Fed leaves markets deflated

Everything feels a little flat in the markets after the Fed left investors deflated and frustrated, despite delivering the 25 basis point rate cut they demanded.

Source – Thomson Reuters Eikon

There is clearly a wide range of views within the central bank – hence the three dissenters, one wanting more and two less – but one thing that did come across is that they are refusing to factor in a trade war into their forecasts in the same way that the market is.

What that means is, we’re left in a situation whereby the dot plot and forecasts are effectively irrelevant, as people in the markets don’t see the situation being resolved any time soon. The Fed is choosing to be reactive rather than proactive which means forward guidance become more focused on being committed to doing what’s necessary, rather than actually guiding on rates.

While investors may be frustrated about this, it’s probably not the worst approach as we don’t know how long the trade war will last, how much worse it will get and what the full consequences will be. That’s a lot of unknowns and if it is resolved over the next couple of months, it would dramatically change the outlook and the path of interest rates.

Sign up for our next webinar with Ed Moya on 24 September below

BoE to pass under the radar

It’s easy to forget that another central bank will also be making an interest rate announcement today but that’s understandable given the six weeks the country is now facing. The Bank of England is widely expected to leave interest rates unchanged at 0.75%, holding back its ammunition for the battle that lies ahead.

A no deal Brexit will demand a lot of the central bank and unfortunately, a decade on from the financial crisis, it doesn’t have a lot to offer. Rates are close to record lows so it makes no sense to stagger further cuts just ahead of a possible no-deal Brexit, not when the data doesn’t really warrant it. Today’s announcement will likely pass under the radar.

Gold vulnerable at key support

Gold continues to look vulnerable in the aftermath of the Fed’s apparent “hawkish cut”. Traders were desperate for the central bank to go full dove and embrace the easing cycle, but the Fed was never likely to do that. Forecasting rates at current levels at the end of next year is quite the opposite, although gold managed to hold on to $1,480 for now.

This level still looks very vulnerable though as rallies get sold into at increasingly lower levels which could pile pressure on this major support zone in the coming days. A break of this could trigger a much steeper decline, with $1,450 offering initial support but further downside possibly being on the cards.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Risk premium still priced in to oil

Oil prices are quite steady this morning following a turbulent week to this point. It’s still more than 5% up from last Friday’s close, which to an extent represents some of the risk premium that must now be factored in following the Saudi attack. Whether it’s a sufficient premium to account for the risk of retaliation, escalation and further outages is arguable.

If days and weeks pass without event, then we could see prices settle back to where they were but this was a huge event that had a massive impact on Saudi output, albeit temporarily. A repeat of this could add another significant premium to prices and the Saudi facility is clearly vulnerable, although I imagine great efforts are being made to guard it against future attacks.

Brent Daily Chart

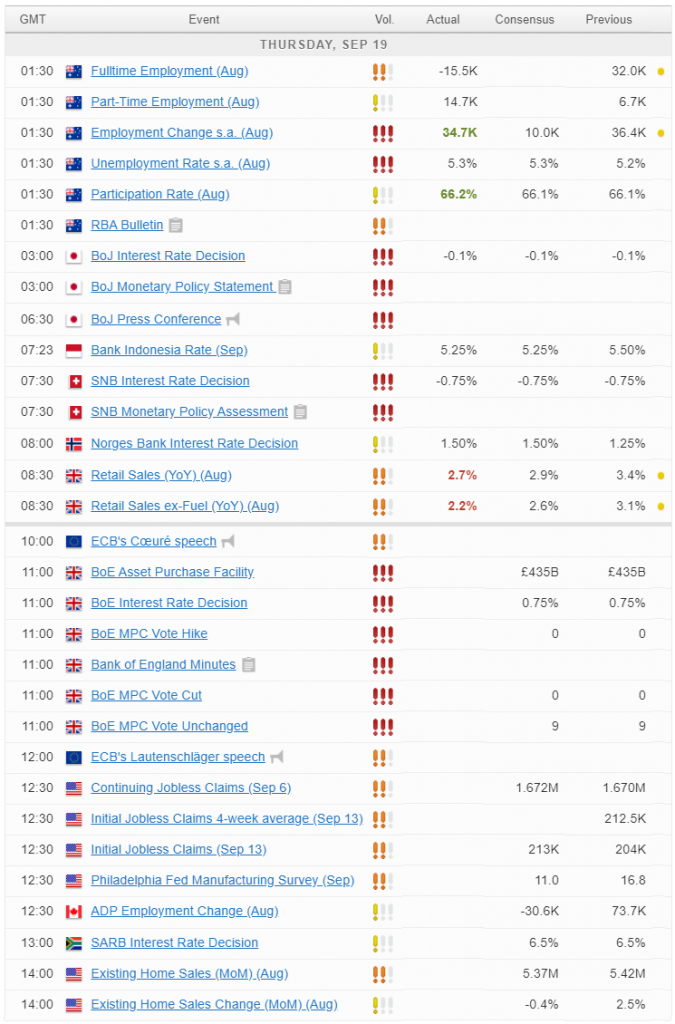

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.