Wednesday November 21: Five things the markets are talking about

Yesterday, major U.S indices extended their losses into a second-day as the relentless selling in technology and high beta names continued to wreak havoc.

However, the bleeding seems to have temporarily stopped in this morning’s Euro session as equities rally along with U.S futures, reducing some of this week’s losses, while Asian bourses traded mixed. The tech sector and auto companies are currently leading the equity advance.

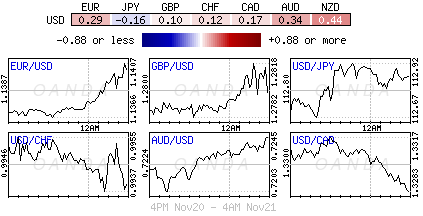

Elsewhere, U.S Treasuries have edged a tad lower and the ‘big’ dollar has slipped, while the EUR (€1.1395) is pushing higher on market reports that the Italian government may be open to budget revisions. Even Italian bonds have found some traction, which is narrowing the BTP/Bund spread.

WTI oil has halted its slide near $54 a barrel as the market weighs inventory reports that showed U.S crude inventories falling last week against doubts over OPEC’s plans to cut output next month.

On tap: U.S core durable goods orders to be released at 08:30 am EDT. It’s a shortened trading week because of the U.S Thanksgiving holiday.

1. Stocks mixed results

There was a broad rebound in Asian equities after strong early declines on the back of yesterday’s declines in the U.S, coupled with the yen (¥112.94) turning lower, allowed Japanese stocks to pare much of their drop by day’s end. The Nikkei fell -0.35% on daylong weakness in energy and electronics stocks. The broader Topix fell -0.6% and trades atop of bear market territory.

Down-under, Aussie shares closed at their lowest level in 21-months on global growth worries. The S&P/ASX 200 index clawed back some of its earlier losses, but still closed -0.51% lower. The benchmark fell -0.4% on Tuesday. In S. Korea, the Kospi retreated -0.4%.

In China and Hong Kong, stocks bucked the regional sell-off as policy support gathers pace. The Shanghai Composite Index gained +0.2% and Hong Kong’s Hang Seng Index added +0.5%, as both benchmark gauges reversed intraday losses of at least -1%.

Note: Investors brought stocks after President Xi Jinping said support for China’s private companies was “unwavering” and financial regulators vowed to widen funding channels for smaller firms to defuse the risk linked to shares pledged as collateral for loans.

In Europe, regional indices trade higher across the board following a mixed Asian session and positive U.S futures. Market focus is on Italy with the FTSE MIB outperforming ahead of the E.U Commission’s opinion on the 2019 draft budget plans.

U.S stocks are set to open in the ‘black’ (+0.5%).

Indices: Stoxx600 +0.5% at 352.7, FTSE +0.7% at 6996, DAX +0.6% at 11128, CAC-40 +0.5% at 4947, IBEX-35 +0.7% at 8931, FTSE MIB +0.6% at 18623, SMI 0% at 8769, S&P 500 Futures +0.5%

2. Oil pares some losses, but outlook weak, gold steady

Oil prices have bounced by more than +1% overnight, paring some of yesterday’s -6% plunge, supported by a report of an unexpected decline in U.S commercial crude inventories and record Indian crude imports.

Nevertheless, markets remain on edge, with the IEA warning of “unprecedented uncertainty in oil markets due to a difficult economic environment and political risk.”

Brent crude oil futures are at +$63.39 per barrel, up +86c per barrel, or +1.4% from Tuesday’s close. U.S West Texas Intermediate (WTI) crude futures are up +90c, or +1.7%, at +$54.33 a barrel.

Supporting prices was API data late Tuesday showed that U.S commercial crude inventories last week fell unexpectedly by -1.5M barrels, to +439.2M, in the week to Nov. 16.

Record crude imports by India of almost +5M bpd is also giving ammo to crude ‘bulls.’

Concerned about an emerging production overhang, OPEC is expected to push for cuts at its December 6 meeting – expectations for a supply cut are in the region of -1M to -1.4M bpd.

Ahead of the U.S open, gold prices have inched up a tad this morning in subdued trading ahead of U.S Thanksgiving, supported by weakness in dollar and equities. Spot gold is up +0.2% at +$1,224.02 per ounce, while U.S gold futures has also rallied +0.2% to +$1,223.9 per ounce.

3. Bond traders are starting to doubt the Fed again

The Fed has indicated that it plans to hike short-term interest rates three times next year, however, bond traders are increasingly sceptical that it will.

The recent market turmoil has chipped away at traders and investors’ confidence that the Fed can keep increasing rates at the pace it has signalled.

Fed-funds futures yesterday showed the market is pricing in a +10% chance of the Fed raising rates at least three times next year – that’s down from +21% a week ago and +28% a month ago.

While the Fed is expected to raise rates in December, many are now pricing in the Fed easing its foot off the gas peddle.

Market expectations of a Fed rate increase in December stands at +72.3% vs. +78.4% on Oct. 19.

Elsewhere, German Bund yields trade slightly higher, indicating ease in risk aversion, but sentiment remains shaky ahead of the E.C opinion on Italy’s budget plans. The 10-year Bund yield is trading at +0.36%, up +1.4 bps.

4. Dollar higher, but for how long?

USD remains on soft footing on position adjustments in this holiday shortened trading week. Rate differentials are supporting the greenback on deeper pullbacks, however, given some weaker U.S data of late, there is growing expectations that the Fed could take its foot off the gas peddle to some extent in 2019

EUR/USD (€1.1386) is a tad higher as Italy seems open to compromise on the budget. Previously, Italy had been adamant that fundamentals of budget would not change. Market now waiting for the E.C report.

GBP/USD (£1.2779) was initially holding above the £1.28 level, as a leadership challenge threat seemed to wane for the time being with the Dec Parliament vote on Brexit text vote now being eyed as a referendum to her leadership.

Note: PM Theresa May is said to be examining a last-minute plan to scrap the Irish backstop in a bid to win over the Conservative Brexiteers and bring the DUP back onside.

5. UK borrowing lowest in 13-years

Data this morning showed that the U.K. government borrowing in first seven months of the fiscal year was the lowest in 13 years, despite a big rise in government spending in October.

The Office for National Statistics said the U.K government borrowed £26.7B in the seven-months through October, the lowest borrowing for the same period since 2005.

Borrowing in October, though, was the highest for three-years at £8.8B, a reflection of higher government spending on interest payments on its debts and spending on goods and services.

Today’s data would suggest that Treasury chief Philip Hammond will probably meet his budget goals for the full-fiscal year through March.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.