It’s likely to be another eventful day in the markets on Thursday as the Bank of England becomes the latest central bank to provide its monetary policy update. There’s also a number of pieces of important economic data that will be released which should ensure the markets stay quite active throughout the day.

Central banks have been a key focal point for the markets over the last week, with particular attention being paid to their communication more so at times than the policy actions themselves. Mario Draghi last week felt the wrath of the markets, despite announcing wide ranging stimulus measures, for suggesting that more rate cuts were not being considered at the moment.

This obsession with more and more stimulus has made the job of central bankers increasingly difficult and means they have to be more careful than ever with their communication strategy. The Fed appears to have passed the test last night having gone some way to realigning market expectations with its own – albeit largely by adjusting its own interest rate forecasts – but other central banks may not be so fortunate.

Today it’s the BoE’s turn to try and pass the test. The central bank is expected to be inactive for the rest of the year with the economy slowing, inflation languishing well below target and a number of risks lying ahead, most notably the possibility of the U.K. voting to leave the EU. This makes its communication increasingly important though as it will be determined to continue to manage the markets expectations. The minutes of the meeting, which are released alongside the decision, should provide further insight into how the central bank views the economy and what that means for the path of rates. It will also be interesting to see whether there is any sign of a growing consensus within the BoE for the next move to be a cut, rather than a hike which is what it has alluded to previously.

There’s also plenty of economic data to come from the U.S. today, most notably JOLTS job opening, current account and Philly Fed manufacturing data. The trend for job openings is continuing to rise as the recovery gathers pace which should enable the unemployment rate to continue to decline from the already very low levels, which in turn should start to spur more substantial wage growth. The manufacturing sector remains a weak spot for the U.S. economy and the latest survey is likely to further support this view, rising slightly to -1.7 but remaining in negative territory.

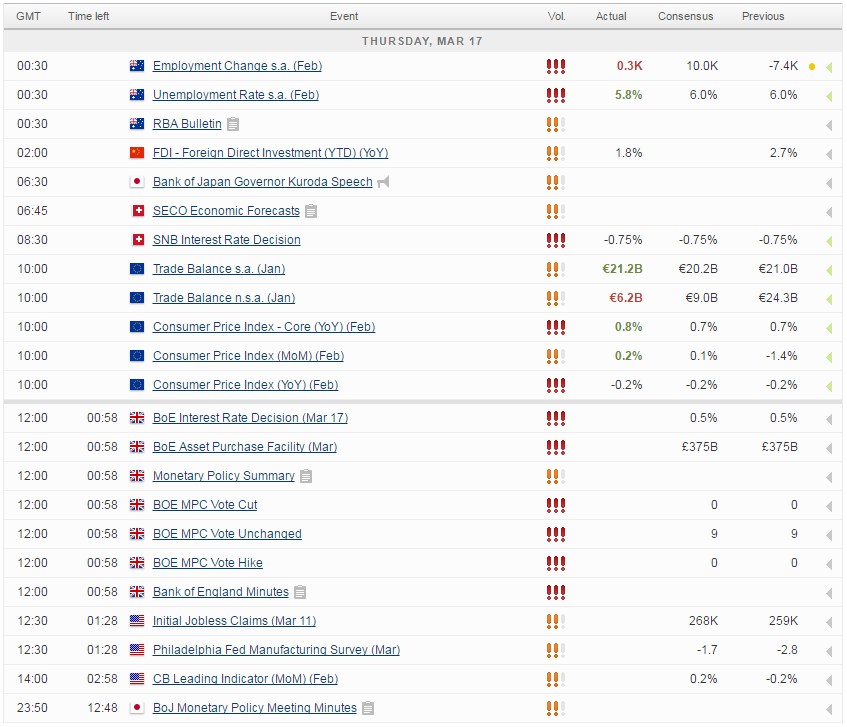

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.