Robbins and Barnier make progress on Irish border

A relatively mixed session in Asia overnight has provided little direction for Europe markets ahead of the open on Tuesday, although it would appear investors haven’t been short of news flow to get their teeth into.

Reports overnight that “meaningful progress” has been made between Theresa May’s chief negotiator Olly Robbins and EU Brexit negotiator Michel Barnier – much to the annoyance of UK Brexit negotiator Dominic Raab I imagine – helped the pound hang on to earlier gains as we enter into a real crunch period for exit talks. Naturally, the report lacked any useful detail but that is something we can hopefully hear more about in the coming hours or days, if this is in fact true which isn’t always the case.

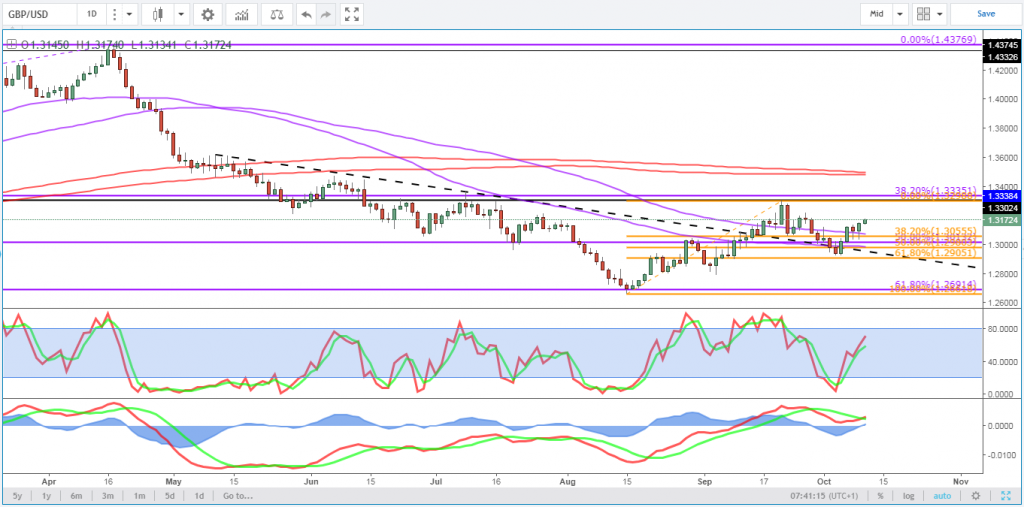

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

Sterling traders – who have been very sensitive to any Brexit-related speculation – were surprisingly unmoved by the reports which emerged late in the evening, although this may simply reflect to constant flow of news we’ve been getting and that this represented more of the message we had been seeing spill out throughout the day. Still, it’s rare cause for optimism, although there’s clearly still some way to go.

Pound extends gains on Brexit noise

Tria seeks to calm investors but stands by budget

Italy has emerged as a greater cause for concern for Europe recently, with the populist coalition of the eurosceptic right and left seizing the first opportunity to collide with Brussels only to find that it is in fact investors that represent a greater risk to their budget plans. Yields on Italian debt have spiked recently after the government proposed widening its fiscal deficit in order to stand by its election promises, something that has drawn criticism from both the European Commission and investors due to both the impact on its already huge debt levels and it’s unrealistic assumptions that risk it missing targets.

Italy’s Finance Minister Giovanni Tria has attempted to take a more calm approach in light of rising yields – very different to the hostility shown by his colleagues to both Brussels and the markets – in an attempt to ease some of the pressure on Italian debt but this is failing to calm fears. Tria stood by the need to spend more and generate more growth but urged calmer discussions with Brussels. Taking on Brussels, providing overly optimistic forecasts and attempting to fuel euroscepticism in the country isn’t the best way for the government to keep investors on side, much to the annoyance of the most vocal anti-establishment figures in government.

OANDA Trading podcast : CNH and IDR insights with MONEYFM 89.3

Dollar softens as Trump once again attacks Fed hikes

The dollar has been given some reprieve after US President Donald Trump gave his two cents on the central bank – not for the first time – claiming once again that he’s not too pleased with the pace at which they’re tightening. Trump has taken it upon himself to regularly chime in on the decisions of the independent central bank, something a President would typically refrain from doing so as to avoid blurring the lines between the two.

US Dollar Index Daily Chart

Source – Thomson Reuters Eikon

Some see this as a desire on his part to have more control over interest rates – which may be true – but I think it’s much more simple than that, a force working against him is an annoyance and he’s laying the groundwork early to direct the finger of blame at when the economy stumbles and markets slip.

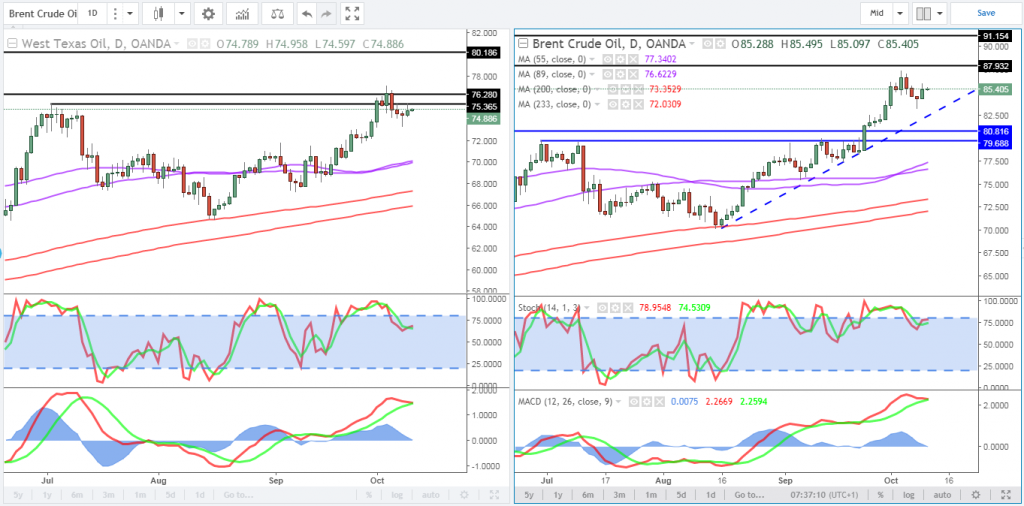

Oil pares gains as IMF lowers growth forecasts

The latest IMF forecasts could be taking some of the spark out of the oil rally in the near term, with lower growth naturally weighing on demand. Oil continues to be well supported though as Iranian sanctions prepare to come into force, taking significant supply out of the market, while Hurricane Michael in the US is expected to provide some additional near-term supply disruptions.

Brent and WTI Crude Daily Charts

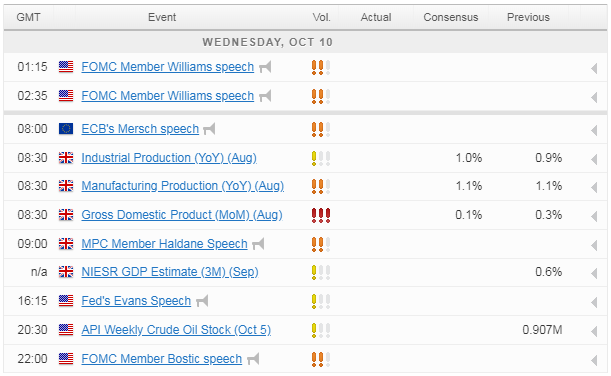

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.