Both Brent and WTI crude continue to drift lower ahead of Thursday’s OPEC/Non-OPEC meeting in Vienna.

The divergence in price behaviour between Brent and WTI continued overnight. Although both contracts fell, WTI had much the worse of it, falling 1.90% to 57.65 as the overbought technical indicators and the imminent reopening of the Keystone pipeline from Canada weighed on it. By contrast, Brent fell a meagre 0.40% to 63.65, staging a late comeback having almost touched 63.00 earlier in the session on rumours of Russian jitters about extending the OPEC/Non-OPEC production cut. Ahead of Thursday’s meeting, we expect position squaring to weigh on both crude contracts.

With no API Crude Inventory figures this evening, the short-term market will be operating in a data vacuum with Wednesday’s official crude inventories likely subsumed ahead of the Thursday summit. Oil trading will therefore probably be choppy intraday as short-term traders chase their tails on rumours and innuendo.

Brent crude is unchanged in early Asian trading with intra-day resistance at 63.95 ahead of the formidable twin double tops at 64.40 and 64.85. Support is at 63.00 and 62.25 ahead of the critical multiple daily lows at 61.25.

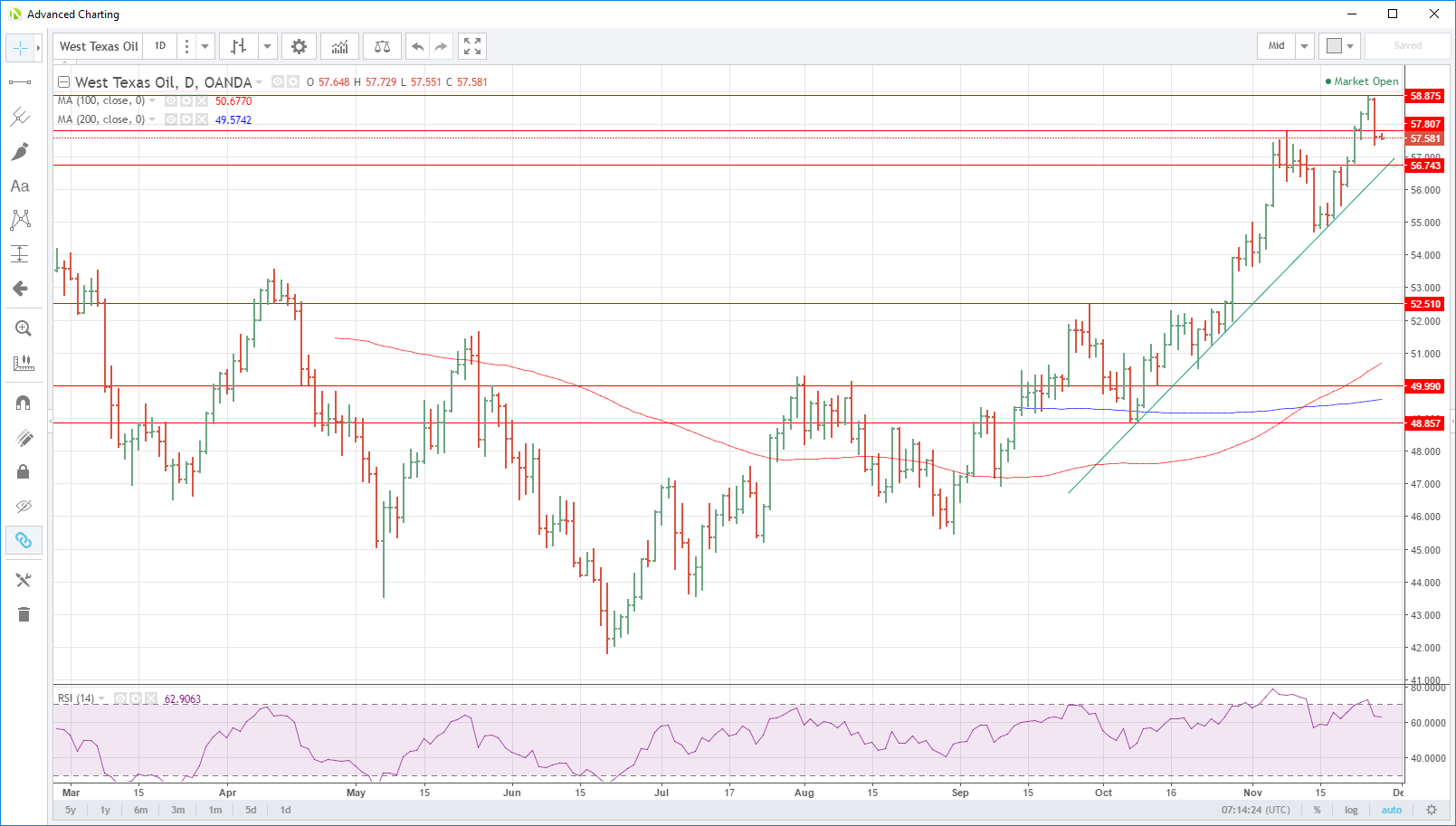

WTI has drifted ten cents lower to 57.55 as traders continue to lighten long positions. Support is initially at the overnight lows of 57.35 followed by 56.75 and then the two-month trendline support close behind at 56.55. A break of this level sets the scene for a much broader correction to 55.00. WTI formed a double top at 56.85 overnight which becomes strong resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.