the U.S. economy continue to improve in the coming months and the markets stabilise for a prolonged period, the Fed may opt to raise rates once this year and continue the process of very gradual tightening. Until we’re told otherwise, we have to assume that this remains a possibility.

A big week for Australia has got off on the wrong footing, with the federal election failing to determine a clear winner, with the major parties now having to look to form coalitions with independent and minor parties in order to find a majority. This could leave a cloud of uncertainty hanging over Australia in the coming weeks, although as of yet this isn’t putting too much pressure on the Aussie dollar or the ASX 200, which is trading up around a quarter of one percent. Still to come tomorrow though we have retail sales and trade balance data followed by the latest Reserve Bank of Australia rate decision so it should be an interesting couple of days.

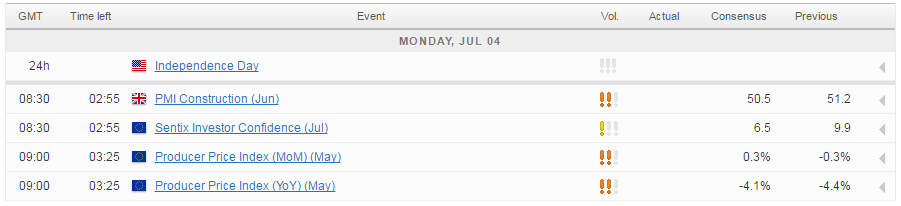

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.