Europe is expected to open lower on Tuesday, tracking similar losses in the U.S. and Asia as commodities continue to come under pressure, weighed down by the ongoing appreciation in the dollar.

We did see a pop in oil on Monday following a pledge from Saudi Arabia to work with OPEC and non-OPEC members to stabilise oil prices. This is the first time the Saudi’s have shown a willingness to work towards a solution having previously opted to allow market forces to push out the higher cost producers, which was clearly aimed at the U.S. shale industry which has since shown a real resilience, despite low prices.

Surprisingly, the rebound in oil has so far been small which may suggest that the markets are not yet ready to believe that all parties are willing to consider production cuts in an effort to resolve the massive oversupply issue. Still, ahead of the OPEC meeting on 4 December, this may bring some stability to oil prices. Although, with containers nearing capacity, I can’t imagine the Saudi’s will be afforded too much time to find a solution before oil heads south again.

Bank of England Governor Mark Carney will be grilled by the Treasury Select Committee later on this morning in an exercise that is meant to be an opportunity to get more insight into the central banks current policy stance but can quite often become a dull politicised affair. That said, these quarterly inflation report hearings do quite often provide useful insight in and among all of the nonsense, which should prove very useful given the BoEs recent shift towards hiking rates later rather than sooner.

Inflation in the U.K. has remained very subdued and while the sharp fall in energy prices should fall out of the year on year calculations in the coming months, the core data clearly shows that there’s more to this low inflation story than just commodity prices. The strong pound is clearly a major headwind for the U.K. economy as it imports a lot of goods, which means deflationary pressures are also imported. At the same time, U.K. exporters are forced to keep prices low in order to try and remain competitive, applying more downward inflation at home.

Carney has repeatedly insisted that the U.K. is experiencing temporary good deflation as consumer inflation expectations are not falling and disposable income is higher. Clearly, however, something has changed which has forced the central bank to re-evaluate when it will be appropriate to raise interest rates and I expect Carney to be pressed more on this today.

Also today we’ll get the latest revisions to third quarter German and U.S. GDP. The latter is expected to be revised from 1.5% to 2% on an annualised basis, which is far from the kind of growth the country wants to see but probably good enough for the Fed to be comfortable raising interest rates in December. German GDP is expected to be unrevised at 0.3%, as the economy continues to struggle to overcome the growing number of economic headwinds that are weighing heavily on the economy, most recently the slowdown in emerging markets and its impact on German exporters.

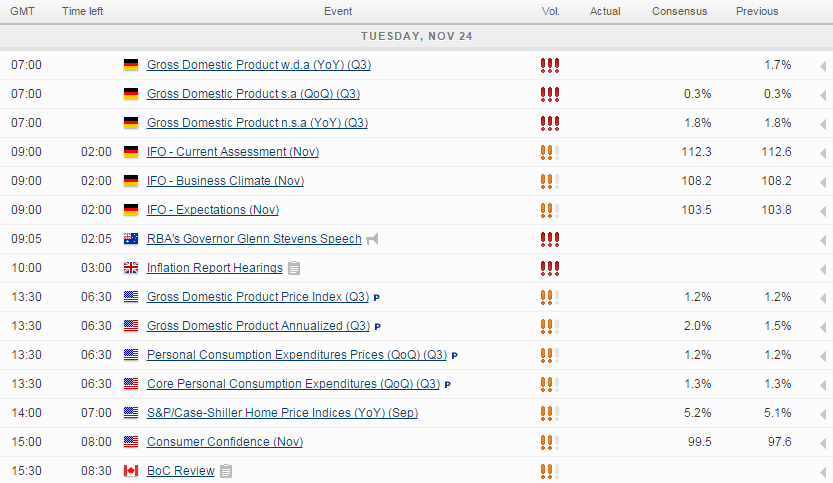

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.