Investors appear to be taking a bit of a breather on Friday following what has been quite a hectic week across the board, from politics to central banks and economic data.

US dollar correction continues, aided by more hawkish tones from BoE and ECB

The US dollar appears to be undergoing a small correction with expectations going into the Fed meeting on Wednesday having been so raised that there was nothing left in the move. It was classic buying the rumour selling the fact. A dovish hike was the minimum that was priced in and the Fed went no further at this stage which has prompted some profit taking.

EUR/USD – Euro Rally Pauses, US Consumer Confidence Next

The fact that this was accompanied by a more hawkish BoE on Thursday, with one policy maker voting for a hike and others suggesting they’re not far behind, and the ECB sending hawkish signals of its own, is clearly aiding the dollar moves. Should other central banks join the US in removing accommodation after years of ultra-loose monetary policy, it could take some of the pressure off the dollar this year, which will please the Trump administration that has repeatedly bemoaned others for keeping their own currencies artificially lower against the greenback.

Commodities higher as weaker dollar offers some reprieve

Commodities continue to benefit from a softer dollar, with Gold having returned back to the levels we were seeing earlier in the month, although it remains vulnerable to further downside. Political risk appeared to be feeding the safe haven appeal of the yellow metal last month but with the first of three election hurdles overcome in Europe this year, this appears to have subsided a little. The French election remains the greatest risk on this front though and despite the jubilation among European leaders at the Dutch election result, there is no room for complacency. Populism remains on the rise, regardless of the lower than expected showing for Geert Wilders this week.

OANDA fxTrade Advanced Charting Platform

Oil pares losses but further downside could be on the cards

Oil is continuing to pare gains on Friday after having made considerable losses over the past week or so. Brent crude found support around $50 earlier in the week which appears to have triggered some profit taking, aided again by the weakness which followed in the dollar from Wednesday evening. WTI on the other hand appears to be having similar trouble with the psychological $50 level but from below.

One-Minute Round Up: A ‘Less Hawkish’ Fed Has the Market Rethinking Strategy

The price action over the last few days doesn’t look particularly bullish for oil and I do wonder whether the $50 level in Brent is on borrowed time. The size of the inventory builds in the US over the last five weeks and the fading possibility of an extension to the output deal appears to still be weighing on oil at the moment.

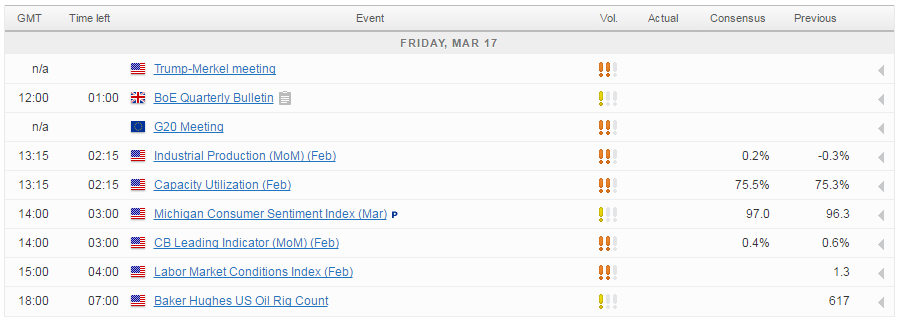

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.