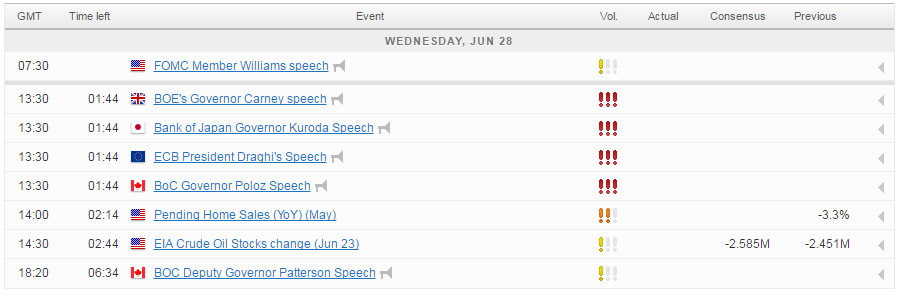

Focus will once again be on the central banks on Wednesday, with heads from a number of them scheduled to take part at an event on central banking in Portugal.

Yellen Reiterates Desire to Gradually Raise Interest Rates

The one notable absence will be Federal Reserve Chair Janet Yellen, who did speak on Tuesday and reiterated the need for gradual rate hikes alongside a gradual and predictable shrinking of the balance sheet. Yellen did also tempt fate, claiming that she doesn’t believe another financial crisis will occur in our lifetime, a statement that will hopefully not prove to be famous last words for the Fed Chair.

EUR/USD – Energized Euro Hits 11-Month High on Draghi Remarks

We will hear from a number of other central bank heads today though, many of whom are leading central banks that appear to be undergoing a hawkish shift at the moment. The two that stand out in particular are Mario Draghi and Mark Carney of the ECB and Bank of England, respectively. Both appear, at least, to be among the more dovish voters on their committees and leading the resistance to premature tightening of monetary policy.

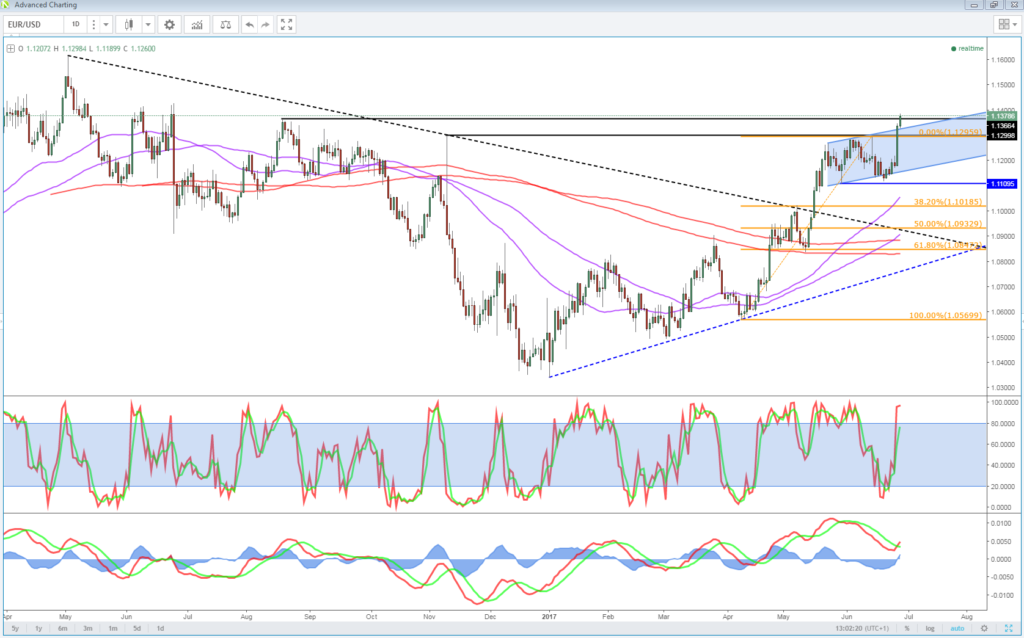

EUR Builds on Gains Ahead of Draghi’s Appearance at Event on Central Banking in Portugal

The euro jumped higher yesterday and is building on those gains today after Mario Draghi acknowledged the strengthening and broadening recovery in the region, a sign that he’s possibly ready to reluctantly back further reductions in stimulus. It’s clear that Draghi favours maintaining a very accommodative stance but the consensus within the committee is clearly shifting. With the euro now above 1.13 against the dollar, there is scope for further upside in the coming weeks, with 1.15-1.16 possibly on the cards. The next test though should come around 1.14.

OANDA fxTrade Advanced Charting Platform

Carney Leads Fight Against Rate Hikes at BoE

The same shift is being seen at the BoE where Carney was among the five policy makers on the eight person committee that voted to keep interest rates unchanged. As some policy makers growing increasingly wary about the inflation data – with annual CPI having reached 2.9% last month – Carney faces a tough task of convincing his colleagues to look though the currency effects and take into consideration the temporary nature of the moves and the economic uncertainty. I expect the BoE Governor to drive home this message today and should we see any shift, similar to that seen from Draghi, it could signal an acceptance of defeat from Carney and an impending rate hike. Yesterday’s increase in the counter-cyclical capital buffer may have bought Carney a little more time.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.