Daily Markets Broadcast

2019-07-08

US indices off highs despite strong payrolls

US nonfarm payrolls rebounded strongly in June, data released Friday showed, but it was not enough to keep powering US indices to new highs in holiday-thinned trading. Greece is to get a new Prime Minister while Turkey has replaced its central bank governor.

US30USD Daily Chart

-

The US30 index snapped a six-day winning streak on Friday, retreating from Thursday’s record high

-

The 100-day moving average at 26,039 is edging closer to the 55-day average at 26,100 and they could possibly cross over later this week

-

The US economy added 224,000 jobs in June, well above estimates of a 160,000 gain. The unemployment rate ticked higher to 3.7% while average hourly earnings rose 0.2% m/m, less than forecast. The are no major data releases scheduled for today.

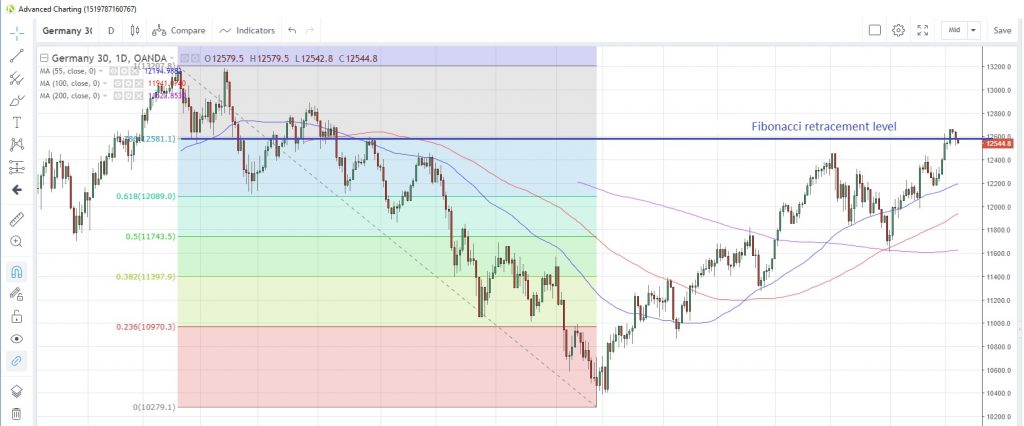

DE30EUR Daily Chart

-

The Germany30 index fell for a second straight day on Friday and looks set to extend those losses today. Deutsche Bank announced an $8.3 billion cost-saving turnaround plan involving the loss of 18,000 jobs

-

The index fell back below the 78.6% Fibonacci retracement of the May-December drop last year at 12,581. The 55-day moving average is at 12,195

-

Germany’s factory orders disappointed in May and this could filter through into the industrial production numbers for the same month. Surveys suggest IP declined 0.4% m/m, an improvement from April’s -1.9%.

CN50USD Daily Chart

-

The China50 index fell for a fourth straight day on Friday but still managed to post a sixth weekly gain

-

The index closed 2.3% off the July 1 high with the nearest support level possibly the 55-day moving average at 13,151

-

China’s new loans data are due tomorrow and are expected to show another solid gain in July. In the first six months of this year, new loans have risen by more than nine trillion yuan ($1.3 trillion), an indication of the type of stimulus flows that are hitting the economy.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.