US equity markets are expected to build on yesterday rapid improvement in risk appetite on Thursday, with futures higher by around 1% and closing in on all-time highs.

At times yesterday, not even the most optimistic of us could have anticipated that we’d be eyeing up record highs today, just the prospect of markets stabilising would have been a relief. Instead it’s been like Brexit on speed and it seems like for now, at least, investors are keen to focus on the positive aspects of a Trump Presidency rather than some of the more worrying pledges made during the campaign.

Fed Hike Back On With Trump Win

With the US election now behind us, attention returns firmly to the Federal Reserve meeting in December. Shortly after it became clear that Trump was going to become President elect and markets were in turmoil and deep risk aversion territory, the probability of a hike in the markets plummeted to around 50% from around 80% previously but, as with everything else, this quickly rebounded and now stands at around 71%. The absence of such a rebound yesterday and any kind of prolonged market turbulence would have made it very difficult in December for the Fed to have raised interest rates.

Source – CME Group FedWatch Tool

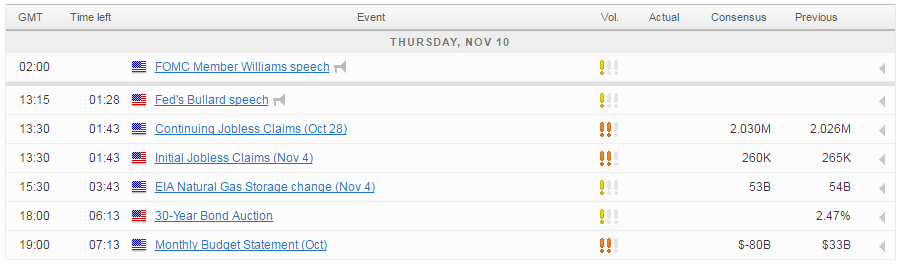

It will be interesting to see what James Bullard has to say on the last 48 hours when he speaks today. Bullard was not one of the dissenters at the last meeting but may have been open to a hike in December prior to the election. His colleague John Williams – who is not a voter on the FOMC until 2018 – earlier appeared to indicate that nothing has changed since the election.

EUR/USD – Dollar Takes Breather After Roller-Coaster Wednesday

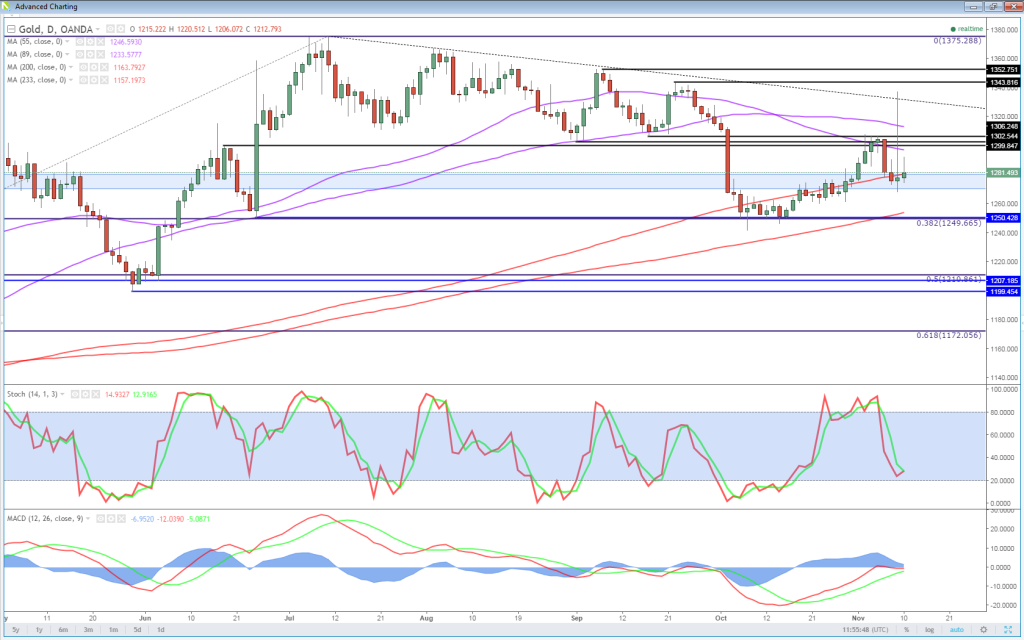

Gold is holding up around $1,280 today, possibly being supported by the broader commodity risk rally, although it’s only trading marginally higher on the day. Given the outlook for interest rates, the dollar and the lack of risk aversion in the markets, I wonder whether we can actually see it significantly rally from here, in the absence of another major risk event. I wouldn’t be surprised if we see $1,250 coming under pressure in the coming weeks, especially if the Fed once again signals an intention to raise rates next month.

OANDA fxTrade Advanced Charting Platform

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.