The greenback got crushed across the board following yesterday’s dovish remarks from Fed Chair Powell. The euro however was unable to extend gains as mixed European data and the ECB Financial Stability Review painted a softer picture that could tilt the ECB into abandoning the 2019 normalization plan.

Euro Zone Economic data

– France’s second reading for third quarter GDP accelerated as expected from 0.2% in Q2 to 0.4%. Household consumption expenditures recovered while imports declined.

– Inflation in Germany also cooled more than expected to 2.2% and off the 6-year high reading of 2.4% in October. If inflation continues to ease for euro zone’s largest economy, the ECB might have to move even slower in unwinding its stimulus. The recent slump with oil prices is also likely support inflation moving lower in the coming months.

– The German unemployment rate also fell to a record low at 5.0%, a potential indication that wage growth could rise.

– Euro Zone confidence data also painted a mixed picture. The Business Climate Indicator beat expectations with a 1.09 reading, while economic confidence fell for an 11th consecutive month. Industrial confidence had a small beat and posted a small gain while Services confidence declined slightly. The survey specifically focused on the markedly drop in Italian sentiment.

ECB Financial Stability Review

The review noted that rising political and policy uncertainties could dent confidence and sentiment. Despite limited spillovers so far, the stress in Italian sovereign debt markets illustrates how quickly policy uncertainties and the ensuing sudden shift in market sentiment can unearth risks to financial stability via higher risk premia and rising public debt sustainability concerns.

The pressure remains on Italy’s government to reach an agreement with the EU Commission on their budget. Optimism is starting to grow as it appears Italy is considering cutting its budget deficit target to 2.2%, much closer to the 2.0% that the EU reportedly would require to avoid sanctions.

Even if we do see a resolution on the Italian budget, a European slowdown could delay the ECB’s plan to normalize policy later in 2019, and thus capping any major euro rallies.

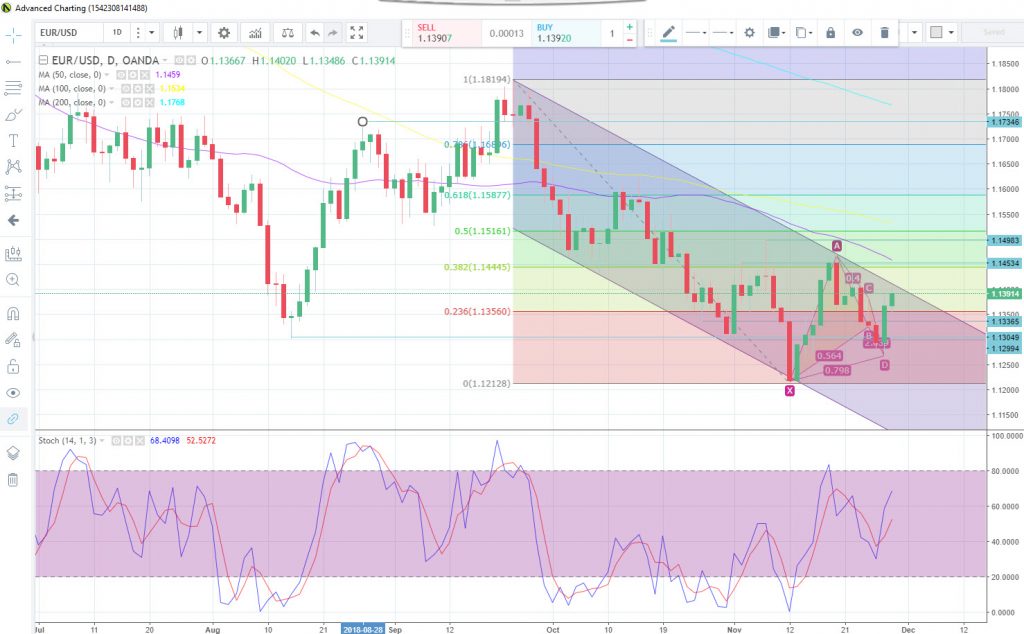

Technical Analysis

Yesterday’s morning post, noted that price was forming a bullish Gartley pattern. The pattern was validated, and price did rally towards the initial target at 1.1350. The rally is tentatively seeing resistance from both the 1.1400 handle and the bearish channel that has been in place since the end of September. If we see a daily close 1.1460 level, we could see further bullish momentum target the 1.1530 area. If the bearish channel is respected key support may come the 1.1275 level.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.