Manufacturing PMI rebounds first time in three months

The Caixin China manufacturing PMI reading for February rebounded strongly from January’s steep decline, surging to 49.9 after January’s dip to 48.3. Estimates had suggested only a slight improvement to 48.5. It was the first improvement in three months and the index is now back at the highest since November. The better performance did not cover all sub-indices however, but new orders jumped to 50.2, a three-month high, while the gauge for new export orders hit its highest in almost a year. Disappointments were seen in the employment and stocks of finished goods sub-indices.

The Aussie perked up from intra-day lows to reach 0.7110 after the data, but gains above the 0.71 handle proved to be short-lived and we are now back at 0.7094 having tested the day’s low of 0.7084. The February low of 0.7054 could act as the next support point.

AUD/USD Daily Chart

Powell repeats patient mantra

Fed Chairman Jerome Powell reiterated that the Federal Reserve will be patient as it mulls rate moves going forward. He commented that most incoming data recently had been “solid”, though some sentiment surveys had eased and thought the unexpectedly weak December retail sales data was a reason for caution. Pressure on prices is muted, despite the strong jobs market, which could leave room for wages to rise.

Negativity bias overwhelms GDP and MSCI

PMIs top of the list

As with Asia, it will be the monthly PMI reading in Europe and the US that will attract the most attention later today. Final numbers from Markit for Germany and the Euro-zone are not expected to deviate from the initial readings of 47.6 and 49.2, respectively. Germany’s PMI would be the lowest since December 2012 while the Euro-zone’s is the lowest since June 2013.

The ISM manufacturing PMI for the US is expected to dip to 55.5 from 56.6 in January while the Markit version is seen unchanged from the flash estimate at 53.7. We see two months’ worth of US personal income and spending data for December and January, owing to the government shutdown, while the Fed’s Bostic’s speech closes off the week, with tone and content unlikely to differ from Powell’s.

The full MarketPulse data calendar can be viewed at https://www.marketpulse.com/economic-events/

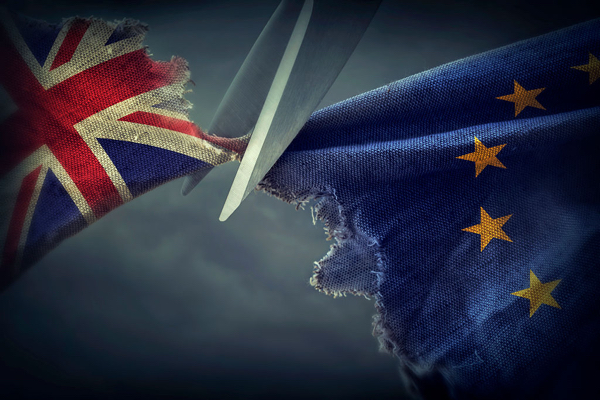

Brexit Risks Ahead, including the latest timeline

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.