Friday November 16: Five things the markets are talking about

Earlier this week U.K PM Theresa May agreed a draft Brexit withdrawal agreement with Brussels. Her cabinet backed it on Wednesday – but there have since been resignations.

Six government ministers, including Brexit Secretary Dominic Raab, one of the architects of the deal, quit yesterday, raising the possibility that she could face an open challenge to her leadership.

The next few days will be critical for May’s Brexit deal and her leadership, as she tries to suppress a rebellion that has been brewing for some time – some party members are openly plotting to try to trigger a no-confidence vote in an effort to force the PM to negotiate a different deal with Brussels.

A leadership challenge can be triggered if 48 Tory lawmakers submit letters of no confidence to the 1922 committee. Even if, such a challenge does occur, its not expected that a majority of Tories would then vote in favour of ousting her from office.

However, 48 lawmakers would mean the PM would not have the party support to get a Brexit deal voted through Parliament and a clear signal that PM May would have to go back to the negotiating table.

Stocks in Europe have found some early support following a mixed session in Asia as investors evaluate whether China and the U.S can de-escalate their trade spat before the G-20 summit later this month. The ‘big’ dollar has eased a tad, while U.S Treasuries trade steady.

1. Stocks mixed results

Stock markets remain volatile as the slowing Chinese economy and uncertain outlook for corporate earnings overlap with investors adjusting to the effects of a tightening U.S monetary policy.

In Japan, the Nikkei fell -0.6% overnight, as a drop in semiconductor-related stocks weighed on the index along with gaming stocks. The broader Topix also dropped -0.6%. The index fell -2.6% this week, hit mostly by a drop in oil prices and weakness in Apple suppliers and other tech shares.

Down-under, Aussie stocks ended slightly lower on Friday with commodity names trumped by a number of negative factors including a tech sell-off and Brexit turmoil. The S&P/ASX 200 index eased -0.09% at the close, bringing the weekly losses to a sizable -3.23%, largely hurt by global growth worries. In S. Korea, the stock index closed marginally higher on Friday, trimming the session’s early gains, amid uncertainty over Brexit. The Kospi index closed up +0.21%. On a weekly basis, the main index climbed +0.2%.

In China, stocks rallied overnight, helped by banks and by securities companies on the back of a broad recovery in the equity market. The Shanghai Composite index ended +0.4% higher, gaining +3.1% for the week. The blue-chip CSI300 index was up +0.5%, posting a weekly gain of +2.8%.

In Hong Kong, stocks rose marginally as China and the U.S were seen as drawing closer to formal trade negotiations. The Hang Seng index was up +0.3% overnight, and up +2.3% for the week. The Hang Seng China Enterprises index rose +0.3%, and was up +1.5% for the week.

In Europe, regional bourses trade slightly higher across the board following a mixed session in Asia and a positive session in the U.S.

U.S stocks are set to open in the ‘red’ (-0.4%).

Indices: Stoxx600 +0.4% at 359.7, FTSE +0.2% at 7048, DAX +0.5% at 11411, CAC-40 +0.3% at 5048, IBEX-35 +0.3% at 9099, FTSE MIB +0.7% at 19032, SMI +0.6% at 8920, S&P 500 Futures -0.4%

2. Oil rises on expected OPEC cuts, gold little changed

Oil prices have rallied overnight amid expectations of supply cuts from OPEC, although record U.S production continues to cap rallies.

Brent crude oil futures are at +$67.49 per barrel, up +87c, or +1.3% from Thursday’s close. U.S West Texas Intermediate (WTI) crude oil futures are at +$56.96 per barrel, up +50c, or +0.9%.

OPEC warned earlier this week that a supply glut could emerge in 2019 as the world economy slows and rivals increase production more quickly than expected.

Of late, prices have mainly been supported by expectations that OPEC would start withholding supply soon, fearing a renewed rout.

Saudi Arabia wants the cartel to cut output by about -1.4M bpd – that’s around +1.5% of global supply.

In its monthly report Wednesday, IEA left its forecast for global demand growth for 2018 and 2019 unchanged from last month at +1.3M and +1.4M bpd, respectively, but cut its forecast for non-OECD demand growth. For H1 2019, based on its outlook for non-OPEC production and global demand, and assuming flat OPEC production, the IEA said the “implied stock build is +2M bpd.”

Ahead of the U.S open, gold prices have rallied a tad overnight, as investors sought safe haven assets amid fears of a chaotic departure for Britain from the E.U. Spot gold is up +0.2% at +$1,214.77 per ounce, while U.S gold futures are +0.1% to +$1,215.6 per ounce.

3. Euro zone bond yields back up, Brexit limits rise

Euro sovereign yields are a tad higher this morning as some stability returned to British markets following the pervious day’s Brexit-driven turmoil.

Nevertheless, 10-year Bund borrowing costs are set for their biggest weekly fall in three-weeks in a sign that uncertainty in Britain and Italy continued to support demand for safe-haven assets.

Germany’s 10-year Bund yield is up about +1 bps at +0.37% – above more than the two-week lows at around +0.35% hit yesterday as Brexit turmoil triggered a slide in sterling and the biggest one-day fall in 10-year gilt yields since just after the 2016 Brexit vote.

Elsewhere, the yield on 10-year Treasuries sank -1 bps to +3.10%, hitting the lowest in more than two weeks with its sixth straight decline. In the U.K, Britain’s 10-year yield climbed less than -1 bps to +1.374%.

4. Sterling holds onto gains

The pound (£1.2829, +0.24%) is holding on to its early Friday morning gains, on the back of U.K PM May’s radio interview in which she said her deal was the best Brexit compromise the U.K could achieve.

However, there is speculation that Conservative ministers may have enough votes – 48 are needed – for a letter of “no confidence” that would force a vote in Parliament.

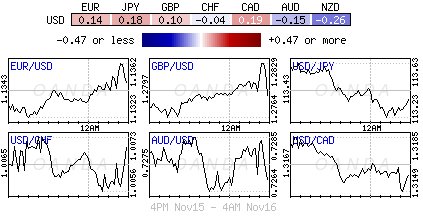

Elsewhere, the EUR has rallied +0.2% to €1.1347, the strongest in more than a week, while the British pound has gained +0.2% to £1.2798. The Japanese yen has increased +0.3% to ¥113.29.

5. New Zealand’s manufacturing activity picks up

Data overnight showed that manufacturing activity in New Zealand recorded its highest level in four-months in October.

The Bank of New Zealand-Business NZ’s seasonally adjusted Performance of Manufacturing Index (PMI) rose to 53.5 from 51.7 the previous month.

This was 1.6 points higher than September, and the highest level of activity in seven months.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.