European equity markets are expected to open around 1% higher on Thursday following a stunning rebound late on Wednesday, as initial risk aversion to Trumps election subsided and investors seized on the opportunity to bag some bargains as appetite suddenly returned.

While Trumps victory was initially seen as the less favourable and higher risk option for the markets, it was always going to present opportunity for the markets, I’m just not sure people quite expected that value to materialise quite so quickly. Trumps speech following the victory was hugely influential in yesterday’s sudden U-turn, as he focused more on unity and the need to spend to get the economy growing again. These policies combined with his desire to deregulate and lower taxes are all very market friendly.

It was important that he stuck to these messages rather than the more protectionist policies that were a major component of his campaign. As long as he continues to do so, the market will likely continue to respond favourably but that vulnerability to protectionism will remain. The stance he takes on trade will likely determine how vulnerable the markets are but in reality, these are very long term policies and for now, markets are more focused on the prospect of lower taxes, fiscal stimulus and less regulation.

XAU/USD – Gold Surges, Retracts as Trump Victory Triggers Market Turmoil

It was also interesting to see the huge swings in rate hike expectations throughout the session on Wednesday, which will likely be a key focus going forward given that the next meeting is one of the only major events remaining this year. Prior to the election, a rate hike in December was priced at just below 80% but this quickly fell back towards 50% after the result as traders began to doubt whether the Fed would want to raise interest rates in such an uncertain volatile environment. As markets settled down again and the rally kicked into gear, rate hike expectations rose in tandem and now markets find themselves back at pricing December at 71%.

Source – CME Group FedWatch Tool

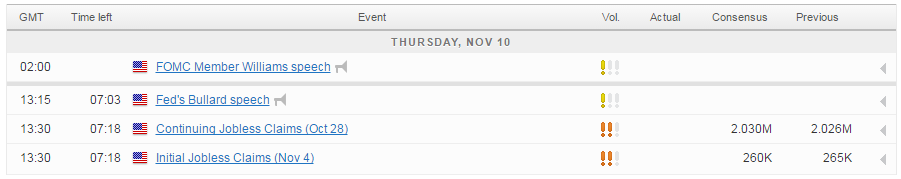

It will now be interesting to see what the view of the Fed is following all of this. Has the election removed uncertainty, which would favour a rate hike, or created it. We’ll hear from James Bullard today, who may offer some insight into this. That said, it’s still very early days and Bullard may not wish to comment on this until the markets settle down and give the central bank a better idea of what environment they are actually dealing with.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.