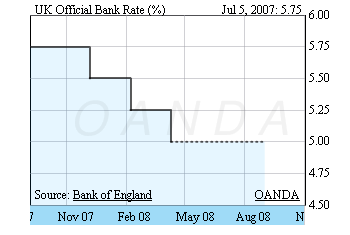

The Bank of England started its rate setting meeting today. The current 5.00% rate is seen by some market participants as harmful to the economy of the UK, specially as Housing and consumer numbers have dropped.

Inflation has eased somewhat after commodities retreated across the board but it is still close to a 16 year high (4.4%). Investors are starting to believe the BOE could cut rates to help boost economic growth if inflation concerns allow the Central Bank to reduce borrowing costs.

The European Central Bank is expected to hold its rates at 4.25%. High Oil prices and Euro strength were singled out as the culprits of the inflation growth in the Eurozone. Now with the USD recovering vs. the EUR and Oil off its record setting high the ECB is not expected to change its rate policy in the short term.

Policy members have made comments interpreted by the market to mean that the Central Bank will hold rates for the remainder of 2008. Economic and Monetary Affairs Commissioner Almunia has remarked the growing concerns about an economic downturn, but has dismissed recession fears, calling them “exaggeratedâ€Â.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.