Traders Look For Subtle Clues Ahead of September Expiry

Thursday’s European Central Bank meeting may not go down as the most exciting on record but it could contain some very subtle hints that the end of quantitative easing is close.

- ECB Bond Buying Expected to End This Year

- Gradual, Calm Exit Sought By Policy Makers

- Markets May Be Sensitive to Small Changes in Message

The ECB has been gradually and carefully bringing its QE program to an end ever since it announced its first reduction – which is claimed was not a taper out of fear of a repeat of the taper tantrum the Federal Reserve experienced in 2013 – back in December 2016.

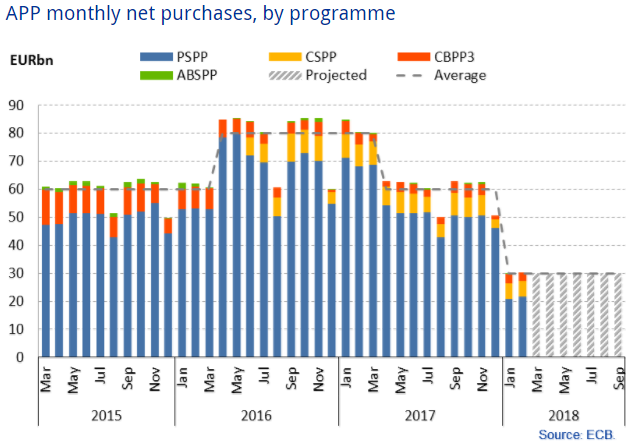

Since then, purchases have fallen from €80 billion a month to €60 billion – in April last year – and then to €30 billion from January this year. With the current purchases expiring in September, there has been speculation about whether the ECB will end it at expiry or briefly extend to the end of the year at a slightly reduced pace. The reality is that it doesn’t really matter and we’re not likely to find out until June, but that doesn’t mean we shouldn’t pay attention to the meetings until then.

Source – ECB Website

For one, a number of things could change between now and the June meeting that could force the ECB to increase the pace of tightening or further delay the end of QE and clues about such a move will come from the meetings and/or the speeches they give in between them.

DAX Ticks Higher as Eurozone GDP Stays Steady

The ECB has also made it clear that any policy changes will be communicated very gradually so I would imagine we will see small differences at almost every meeting for the rest of the year so as to well prepare us for the end of QE. That may not be particularly exciting but it could well move markets.

The language that is speculated to be targeted on Thursday is the reference to the central banks readiness to increase the asset purchase program in size or duration if the outlook becomes less favourable. While this was always a pointless line, the ECB has stuck by it and the removal of it is a small acknowledgement that less dovish language in warranted.

Equities Drop, Bonds and Yen Gain on Trade War Fears

The question is how much this tiny gesture is priced in, what impact it will have on the euro and whether they will go any further given the tense environment – trade wars, fragile market sentiment. We may well see some movement in the euro around the release but ultimately, Mario Draghi – the ECB President – will likely determine what markets will do.

I expect he may keep his cards very close to his chest and let the press conference pass without any major talking points. Either way, traders will be sitting and waiting to pounce on any unexpected hawkish or dovish message Draghi decides to divulge.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.