In April, Bill Gross said betting on a decline in the value of German government debt offered the trade of a “lifetime.” Thus far, the strategy has failed to deliver anything like the stellar profits anticipated by Gross. But that says less about the market acumen of the world’s best-known bond investor than it does about quantitative easing’s failure to extinguish the threat of deflation in the euro zone.

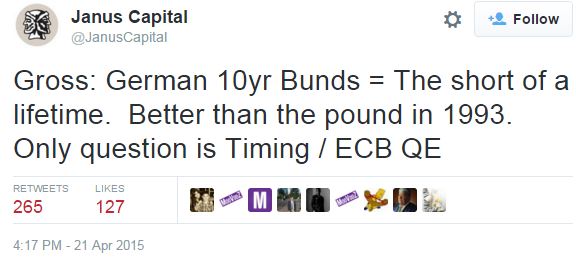

Here’s what Gross, formerly of Pimco and currently managing money at Janus Capital, tweeted on April 21:

The comparison he used to quantify the scale of the opportunity was the British pound’s 1992 departure (ignore that he got the year wrong) from the pre-euro currency-pegging system called the Exchange Rate Mechanism. That netted $1 billion for George Soros and Stanley Druckenmiller, as the pound lost 14 percent of its value against the deutsche mark in three weeks.

When Gross sent his tweet, the then benchmark German 10-year bond was trading at about 103.26. In the following weeks, it dropped to as low as 95.59, marking a 7.4 percent decline. But since then it’s drifted back up, and was recently at about 100.85, down a measly 2.3 percent from when Gross first recommended the transaction.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.