A sure thing is always a dangerous bet and more so when it’s in reference to the ECB. However, it’s widely expected that that they will cut the benchmark interest rate by -0.25% to +0.5% this morning while keeping the deposit rate unchanged. The real surprise from Draghi and company could come from any further hint or announcement of non-conventional measures.

If the ECB only delivers a -25bp refi-rate cut without any non-standard measures, the market should be disappointed- weighing on the EUR outright against the dollar. A rate cut with additional measures is likely to have a mixed impact on the 17-member single currency. While the cut would likely undermine rate support for the EUR, announcement of measures targeted at SMEs may compress the important “peripheral yields” – which could end up being a net supporter of the single-currency. The BoJ’s Kuroda should be happy with this, as EUR/JPY will be expected to outperform under this scenario.

The most interesting of scenarios would be if the ECB keeps rates on “hold” but announces substantial non-standard credit-easing measures. The markets kneejerk reaction should ultimately see a stronger EUR currency that will eventually be smacked down to size by the disappointment in risky assets. As per usual, the post announcement news conference will be closely watched for hints at the path of the Euro-zone monetary policy in the months ahead.

Yesterday the Fed showed that they are not ready to sound any alarm bells just yet, however, when they suggest that they may increase or reduce stimulus to achieve their targets they are referring to “more” QE rather than less. The ‘new’ reality is that the US economy has done the mighty greenback no favors of late. The Fed has been backed into the “reality check” corner – two meetings ago the market was expecting some early signs of an exit strategy and rightly so began focusing on the timing. Now, policy members find it difficult to repeat many things that were said in March. Any sign in job improvement remains their ‘yardstick’. The Fed has shifted from a sole focus on the timing of tapering purchases to a two-sided policy risk. When the dust truly settles yesterday’s statement will be seen as more dovish and dollar negative.

This week’s US ADP disappointed and has a few revising their estimates for tomorrow’s granddaddy of reports, non-farm payrolls (+150K). Recent manufacturing surveys suggest that the “return to moderate economic growth” must now surely be at risk – both inflation and employment data have been particularly weak, but some forward looking components have managed to hold up, for instance, US manufacturing new-orders index is seen as an example of a “plus” for future production. With employment the Fed’s new yardstick, tomorrow’s US jobs data now becomes even more important lending weight to additional QE or not. Despite the April ADP gain being widespread across a spectrum of company-size sectors, many will consider tinkering their results to reflect softer reports in general in Q2 – all equating to a sluggish economic growth. Other job indicators like the Manpower hiring survey actually dipped this Q, again signaling new weakness – Could tomorrow’s number be the benchmark that breaks the greenbacks back and give the EUR an even bigger headache?

Euro data this morning is certainly lending its support for an accommodative policy decision by Draghi and company. Activity amongst Euro-zone manufactures fell at the fastest pace in four-months last month (46.7 vs. 46.8, m/m). The headline print suggests that Euro manufacturing “looks to be acting as a significant and increasing drag on the economy, raising the risk of a deepening contraction of gross domestic product in Q2.” So, it’s a -25bp cut to another record low and nothing else, or cut and get credit flowing or no cut and get credit flowing – no matter what, it’s the ECB and will always be surprised.

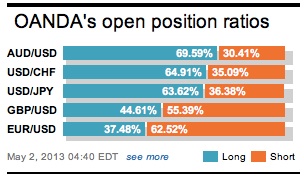

It now seems that the most traders have cut back on their aggressive bets ahead of the ECB and tomorrows NFP report as the dollar holds steady against the Yen and EUR this morning. These two events combined are expected to set the tone for remainder of Q2. Speculators have certainly pared Wednesday’s longs but have failed to drive trade below support 1.3150-30. This is very much a neutral market, stuck at the mid-point of week’s range before rate decision. Is this a good enough reason to fade any kneejerk reaction? Time will only tell. In the US, initial jobless claims are anticipated to be basically unchanged on the week at +340K. Investors should expect a few analysts to maybe soften tomorrows NFP expectations – the average is calling for +150K headline print, expect to see a few weaker recalculations towards a +135K print.

Other Links:

Euro Continues Rally as Dollar Struggles

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.