The Monday after a US employment data release is historically the least volatile day of the month. Events occurring in the overnight sessions could be putting an end to this myth, as we head slowly towards the US Fiscal Cliff deadline. The Italian Prime Minister Mario Monti’s announcement over the weekend of his intention to resign, once Italy’s budget is pushed through parliament, could be throwing a wrench into the ‘periphery’ works. His intention could be seen as jeopardizing the regions efforts to stabilize its economy.

His announcement will likely pave the way for Italy to hold general elections a month sooner, probably in February next year. Politically, Monti’s succession was always going to be some sort of stumbling block for the Euro-zone solution as capital markets have always seen him as a credible ally to the European cause. Without Monti at the helm, the credibility of his country’s reforms will come under close global scrutiny. So far, Italian politics have overshadowed a mixed result to Greece’s bond buyback.

This morning Greece extended the deadline for participation in its bond-buyback program. Apparently, the country had only attracted between +EUR 26 and +EUR 28b in offers by last Friday’s original deadline, just shy of the +EUR 30b target that everyone had hoped. Remember, this buyback is a precondition for fresh aid. The third member of the Euro periphery trio in trouble, Spain, is not immune to this morning’s events being played out in southern Europe.

Contagion to Spanish Government bonds, from the early departure of Italian PM Monti, could be enough to force Spanish Prime Minister Rajoy to seek an early bailout and, in turn, trigger the ECB’s OMT. Until now, Spain’s ability to start to pre-fund for 2013, had been enough to keep Spanish yields from persuading Rajoy to seek aid. However, periphery yields backing up this morning may hasten the situation. Some reporters are beginning to tell us to “forget fiscal union-the EURO has become an austerity union.”

Euro troubles have again trumped Chinese data in the overnight session. China’s exports happened to rise +2.9%, y/y, in November, compared with a +11.6% rise in October, while imports were unchanged, leaving a trade surplus of +$19.6b for the month, following a +$32b surplus in October. China remains the globes economic barometer; when she sees red the rest of the world worries. Separately, and more comfortably, IP growth increased to +10.1%, y/y, in November, compared with +9.6% the previous month. Retail sales happened to see the highest growth in eight-months at +14.9%, y/y, in November. Finally, the headline CPI inflation returned to +2.0% on the month, compared with a +1.7%, y/y, rise in October.

The remainder of this week will be dominated by US FOMC expectations and the week ending meet of the European leaders. Many expect the FOMC’s mid-week policy statement to announce complementing its already +$40b/month MBS purchases with +$45b/month of Treasury purchases. Despite keeping the Fed’s +$85b/month purchase objective, the difference now is that the Treasury purchases would be unsterilized. Not meeting consensus should put pressure on the purchase of risky assets and any currencies geared towards global growth, like the loonie for example.

On Thursday begins the EU leaders two-day meet to “Shape the Union.” Leaders are supposedly meeting to discuss potential changes to the EU’s institutional framework. Knowing how slow the Eurocrats move, markets should expect members to reach a political agreement first. The ‘meat’ of any new commitments tend to occur after the original meet. Also, expect the Euro finance ministers to discuss the Greek buy-back program. Let’s hope the results are positive enough to convince all credit agencies involved, like the IMF, to release further financial aid to this crippled economy. Do not expect EU members to find a financial supervisory solution before year-end.

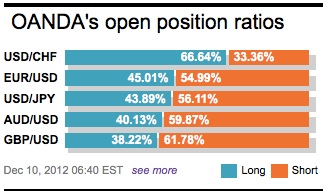

Yield differentials are expected to weigh on the single currency. The further narrowing of German and US spreads should be capable of keeping the EUR under pressure. The market’s bias is skewed towards the downside. Now that the market has taken a whiff of 1.2875 below, it has certainly opened up and thrown lower levels into the mix for technical analysts. Ideally, the EUR bears are looking to add to their shorts by sell EUR rallies ahead of 1.2955 and 1.2975. A good chunk of last Friday’s move has yet to be filled in. This will require patience, especially so when liquidity becomes a December issue.

Other Links:

Rain Soaked NFP to Save EURO?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.