Services PMI at four-month high

Despite the manufacturing PMI remaining below the 50 threshold denoting expansion and contraction for a second month, coming in at 49.5, the fact that we didn’t fall deeper into contraction territory in January, and actually beat economists’ forecasts, was taken as a positive. The non-manufacturing index performed even better, rising to 54.7, the highest since last September, from 53.8 in December.

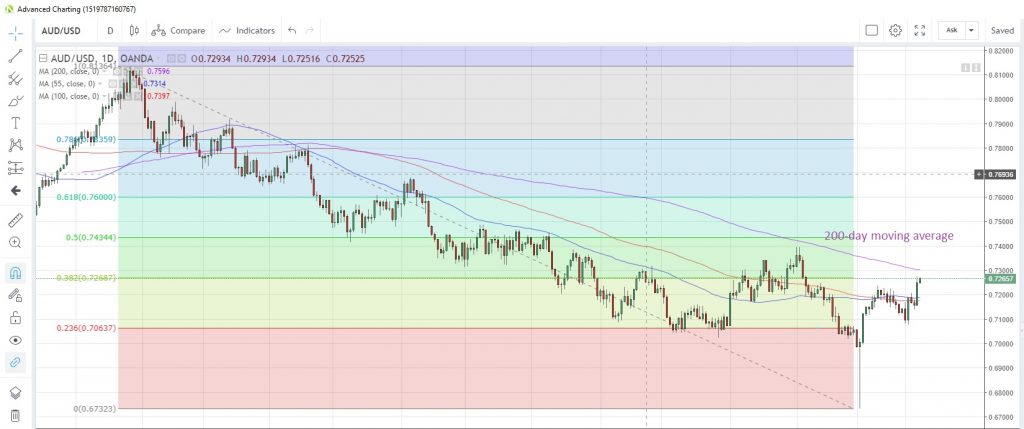

The positive slant given to the data helped AUD/USD advance for a second day, treading ever closer to the 200-day moving average at 0.7301. This moving average has capped prices since March 15 last year.

AUD/USD Daily Chart

Dollar falls and stocks rise as Fed confirms dovish stance on future hikes

Kiwi lifted by positive ratings outlook

Earlier this morning, ratings agency S&P announced it was upgrading New Zealand’s ratings outlook to positive from stable, while reaffirming its AA rating. The agency cited forecasts that the local government could reach a budget surplus in the early 2020s as a reason for the upgrade. It also mentioned that the country has monetary and fiscal flexibility, a resilient economy and institutions that are conducive to swift and decisive policy actions as other factors.

NZD/USD was already benefiting from US dollar weakness overnight and the FX pair climbed to an eight week high of 0.6926 after the announcement. The next resistance point could be the December 4 high of 0.6971.

NZD/USD Daily Chart

Slower European growth anticipated

The highlight for today’s European data calendar will doubtless be the release of Euro-zone GDP growth data for the fourth quarter. The latest poll of economists show growth slowing to +1.2% q/q from +1.6% in the third quarter with the prospect of a deeper slowdown into Q1 as the data across the Europe spectrum fails to impress.

More jobs-related data from the US ahead of tomorrow’s nonfarm payroll report are also due. January Challenger job cuts and the Q4 employment cost index for Q4 are the main focus. Speeches come from ECB’s Mersch, Bundesbank president Weidmann and BOC’s Wilkins.

The full data calendar can be viewed at https://www.marketpulse.com/economic-events/

GBP/USD – Pares gains after Brexit vote (video)

Senior Market Analyst Craig Erlam explains why he thinks GBP/USD slipped after the Brexit vote and where the UK goes from here

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.