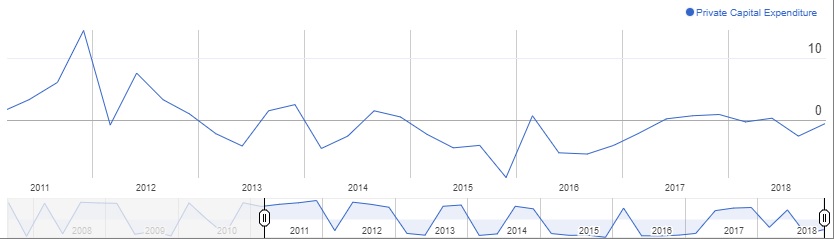

Private capital expenditure drops

Private capital expenditure plans for the third quarter contracted 0.5%, data released today showed. That was below economists’ predictions of a 1.0% gain and means expenditure contracted for a second straight quarter. Expenditure has only recorded seven quarters of expansion in the last five years, testimony to the fragility of the Australian economy and perhaps one of the reasons the RBA has kept rates at record lows for so long. AUD/USD eased off from the 10-day highs struck yesterday, posting a slide of 0.1%.

Australia Private Capital Expenditure (Quarterly)

Japan retail sales at 10-month high

Japan’s retail trade jumped 3.5% y/y in October, the biggest increase this year, with consumers spending on fuel, cars, medicines and cosmetics. The rebound in consumption, which accounts for about 60% of the Japanese economy, suggests that the economy could rebound from the contraction posted in the third quarter.

Meanwhile, BOJ monetary policy board member Takako Masai said that prolonged low rates could have adverse effects on bond market functioning and the profits at financial institutions, but reiterated that the Bank must maintain an extremely easy monetary policy to ensure the positive momentum seen in prices is not curtailed. She admitted that price moves towards target were weak, but at least in the right direction.

USD/JPY weakened today as some profit-taking was seen in equity markets following yesterday’s huge leap, with the FX pair building a possible triangle formation on the daily chart. We must await the breakout either way to see if it is a continuation or reversal pattern.

USD/JPY Daily Chart

Busy European data calendar

It’s a fairly hectic data calendar in Europe starting with German unemployment data for November. UK lending and money supply data follow and then it’s Euro-zone confidence indicators, most of which are expected to show deteriorating sentiment. The highlight in the European session could be German consumer prices, which are expected to show a slower pace of increase than October.

Dollar tumbles as Powell sees rates just below neutral levels

FOMC minutes in the spotlight

The US session focuses on personal income and spending together with the monthly price index based on personal consumption expenditures. Pending home sales add to the picture but the main event will be the release of minutes of the last FOMC meeting. Rates were held unchanged at that meeting, but speeches by Fed members since then have suggested 2019 may not be so clear-cut on the hiking front, as the US economy faces mounting headwinds. Indeed, Fed Chairman Powell’s speech yesterday gave the most clues about a more dovish-leaning Fed. Let’s see if these issues were discussed as early as the last meeting, or whether it is a more recent phenomenon.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

938NOW with OANDA’s Stephen Innes on Jay Powell’s dovish pivot

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.