U.S. futures are pointing to a relatively unchanged open on Friday, after indices ended a three day winning streak on Thursday with minor losses.

We’re seeing similar losses already in Europe this morning as further declines in oil weigh on energy stocks. Yesterday’s inventory build was yet another reminder that the market remains oversupplied and the production freeze agreed between Russia and some OPEC members fails to address the issue. This may have spurred some short-term buying but I’m not convinced it is enough to prevent oil from trading back at January lows in the coming weeks.

The U.S. CPI data will be key today as investors look for signs that inflation is showing any sign of returning to target. While inflation, as measured by core CPI, is actually already above the Federal Reserve’s 2% inflation target, it is not the central banks’ preferred inflation measure – core personal consumption expenditure price index – which is currently some way behind at 1.4%.

EUR/USD – Euro In Holding Pattern Ahead of U.S. Inflation Report

The CPI release is still important though as it is released a week earlier than the core PCE reading and therefore offers important insight into price pressures in January. Should we see an unexpected rise or drop in the CPI measure, we could possibly expect to see the same in next week’s release. Inflation expectations are still very low and given the number of other global economic uncertainties, the markets are now pricing in no more Fed rate hikes this year. While I don’t believe the Fed will slam the breaks on quite so much, I do believe that we’ll only see one or two hikes as prices pick up more slowly and risks grow.

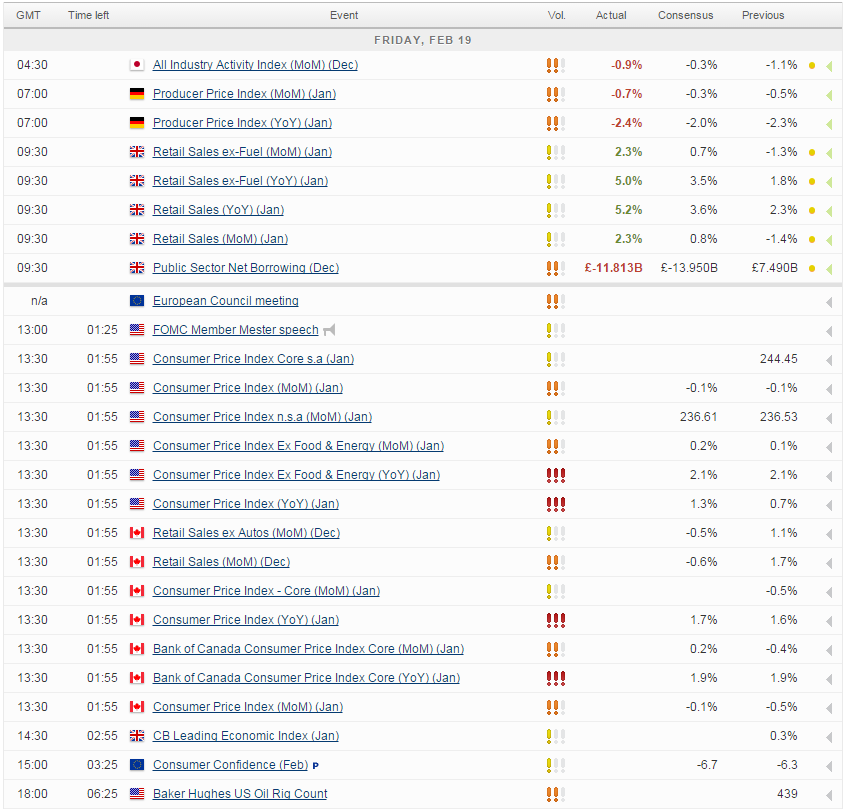

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.