Fed has much to answer for

European markets are mixed on the open on Wednesday as investors wait patiently for the first major interest rate decision of the week and the most important.

Source – Thomson Reuters Eikon

The Federal Reserve will complete its two day meeting later today and it may be in for a slightly trickier time than it envisaged, given the recent activity in the repo market which it has already sought to address. We’ll see over the coming week’s whether the Fed’s efforts have resolved the problem but I expect Powell will be heavily questioned about the need to intervene, something that may overshadow interest rates in the near-term.

There’s been plenty of attempts to explain the sudden spike in the overnight rate but as ever with these things, it’s very hard to say definitively. We can only hope that, coming so soon after recession sirens sounded on the back of the yield curve inversion, this is only a coincidence and not a symptom of greater issues to come.

While the interest rate probability tools have become a little erratic in recent days, there seems to be little question that the Fed is going to cut interest rates again today. The real question is whether they will stick to the mid-cycle adjustment message and refuse to explicitly signal more cuts or give up the fight and acknowledge that an easing cycle is underway.

Sign up for our next webinar with Ed Moya on 24 September below

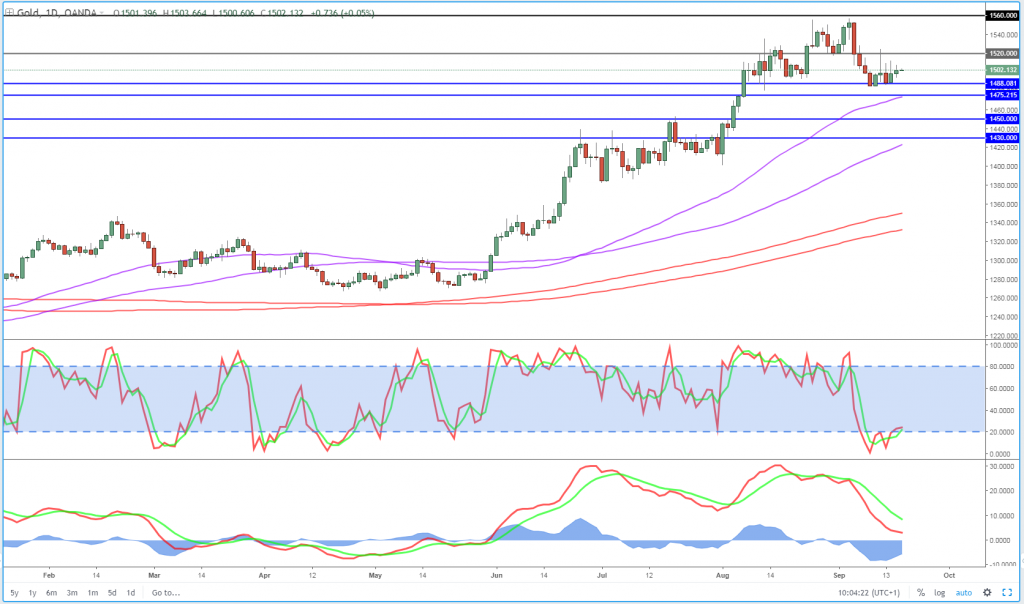

Easing Fed could reinvigorate gold

Gold prices are continuing to hover around $1,500 ahead of the interest rate decision. The yellow metal has been consolidating over the last week or so in anticipation of the decision. Prior to this, the uptrend had already been weakening and even the spike earlier this week was short-lived, which suggests $1,480 could come under significant pressure once again. If this breaks, then $1,450 is the next support area, although $1,400 may ultimately be tested. Of course, if the Fed goes full easing today, bulls may be reinvigorated.

Gold Daily Chart

OANDA fxTrade Advanced Charting Platform

Oil pares gains as Saudi’s calm market fears

Oil prices are stable again after paring a chunk of Monday’s gains yesterday, as Saudi Arabia confirmed that 50% of its lost crude production has been restored and the rest will be operational by the end of the month. This is a much faster timeline that people were expecting, or at least fearing, removing much of the premium from oil prices.

It hasn’t removed the premium entirely though as the facilities are clearly vulnerable to attacks and tensions only look likely to be heightened in the aftermath of the weekend’s events. We still don’t know how the US and Saudi Arabia will retaliate against Iran, who is being blamed for the attack, but this is unlikely to go without retribution.

Brent Daily Chart

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.