US futures are pointing to a slightly softer open on Monday, tracking similar moves in Europe, as traders look ahead to a busy week on the corporate calendar with a large number of companies reporting on the second quarter, as well as some important data points and a Federal Reserve monetary policy decision.

Earnings season is likely to be the main focus this week, with 189 S&P 500 companies scheduled to report, as well as plenty more from across the pond. With indices in the US trading at record highs and central banks favouring a less accommodative stance, earnings will become increasingly important in maintaining or expanding on these levels, particularly in the continued absence of the growth policies that won Donald Trump the US election last November.

Eurozone PMIs Fall Short But No Cause For Concern

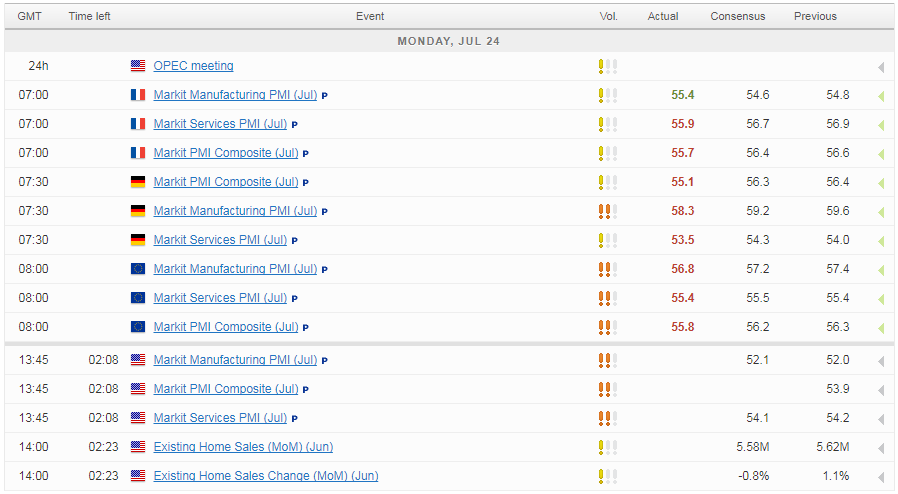

There will be plenty of economic data scattered around the earnings reports, with PMIs from the euro area and the US coming first on Monday. The euro has dipped a little in early European trade, with PMIs from Germany, France and the eurozone all falling a little short of expectations but not so much as to cause any concern about any significant slowdown in growth in the region.

While the numbers may suggest momentum is slowing, they all remain well above the 50 level that separates growth from contraction. The fact that the euro has slipped a little in response to these numbers may also be a reflection of the fact that it is trading at a near two year high against the dollar and was therefore prone to a little profit taking. A move through 1.1714 in the pair would see it trade at its highest level since the start of 2015 and potentially trigger another sharp move higher.

Venezuela May Make or Break Oil’s Recovery

Momentum Remains With Cable Bulls

The pound is trading above 1.30 against the dollar again this morning, up around a third of one percent on the day, which is weighing on the FTSE, the worst performing major index in Europe. The pair has struggled at these levels over the last couple of months but momentum appears to remain with the bulls, which could put some pressure on last week’s highs in the coming days.

OANDA fxTrade Advanced Charting Platform

Oil Stable Ahead of Meeting in Russia

Oil prices are trading a little higher on Monday but continue to hover around the levels its traded at for much of the last two months. With OPEC and non-OPEC oil ministers meeting in Russia to discuss compliance with the cuts as well as Libyan and Nigerian output, prices may remain volatile throughout the session as we possibly get more insight into whether deeper cuts could be on the cards.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.